A Guide to Life Insurance with Pre-existing Medical Conditions in the UK

Start saving money on Life insurance today

It's one of the most common questions we hear: "Can I get life insurance if I have a pre-existing medical condition?" The answer, in nearly all cases, is a reassuring yes. While a health issue will be a factor in your application, being declined for cover is far rarer than many people believe. What truly matters to insurers is how well your condition is managed. They will always assess your individual circumstances to determine a fair premium.

This guide explains how UK insurers approach life insurance medical conditions, what you can expect during the application process, and why honesty is always the best policy.

Getting Life Insurance with Health Conditions

One of the biggest myths about life insurance is that having a health problem automatically disqualifies you from getting cover. The reality is quite different. UK insurers are highly experienced in assessing a vast range of medical histories, from common issues like high blood pressure to more serious, complex diagnoses.

The process they use is called underwriting. It’s not as intimidating as it sounds. Think of it like a car insurer checking your driving history before giving you a quote. A life insurer does the same with your health and lifestyle to understand the level of risk involved. This is how they ensure the price you pay is a fair reflection of your personal situation.

What Insurers Really Look At

Insurers are more interested in the specifics of your health than the name of your diagnosis. When you apply for cover, they're trying to build a clear picture of a few key things:

- How well is your condition managed? Are you following your doctor's advice and taking medication as prescribed? A stable, well-controlled condition is always viewed more favourably.

- How severe is it? The impact of any condition varies from person to person. An insurer will assess your specific case rather than making a blanket assumption based on the diagnosis alone.

- What's your overall lifestyle like? Factors like whether you smoke, your alcohol consumption, and even your occupation play a significant part in the final decision, alongside your medical history.

For many people, the standard application process is sufficient. However, if you have more significant health concerns or would prefer not to undergo a medical examination, there are other options available. Our detailed guide on securing life insurance with no medical exam can be a great starting point. It’s all about finding the right policy to fit your needs.

To give you a clearer idea, let's look at how insurers might view some common conditions.

How UK Insurers Typically View Common Medical Conditions

The table below provides a general overview of some common health conditions and the typical questions or factors that underwriters will focus on during an application. Remember, this is a guide, and every application is assessed on its own merits.

| Medical Condition | Key Factors Insurers Consider |

|---|---|

| High Blood Pressure | Your most recent blood pressure readings, the type and dosage of any medication, and whether there are any related complications like kidney or heart issues. |

| High Cholesterol | Your latest cholesterol readings (total cholesterol and ratio), any medication being taken to manage it, and your overall cardiovascular health, including factors like smoking and your BMI. |

| Diabetes (Type 1 & 2) | The type of diabetes, how long you've been diagnosed, your latest HbA1c readings (a measure of blood sugar control), and whether there are any complications affecting your eyes, kidneys, or nerves. |

| Asthma | The frequency and severity of your symptoms, whether you've been hospitalised recently, and the type of medication you use (e.g., occasional inhalers vs. daily steroids). |

| Depression/Anxiety | The date of your diagnosis, the frequency of symptoms, any time taken off work, details of any treatment or medication, and whether there have been any instances of hospitalisation or self-harm. |

| Cancer | The type and stage of cancer, the date you were diagnosed, what treatment you received (e.g., surgery, chemotherapy), the date your treatment finished, and whether you are now in remission. The length of time you've been in remission is a crucial factor. |

| Heart Conditions | The specific condition (e.g., heart attack, angina), the date of the event or diagnosis, details of any surgery or treatment (like stents or bypass), and the results of recent tests like ECGs or stress tests. Your current lifestyle and medication are also very important. |

As you can see, the theme is consistent: insurers want to understand control, stability, and severity. A well-managed condition with no recent complications will always result in a more favourable outcome than one that is unstable or poorly controlled.

Why Honesty Is Your Best Policy

When filling out a life insurance application, it can be tempting to downplay a medical condition or hope the insurer won’t look too closely at a minor health issue. However, being completely upfront and honest about your health history is the single most important thing you can do to ensure your policy pays out when your family needs it most.

