Income Protection and Redundancy Cover: A UK Guide

Start saving money on Life insurance today

Income protection and redundancy cover is a type of insurance policy designed for one specific purpose: to replace a portion of your monthly income if you lose your job through no fault of your own. Unlike standard income protection that pays out for illness or injury, this policy provides a financial safety net specifically for involuntary redundancy.

Understanding Your Financial Safety Net

Let's face it, being made redundant is one of life's most stressful events, often throwing your finances into immediate chaos. While traditional income protection is excellent for safeguarding you against being unable to work due to sickness, it won't pay a penny if your role is made redundant. That's the critical gap that redundancy cover is designed to fill.

Think of it as a temporary financial bridge. If you're made redundant, the policy pays you a tax-free monthly sum for a set period, usually for up to 12 or 24 months. This money helps you stay on top of essential outgoings like your mortgage, rent, and household bills. It gives you some much-needed breathing space to focus on finding a new job, without the crippling pressure of mounting debt.

Why Is Redundancy Cover Important?

In today's unpredictable job market, having a dedicated financial buffer is more crucial than ever. The purpose of income protection redundancy insurance is to provide stability during a rocky transition period. It prevents an unexpected job loss from completely derailing your life or forcing you to dip into long-term savings meant for things like your retirement. It’s all about keeping you in control of your finances when your employment status suddenly changes.

It's easy to mix this up with critical illness cover, but they are completely different products. Critical illness cover pays out a single lump sum if you're diagnosed with a specific serious condition listed on the policy. Redundancy protection, on the other hand, provides a regular monthly income to replace your lost salary.

Key Features of Redundancy Protection Cover

So, what do you actually get with one of these policies? To get a proper handle on it, it's best to break down the main components. The exact details will always vary between insurers, but most UK policies are built around these core features.

Here's a quick look at what you can generally expect from a policy in the UK.

| Feature | Typical UK Policy Details |

|---|---|

| Monthly Payout | Typically covers between 50-70% of your gross monthly salary to meet core expenses. |

| Payment Period | Benefits are usually paid for a fixed term, often 12 or 24 months, giving you a defined window of support. |

| Deferred Period | A pre-agreed waiting period after you're made redundant before payments start. This can often be aligned with any redundancy package you receive from your employer. |

| Tax-Free Benefits | Any income you receive from the policy is not subject to income tax in the UK. |

By understanding these elements, you can start to see if this kind of cover aligns with your financial situation. Of course, the best way to understand how it could work for you is to get a personalised income protection quote and see how these features translate into a real-world policy.

How Redundancy Protection Works In Practice

Understanding a policy on paper is one thing, but seeing how it plays out in the real world makes everything clearer. Let's walk through what happens with income protection and redundancy cover, from the moment you take out a policy to the day it becomes a financial lifeline.

The process is quite straightforward, but a couple of key stages and terms are vital to understand. When you first buy your cover, you’ll encounter something called an initial exclusion period. This is a set time, often 60 to 120 days from the policy start date, during which you cannot make a claim. It’s the insurer's way of ensuring people aren't signing up when they already know a redundancy is on the horizon.

