Decoding UK Term Life Insurance Rates: A Complete Guide

Start saving money on Life insurance today

Understanding term life insurance rates is the first step towards securing your family's financial future. Think of the rate as your premium—the regular monthly payment you make to an insurer. In return for this premium, the insurance company promises to pay a tax-free cash lump sum to your loved ones if you pass away during the policy's set term.

This guide explains how these rates are calculated, what factors influence the price you pay, and how you can find affordable cover in the UK.

What Goes Into Your Life Insurance Premium?

The rate you are quoted is the monthly or annual fee for a specific amount of financial cover over a fixed number of years. In the UK, all life insurance providers are regulated by the Financial Conduct Authority (FCA), which ensures fair practice. However, the price itself isn't arbitrary.

Insurers calculate your premium based on the level of risk they believe you represent—essentially, the likelihood of a claim being made on your policy. This is why they ask for detailed personal information during the application process.

At its core, term life insurance provides peace of mind. It ensures your family won't face a financial crisis if the unexpected happens. This payout could help them:

- Pay off the mortgage and remain in the family home.

- Cover everyday living costs like bills, food, and transport.

- Fund future expenses, such as children's university fees.

- Settle any outstanding debts or cover funeral costs.

The Average Cost in the UK

While every quote is personalised, it’s useful to have a benchmark. According to recent industry analysis, the average monthly cost for term life insurance in the UK during 2024 was £32.64.

This figure is based on over 121,000 policies, with an average cover amount of just over £160,000. Interestingly, this represents a slight decrease from the previous year, showing that market rates can fluctuate. You can explore the latest cost trends in this full research.

This average demonstrates that meaningful financial protection can be surprisingly affordable. The final price you pay, however, depends on your personal circumstances and the policy choices you make. By understanding these factors, you can find a policy that provides the right level of security without straining your budget.

The Personal Factors That Shape Your Premium

Have you ever wondered why your life insurance quote differs so much from a friend's, even if you're a similar age? Insurers assess risk much like a lender assesses a loan application. They analyse a range of personal details to build a picture of your health and lifestyle, which they use to calculate a fair premium.

Ultimately, your term life insurance rates are a direct reflection of your individual circumstances. While some factors are beyond your control, understanding what insurers look for gives you a clearer idea of how they arrive at their final figure.

Your Age and Health Status

Age is one of the most significant factors in pricing life insurance. From a statistical standpoint, younger applicants are less likely to pass away during the policy term, making them a lower risk for the insurer. Consequently, they benefit from much lower premiums.

Your health is equally crucial. You will be asked detailed questions about your medical history, including past illnesses, current conditions, and family medical history. A clean bill of health typically leads to more affordable cover.

However, having a pre-existing medical condition doesn't automatically disqualify you from getting cover. Many people with conditions like diabetes or high blood pressure secure life insurance, though the premium may be higher. It is vital to be completely honest on your application, as non-disclosure could invalidate your policy later on. You can learn more in our guide to getting life insurance with medical conditions.

Lifestyle Choices and Occupation

Your daily habits and activities also play a major role in determining your premium. Insurers need to understand any lifestyle choices that could increase your risk.

Key lifestyle factors include:

- Smoking or Vaping: This is a major consideration. Smokers and vapers often pay significantly more—sometimes double—than non-smokers due to the well-documented health risks associated with nicotine and tobacco.

- Alcohol Consumption: Insurers will ask about your weekly alcohol intake. Consistently high consumption can lead to long-term health problems, which is a red flag.

- High-Risk Hobbies: If you participate in activities like rock climbing, scuba diving, or private aviation, your premium will likely be higher to reflect the increased risk.

- Occupation: A desk-based job is considered low-risk. However, if you work in a hazardous profession, such as construction or offshore drilling, insurers will factor this into your rate.

Your personal circumstances significantly influence your premiums; understanding which life changes to tell your insurance agent about can help keep your policy relevant and potentially optimise costs. Honesty and transparency during the application process are always the best policy.

By gathering this information, insurers create a personalised risk profile that directly determines the premium they offer. The more favourable your profile, the lower your term life insurance rates will be.