Think of your application as the foundation of your contract with the insurer. If that foundation is built on inaccurate information, the entire policy could be at risk. This comes down to a crucial concept called non-disclosure.

The Risks of Non-Disclosure

Non-disclosure occurs when an applicant fails to share relevant information or provides misleading details about their health or lifestyle. If this comes to light when a claim is made, the consequences can be devastating for the family left behind.

An insurer has the right to void the policy, meaning they can treat it as if it never existed. In that scenario, they would refuse to pay the claim and might only refund the premiums paid. Imagine contributing to a policy for years, believing your family is protected, only for that safety net to disappear when it's needed.

The purpose of life insurance is to provide a financial lifeline to your loved ones. Hiding information puts that entire goal at risk, potentially leaving your family without the support you planned for them.

The risk is highest during the first few years of a policy, a period often called the contestability period. During this time, insurers have greater scope to investigate the details you provided. A seemingly small omission – like not mentioning a referral to a specialist or a recent change in medication – could be flagged as a material misrepresentation. This is why being thorough and honest from the start is so critical.

The Importance of Full Disclosure

Full disclosure is ultimately about protecting you and your family. By providing a complete and accurate picture of your health, you ensure the policy you're offered is valid and reliable. It removes any doubt that a future claim will be paid, which is what provides genuine peace of mind. To get a better sense of the security a good policy offers, have a read of our guide on the 5 benefits of life insurance.

Furthermore, regulations from the Financial Conduct Authority (FCA) in the UK require insurers to ask clear, specific questions. This is designed to help you provide the right information, not to catch you out. It's about making sure the insurer has the full story so they can offer a fair and valid contract. By answering every question truthfully, you are securing a promise that your family can rely on.

What Happens During the Underwriting Process

So, you’ve filled out your application and sent it off. What happens next? It lands with an underwriter, and a crucial process called underwriting begins.

This is where the insurer takes a closer look at your application to determine the level of risk you represent. It might sound intimidating, but it's a standard part of every application. The goal is to ensure the premium you’re quoted is fair and accurate for you as an individual.

The process starts with the health and lifestyle questionnaire you completed. For many people with minor or well-managed health issues, that's often all the insurer needs to approve the policy. Sometimes, however, they need to dig a little deeper to get the full picture.

Gathering Further Medical Information

If your application flags certain life insurance medical conditions, or if you're applying for a particularly large amount of cover, it’s quite normal for an insurer to request more information. This is a routine check, not a sign that there's a problem.

They might do one of two things:

- Ask for a GP Report: The insurer might request a report from your doctor. This provides them with an official, detailed record of your medical history, including diagnoses, treatments, and how well you're managing your health. They cannot do this without your permission and will always ask for your consent first.

- Arrange a Medical Examination: For larger policies or more complex medical histories, a mini-medical might be required. A nurse usually carries this out at your home or workplace, and the insurer always covers the cost. It's nothing to worry about – they'll typically measure your height, weight, and blood pressure, and may take a small blood or urine sample.