From Redundancy Notice to Financial Support

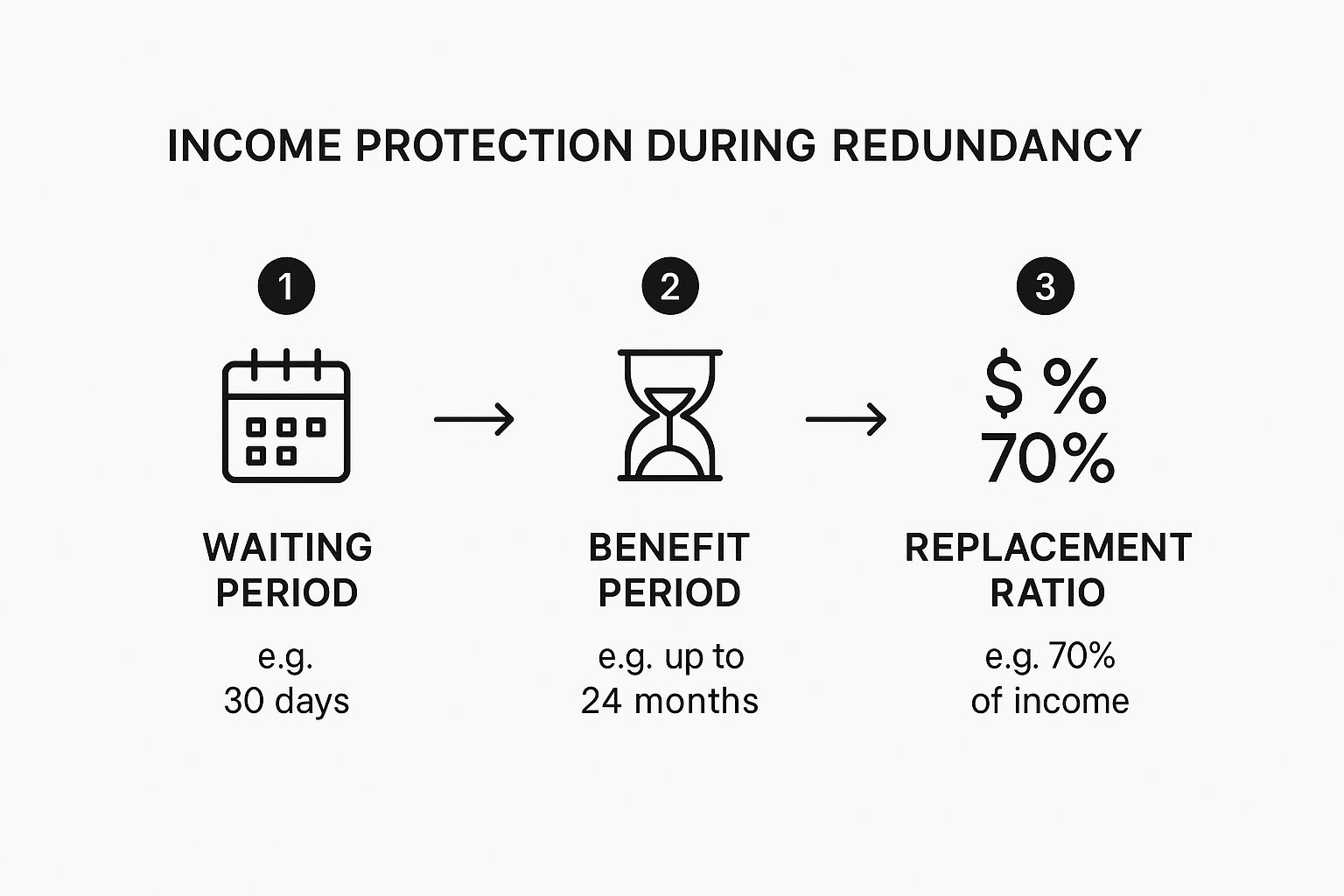

Once that initial period is over, your protection is active. If you're later made redundant, the next key stage is the deferred period. Think of this as your policy’s waiting time—a pre-agreed number of days (30, 60, or 90, for example) that must pass after your job ends before the insurer starts paying out. You choose this when you set up the policy, and a smart move is to align it with your employer’s redundancy package to ensure there are no gaps in your income.

This simple three-step flow shows how you go from the waiting period to actually receiving your monthly payments.

As you can see, the process is designed to give you a structured, predictable income, which is exactly what you need when you’re focused on finding a new role.

A Real-World Example

Let's imagine this in a real-life scenario. Meet Sarah, a 45-year-old marketing manager from Manchester with two children and a mortgage. She has a policy covering 60% of her salary with a 30-day deferred period. Out of the blue, she's made redundant and receives one month's salary as a severance payment from her company.

Here’s how her policy kicks in to support her:

- Notification: The first thing Sarah does is notify her insurer about the redundancy, sending over the necessary paperwork like her P45.

- Deferred Period: Her 30-day deferred period begins. She uses her final month's salary from her old job to cover her mortgage and bills during this time.

- First Payment: After those 30 days are up, her policy starts paying. She receives her first tax-free monthly payment, which is a massive help for her mortgage and living costs.

- Ongoing Support: These payments will continue each month for up to her policy's maximum term (e.g., 12 months), or until she finds a new job.