How Your Policy Choices Influence Cost

Beyond your personal details, the specific features of your policy have a major impact on your monthly premium. You have a significant degree of control over your term life insurance rates by adjusting the structure of your cover.

Understanding how these elements work together allows you to build a policy that provides the right financial safety net for your family without overstretching your budget. The three main levers you can adjust are the amount of cover, the policy term, and the type of policy.

The Amount of Cover (Sum Assured)

The sum assured is the cash lump sum your beneficiaries receive if you pass away while the policy is active. The principle is simple: the larger the payout you want them to receive, the higher your monthly premium will be.

Determining the right amount of cover is a personal calculation. Consider your key financial obligations:

- Your mortgage: Enough to clear the outstanding balance so your family can stay in their home.

- Family living costs: Funds to replace your income and support your dependents for a set number of years.

- Children's futures: Money to cover costs for childcare, university, or other life events.

- Other debts: Sufficient funds to clear car loans, credit cards, or personal loans.

A larger sum assured provides a more robust financial cushion but naturally comes at a higher price.

The Length of the Term

The policy term is the duration for which your cover is active—this can range from 5 to 40 years or more. A longer term means the insurer carries the risk for a greater period, which statistically increases the chance of a payout.

For this reason, a 30-year policy will always cost more than a 10-year policy for the same amount of cover. A sensible approach is to align your policy term with your longest financial commitment, such as the remaining years on your mortgage or until your youngest child is financially independent.

The Type of Policy Cover

Finally, the type of term insurance you choose significantly affects your premiums. Each is designed for a different purpose, and the cost reflects the insurer's level of risk. The most common types are level term, decreasing term, and increasing term. Comparing them side-by-side clarifies their impact.

How Policy Types Affect Premiums and Payouts

| Policy Type | Typical Use Case | Premium Cost (Relative) | Payout Value Over Time |

|---|---|---|---|

| Level Term | Covering an interest-only mortgage, leaving a fixed inheritance, or replacing a salary. | Higher | Stays the same throughout the term. A £200,000 policy pays out £200,000 whether you claim in year 1 or year 20. |

| Decreasing Term | Paying off a repayment mortgage, where the outstanding loan balance reduces over time. | Lower | Reduces over the term. The payout is highest at the start and shrinks towards zero by the end. |

| Increasing Term | Protecting your family from inflation, ensuring the payout's buying power doesn't erode over time. | Highest | Grows each year, usually in line with the Retail Prices Index (RPI) or a fixed percentage. |

As the table shows, a decreasing term policy is the most budget-friendly option because the insurer's potential liability reduces each year. In contrast, an increasing term policy is the most expensive because their liability grows over time.

Your choice should be guided by what you need to protect. If you are deciding between the two most popular options, our guide explores whether you should choose level term or decreasing term life insurance to help you make the right decision for your circumstances.

Why Applying Early Can Save You Thousands

When it comes to securing the best term life insurance rates, one of the most effective strategies is also the simplest: apply as early as you can. You cannot control every factor that determines your premium, but your age is one where timing is crucial. Acting sooner rather than later can result in significant savings over the life of your policy.

The logic is straightforward. Insurers base their calculations on risk, and from their perspective, younger and healthier individuals represent a much lower statistical risk. This lower mortality risk translates directly into cheaper premiums because there is less chance they will have to pay out a claim during the policy term.

By taking out a policy in your 20s or 30s, you effectively lock in that low-risk status for decades. This means you could be paying a fraction of what someone in their late 40s or 50s would pay for the exact same amount of cover.

The Financial Impact of Waiting

Delaying your application by just a few years can make a noticeable difference to your monthly payments. Waiting a decade could see your premiums more than double. Over a typical 20 or 30-year term, that difference often amounts to thousands of pounds.