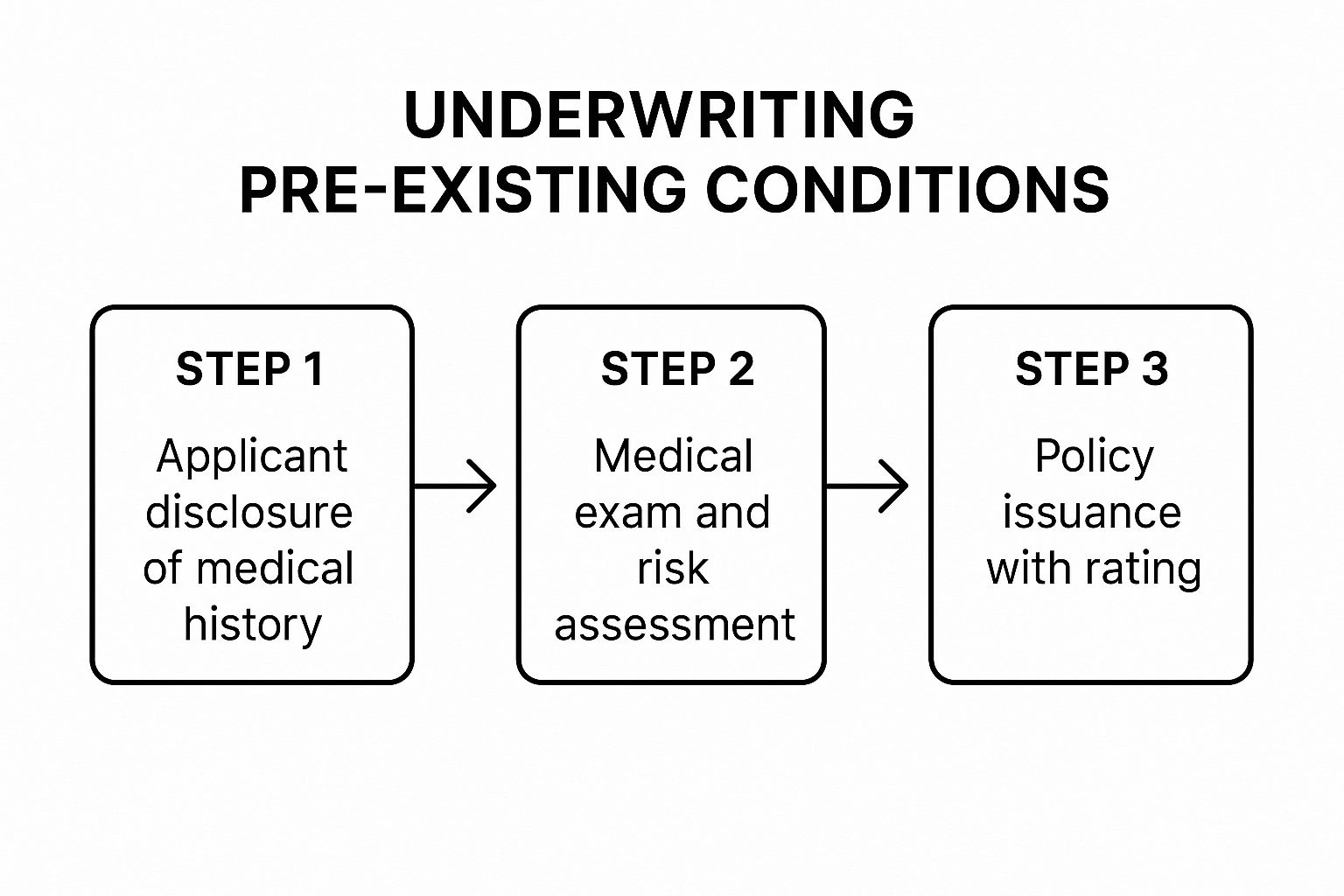

This flowchart gives you an idea of how the underwriting journey typically looks when a medical condition is involved.

As you can see, your honest disclosure is the starting point for a structured assessment that leads to a final decision on your policy.

Understanding the Insurer's Decision

Once the underwriter has all the information they need, they'll make a final decision. This is not always a straightforward 'yes' or 'no'. There are a few possible outcomes:

- Standard Terms: Great news! If your condition is considered low-risk, you'll be offered cover at the standard price.

- Premium Loading: If your condition presents a slightly higher risk, the insurer might add a percentage increase to your premium. This is known as a ‘loading’. For instance, a 50% loading means your premium will be 50% higher than the standard rate.

- Special Terms or Exclusions: In some situations, an insurer might offer you cover but with an exclusion for claims related to your specific pre-existing condition. This can be a good compromise, as it means you can still get protection for everything else.

- Postponement or Decline: For very recent diagnoses or severe conditions, an insurer might postpone their decision for a period (e.g., 6-12 months) to see how your condition stabilises. An outright decline is rare, but it can happen if the risk is deemed too high to insure.

Knowing these potential outcomes can help you feel more prepared and in control during the application process. It’s also why, when policies are set up correctly from the start, claims are so reliably paid. The data speaks for itself: in 2022, 91.3% of all critical illness claims were paid, with major UK insurers like Aviva and Legal & General consistently paying over 90% of claims. You can read more about these protection payout statistics to see just how dependable cover can be.