This gives Sarah and her family vital financial breathing room when they need it most. While redundancy cover is specifically for job loss, it’s worth remembering that standard income protection is built for different situations. You can learn more about how accident and sickness insurance works if you’re ever unable to work because of an illness or injury.

Who Is Eligible for Redundancy Cover?

Unfortunately, income protection and redundancy cover isn't available to everyone. UK insurers have a specific checklist you'll need to meet. Knowing what they're looking for from the start can save you hassle and help you figure out if this policy is right for you.

Insurers generally want to see applicants in stable, long-term employment. While the job market is always shifting, it's useful to understand the wider context. You can dig deeper into the official UK labour market statistics to see these trends for yourself.

Core Eligibility Requirements

To be approved for redundancy cover, you'll need to tick a few key boxes. These are the criteria insurers put in place to manage their risk.

Here’s what you’ll almost certainly need:

- Employment Status: You'll typically need to be a permanent employee on a PAYE contract.

- Working Hours: Most insurers require you to work a minimum of 16 hours per week.

- Age Limits: The cover is usually offered to people aged between 18 and 60.

- UK Residency: You must be a permanent resident in the UK.

And this is the most important rule: you cannot have any knowledge that redundancies are being considered at your workplace. If your employer has already started talking about potential job cuts, it is too late to get a policy.

Who Is Usually Excluded?

It’s just as vital to know who can't get cover as who can. It saves you from wasting time applying for a policy you were never going to be approved for.

You’ll generally find it impossible to get redundancy cover if you fall into these categories:

- Self-employed individuals or sole traders

- Temporary or contract workers

- Company directors with a significant shareholding in the business

- Part-time workers who work fewer hours than the policy's minimum

The reason for these exclusions is straightforward: the nature of this work is often less predictable, making it a challenge for insurers to calculate the risk of redundancy compared to that of a permanent employee.

Comparing Your Financial Safety Net Options

When you're considering redundancy cover, it's wise to see how it stacks up against other options. There's no single "best" way to protect yourself financially; each approach has its own pros and cons. Understanding these is the key to building a financial plan that works for you.

Relying on just one thing, like statutory pay or your savings, can leave you exposed if the worst happens. A better approach is to combine a few different strategies to give you the strongest protection against the financial shock of losing your job.

Statutory Redundancy Pay

If you've been with your employer for at least two years, you are legally entitled to statutory redundancy pay. It’s a helpful baseline of support, but realistically, it's rarely enough to cover your outgoings for very long. The amount is based on your age, weekly pay (capped by the government), and length of service. For many, it might only cover a few months of essential bills.

Personal Savings and Emergency Funds

Having a healthy savings pot is a fantastic buffer against any kind of financial surprise, redundancy included. In fact, building an emergency fund is one of the first things any financial expert will tell you to do. The huge advantage here is that the money is yours, and you can access it instantly without filling out any forms or waiting for a claim to be approved.

The downside, of course, is that building up a fund big enough to cover six months of expenses can take years. A difficult job search could wipe out your hard-earned savings, putting bigger goals like retirement or a house deposit in jeopardy.

Standard Income Protection Insurance

This is a very important distinction to make. Standard income protection is not redundancy cover. A normal income protection policy is designed to pay out only if you're unable to work because of an illness or injury. It will not pay a penny if you are made redundant.

It is an essential type of cover for protecting you against health problems stopping you from earning, but it serves a completely different purpose to redundancy insurance. You can compare income protection insurance policies to get a better feel for what they do and the situations they’re designed for.

Redundancy Cover vs Other Financial Options

Sometimes it's easier to see things laid out side-by-side. This table gives you a quick snapshot of how each financial safety net stacks up against the others, helping you see the strengths and weaknesses at a glance.

| Financial Option | How It Works | Key Benefit | Key Limitation |

|---|---|---|---|

| Redundancy Cover | An insurance policy providing a monthly income for a set period after involuntary redundancy. | Provides a regular, predictable income stream to cover ongoing bills and mortgage payments. | Excludes voluntary redundancy, dismissals, and requires you to meet specific eligibility criteria. |

| Statutory Pay | A one-off lump sum from your employer, legally required after two years of service. | A guaranteed payment if you meet the service length requirement, providing an immediate cash injection. | The amount is capped and may not be sufficient to cover expenses for more than a few months. |

| Personal Savings | Money you have put aside in an accessible account for unexpected events. | Instant access to your own money with complete flexibility on how you use it. | It can take a long time to build and can be quickly depleted, impacting other financial goals. |

| Income Protection | An insurance policy paying a monthly income if you cannot work due to illness or injury. | Long-term financial support for health-related absences, often until retirement age. | Does not cover redundancy or any form of job loss unrelated to your health. |

Ultimately, choosing the right safety net—or combination of them—comes down to your personal finances, your attitude to risk, and how stable you feel your job is.