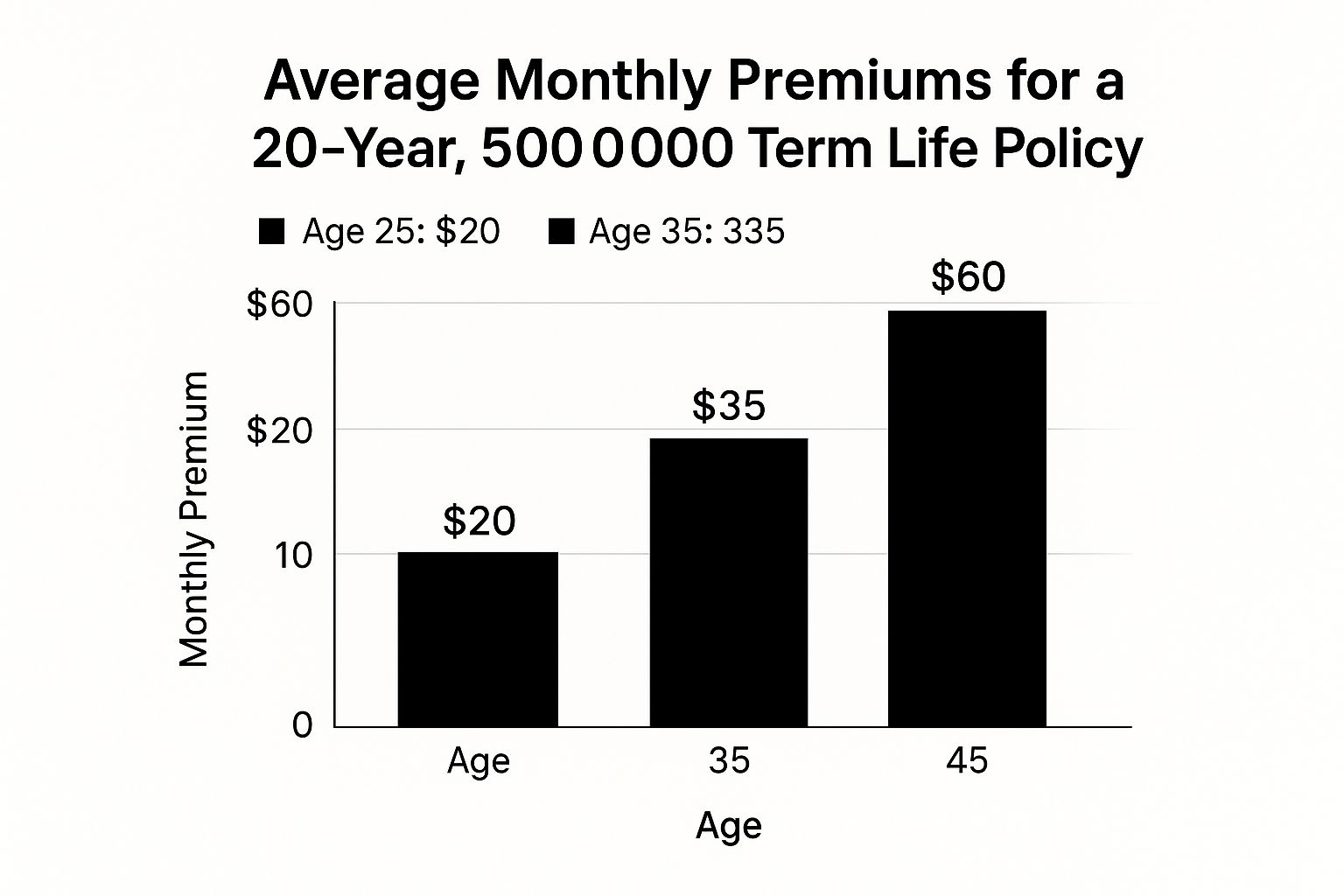

The chart below provides sample monthly premiums for a £500,000 policy over a 20-year term for non-smokers applying at different ages to illustrate this point.

As you can see, the premium for a 45-year-old is three times higher than for a 25-year-old. It's a stark reminder of the financial penalty for waiting.

A Real-World Look at Age and Premiums

This pattern of rising costs is consistent across the UK market. To provide another concrete example, let's look at how premiums might appear for smaller cover amounts.