How Common Health Conditions Impact Your Application

When you apply for life insurance, underwriters are trying to understand your personal health story. They look at specific medical conditions not to pass judgement, but to build an accurate picture of your overall health and, ultimately, your life expectancy.

The good news is that the more stable and well-managed your condition is, the better. Insurers are far more comfortable when they see a clear history of you taking control of your health.

In this section, we’ll break down how insurers in the UK typically look at some of the most common health issues. Remember, every provider is different, so treat these as general guidelines. Having the right information ready will make the whole process much smoother.

Heart-Related Conditions

Conditions like high blood pressure (hypertension) and high cholesterol are incredibly common across the UK. Because they’re so widespread, insurers have a very established process for assessing them.

If you're managing your condition well with medication and regular check-ups, it often has a surprisingly small impact on your application.

Some insurers may want to know:

- Your most recent readings for blood pressure or cholesterol levels.

- Details of any medication you're on, including the name and dosage.

- The date you were diagnosed and whether the condition is stable.

- Any related lifestyle factors, like your diet, exercise routine, and smoking status.

A crucial part of the assessment is looking at an applicant's overall habits, which includes understanding how smoking can impact your life expectancy.

Mental Health Conditions

Thankfully, awareness around mental health has improved significantly, and insurers are now much more experienced in assessing conditions like anxiety and depression. The main focus for an underwriter here is on stability and severity.

For example, a history of mild anxiety that's managed with therapy is viewed completely differently from a recent hospitalisation for severe depression.

Be ready to share details on:

- Your specific diagnosis and when it was first made.

- The frequency and severity of your symptoms over the last few years.

- Any treatment you’ve had, such as medication or counselling.

- Whether the condition has ever required you to take time off work.

It's important to realise that having a mental health condition doesn't automatically mean you'll pay more. A well-documented history of effective management and stability can often result in standard premium rates.

Metabolic Conditions Like Diabetes

For conditions like Type 1 or Type 2 diabetes, underwriters are laser-focused on one thing: how well you control your blood sugar levels. Good control dramatically reduces the long-term risk of complications, which is a key factor in their assessment.

Insurers will typically ask for:

- The date of your diagnosis and which type of diabetes you have.

- Your latest HbA1c reading, as this gives a long-term view of your blood sugar control.

- Details of your treatment, whether that’s diet, tablets, or insulin.

- Information about any complications, such as issues with your eyes (retinopathy), nerves (neuropathy), or kidneys.

No matter the medical condition, providing clear, up-to-date information is always the best way to get a smooth and fair assessment. Taking the time to gather recent test results or letters from your specialist before you apply can make the process much faster and help you secure the right cover at the best possible price.

Policy Options for Applicants with Medical Conditions

Navigating life insurance with a pre-existing condition can feel complicated, but there are more options available than you might think. Different policies are designed for various needs, and some can be particularly well-suited for those with health concerns.

| Policy Type | Best For | Considerations for Medical Conditions |

|---|---|---|

| Term Life Insurance | Covering specific debts like a mortgage or providing for dependents for a set period. | Premiums are directly influenced by health. Well-managed conditions may qualify for standard rates, while more severe or unstable conditions can lead to higher "loadings" or even a decline. |

| Whole of Life Insurance | Guaranteed payout upon death, often used for inheritance tax planning or leaving a legacy. | Generally more expensive and undergoes stricter medical underwriting. Can be difficult to secure with serious health issues, but not impossible if the condition is stable. |

| Over 50s Plan | UK residents aged 50-85 looking for a competitive lump sum to cover funeral costs or leave a small gift. | Guaranteed acceptance with no medical questions. This makes it a fantastic option if you've been declined for other types of cover due to your health. The trade-off is typically a lower cover amount. |

| Critical Illness Cover | A policy add-on that pays out a lump sum if you're diagnosed with a specific serious illness. | Pre-existing conditions related to the illnesses covered (e.g., a past heart attack) will usually be excluded. However, you can still get cover for dozens of other unrelated conditions. |

Ultimately, the "best" policy is the one that aligns with your personal circumstances, your budget, and your family's needs. By working with an experienced adviser, you can explore these options in detail and find a policy that gives you peace of mind, regardless of your medical history.

Finding the Right Policy for Your Needs

Understanding how insurers look at medical conditions is the first big hurdle. The next step is choosing a policy that fits your life and your financial goals. Not all cover is the same, and the best choice really boils down to what you're trying to protect – whether that's your family's daily lifestyle or a specific debt like a mortgage.

The two main types of term life insurance you'll come across are Level Term and Decreasing Term. They each serve a different purpose, so it's vital to understand the distinction.

Level vs Decreasing Term Insurance

Level Term Insurance is straightforward. It provides a fixed, level payout for the entire duration of the policy. If you take out a £200,000 policy for 20 years, your loved ones would receive £200,000 whether you passed away in year one or year nineteen. This consistency makes it an excellent choice for:

- Family Protection: Giving your family a lump sum to replace your lost income, helping them cover everything from weekly bills to future university fees.

- Covering an Interest-Only Mortgage: Ensuring the capital loan can be paid off in full.

Decreasing Term Insurance, on the other hand, is designed differently. The payout amount reduces over time, usually in line with a repayment mortgage. As you pay down your mortgage, the amount of cover needed to clear the debt gets smaller. This design often makes it a more affordable option than level term cover.

Specialist Policies for Specific Needs

Beyond standard term policies, a couple of other options can be a real lifeline, especially for those with more significant health concerns.

Over 50s Plans are unique. They offer competitive acceptance to UK residents aged 50-85, with no medical questions asked. This makes them an invaluable safety net if you've been turned down for other types of cover. However, you need to be aware of their limitations: the payout is much smaller and is primarily intended to cover funeral costs or leave a small gift. There is also usually a 12-24 month waiting period at the start of the policy before the full benefit would be paid for death by natural causes.

Another key option to consider is Critical Illness Cover. This can often be added to a life insurance policy and pays out if you're diagnosed with one of a list of specified serious illnesses. Your medical history will be assessed, and any pre-existing conditions might be excluded, but it can still provide fantastic financial protection against dozens of other illnesses you might face in the future.

Choosing the right policy is all about matching your personal needs with the product's features. A homeowner with a young family has very different requirements from someone over 50 just looking to cover their funeral expenses.

The goal is to find a policy that gives you genuine peace of mind. By comparing the best life insurance UK providers, you can get a feel for how different insurers handle various medical conditions and find the cover that's the best fit for your family's future.

Frequently Asked Questions

Will my premiums go up if I get ill after my policy starts?

No. Once your policy is active, your premiums are fixed for the entire term. They will not change, even if you are diagnosed with a new medical condition later on. The price is locked in based on your health at the time you apply.

Can an insurer refuse to cover me because of my health?

It is possible for very severe or complex conditions, but an outright decline is less common than many people think. It is more likely that an insurer will offer you cover with 'special terms'. This could mean a higher premium (a 'loading') to reflect the increased risk, or they might add an exclusion for claims directly related to your specific health condition.

What is a premium loading and why is it applied?

A 'premium loading' is an extra charge added to the standard premium. Insurers apply this when their underwriting assessment indicates that a particular medical condition makes a future claim statistically more likely. For example, a '50% loading' means your premium will be 50% higher than the standard rate. This percentage is calculated based on the insurer's data related to your specific condition, its severity, and how well it is managed.

Is an Over 50s Plan a good alternative if I am declined?

For some people, it can be a practical solution. Over 50s policies guarantee acceptance for UK residents aged 50-85, with no medical questions asked. This makes them a good fallback if you've been declined for standard cover due to your health. However, you must be aware of the trade-offs: the payout is much smaller and is designed for funeral costs or a small gift, and there is typically a 12-24 month waiting period before the full benefit is paid for death by natural causes. It is not suitable for covering large debts like a mortgage.

Ready to find a life insurance policy that fits your needs and budget, even with a medical condition? At Discount Life Cover, our expert advisers can help you compare quotes from leading UK insurers to find the right protection for your family.

Get your free, no-obligation quote today and take the first step towards peace of mind.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.