Example Monthly Premiums for £100,000 Cover (20-Year Term)

The table below shows illustrative monthly rates for a healthy, non-smoking individual, demonstrating how premiums climb steadily with each passing year.

| Age | Example Monthly Premium |

|---|---|

| 25 | £3.04 |

| 35 | £9.85 |

| 45 | £15.76 |

| 55 | £24.26 |

Even for £100,000 of cover, modest jumps in age lead to progressively higher premiums. You can find more details about how age impacts life insurance rates to see the full picture.

The best time to consider life insurance is when you first have dependents or take on a major financial commitment like a mortgage. Securing cover early not only provides immediate peace of mind for your loved ones but is also one of the smartest financial decisions you can make for their long-term security.

Finding Cheaper Term Life Insurance Rates

Securing competitive term life insurance rates doesn't have to be complicated. It comes down to a few practical strategies that can significantly reduce your monthly premiums without compromising the quality of your cover. By taking control of the factors you can influence and making smart policy choices, you can find an affordable solution.

Simple lifestyle changes can have a huge impact. For instance, quitting smoking is one of the single best things you can do to lower your costs. Insurers often charge non-smokers up to 50% less. Even small health improvements, like lowering your cholesterol or blood pressure before applying, can demonstrate to an insurer that you are a lower risk.

Aligning Your Policy with Your Needs

Another key tactic is ensuring the type of cover you choose perfectly matches your financial goals. There is no point paying for more protection than you actually need.

- For Repayment Mortgages: A decreasing term policy is almost always the most cost-effective choice. As your mortgage balance reduces over time, so does your cover, which keeps your premiums low.

- For Family Protection: If your main aim is to leave a financial safety net to replace your income for your family, a level term policy is suitable. It provides a fixed payout, but you can still adjust the term length to fit your budget. Choosing a 20-year term instead of 30 years, for example, will reduce the price.

By thinking carefully about what you need to protect, you can avoid being over-insured and keep your costs manageable. For more tips, check out our guide to finding budget life insurance.

The Power of Comparison

This is arguably the most important step: always shop around. Each insurer has its own unique method for calculating risk, which means the price for the exact same policy can vary dramatically from one provider to another.

Never accept the first quote you receive. The UK life insurance market is highly competitive, and the only way to ensure you are getting the best deal for your circumstances is to compare offers from multiple insurers.

Working with an independent, FCA-regulated broker like Discount Life Cover can streamline this process. A good broker will scan the entire market for you, comparing policies from a wide range of trusted UK insurers to find the most favourable rates. We understand the nuances in each provider's criteria and can help you identify deals you might otherwise miss, putting you in control of your decision.

Frequently Asked Questions (FAQ)

To conclude, here are answers to some of the most common questions people have when exploring term life insurance rates. Clear answers can help you feel more confident as you compare your options.

How much does smoking affect life insurance rates in the UK?

Significantly. Insurers view smoking as a major risk factor due to its strong links with numerous health problems. As a result, smokers can expect to pay anywhere from 50% to 100% more for the same cover as a non-smoker. It is one of the single biggest factors that can increase your premiums.

Are my term life insurance premiums fixed?

For the vast majority of UK policies, yes. With standard level and decreasing term insurance, your premiums are competitive to remain the same for the entire policy term. This provides certainty for budgeting. The main exception is increasing term cover, where premiums rise annually to correspond with the growing payout.

Can I get life insurance with a pre-existing medical condition?

Yes, in many cases, you can. It is a common myth that having a condition like diabetes, high blood pressure, or a history of cancer makes you ineligible for cover. The key is to be completely transparent about your medical history during the application. An insurer may charge a higher premium or add specific exclusions related to your condition, but cover is often still possible through standard or specialist providers.

Is it cheaper to get a joint policy with my partner?

Initially, yes. A joint life policy, which covers two people but pays out only once (typically on the first death), is usually cheaper than buying two separate single policies. However, it is crucial to weigh the pros and cons. Two single policies provide double the potential payout. Furthermore, after a claim on a single policy, the surviving partner's cover remains intact, which is not the case with a joint policy.

Ready to discover how affordable your cover could be? The team at Discount Life Cover is here to help you compare quotes from leading UK insurers in minutes.

Get Your Free, No-Obligation Quote Today

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.