What Factors Affect The Cost Of Cover?

When you get a quote for redundancy cover, the price you’re offered isn’t random. UK insurers carefully weigh up a few key factors to calculate your monthly premium.

Understanding these factors puts you in a much stronger position to tailor a policy to your budget without sacrificing necessary protection. Some of these are about you, and others are about the choices you make when setting up the policy itself.

Personal Factors That Influence Your Premium

Insurers need to build a clear picture of you to assess the likelihood of a claim. The main personal details that will shape your quote are:

- Your Age: A simple fact of insurance is that the younger you are when you take out a policy, the cheaper it tends to be.

- Your Occupation: The job you do and the industry you’re in play a massive role. Someone working in a historically volatile sector, like construction or retail, might see higher premiums than an accountant in a more stable field.

- Your Salary: This one is straightforward. The payout is always a percentage of your income. So, a higher salary means the insurer is covering a bigger potential payout, which naturally leads to a higher premium.

Policy Choices You Can Control

This is where you can take control. By adjusting the details of your policy, you can find the right balance between comprehensive protection and an affordable monthly premium.

The choices you make when you apply are the most direct way to manage how much you pay. Something as simple as a longer waiting period before the policy kicks in can make a real difference to the monthly cost.

Here are the main levers you can pull to adjust the price:

- The Monthly Payout Amount: Choosing to cover 50% of your salary instead of the maximum 70% will reduce your premium. It’s a trade-off between how much you’ll receive and how much you pay.

- The Deferred Period: This is the waiting time between losing your job and when the payments start. If you have savings to rely on, opting for a 90-day period instead of 30 will almost always mean a lower cost.

- The Payment Period: This sets the maximum time you’ll receive payments for a single claim. A policy that pays out for up to 12 months will be cheaper than one that covers you for 24 months.

Navigating The Claims Process

Facing redundancy is stressful enough without a complicated insurance claim adding to your worries. Thankfully, the process for claiming on a redundancy policy is usually quite direct.

Knowing the steps in advance makes a world of difference, helping you feel prepared and more in control.

The moment you receive official redundancy notice, your first call should be to your insurer. The sooner you let them know, the quicker they can start your claim. This first contact kicks everything off, and they'll guide you on what to do next.

Kicking Off Your Claim

Once you've notified your provider, they will send you a claims form and a list of the documents they need. It is very important to fill this paperwork out accurately and return it as soon as possible to avoid any delays.

Our best advice? Stay organised. Keep copies of everything you send, just in case.

Insurers typically ask for a few key documents:

- Proof of Redundancy: This is usually the formal letter from your former employer confirming your role was made redundant.

- Your P45: This form is standard proof that you've left your previous job.

- Proof of Income: You'll likely need to provide recent payslips to confirm the salary your policy was based on.

- Identification: Standard documents to prove your identity, like a copy of your passport or driving licence.

What Happens If A Claim Is Disputed?

In most cases, if you have a valid policy and all your documents are in order, the claims process is smooth. However, disputes can happen. If you feel your claim has been unfairly rejected, you have clear rights under the Financial Conduct Authority (FCA) regulations.

Your first step is to make a formal complaint to the insurer's internal complaints department. If you're not happy with their final response, you can then take the issue to the Financial Ombudsman Service. This is an independent body that steps in to resolve disputes between consumers and financial companies.

The Financial Ombudsman Service offers a free and impartial review of your case. Their decision is binding on the insurance company, which gives you a powerful layer of protection if you feel you have been treated unfairly.

It’s invaluable to keep detailed records of every conversation you have with your insurer—note down dates, times, and the names of people you spoke to. This simple habit ensures you have a strong, evidence-based case to present if you ever need to escalate the issue.

FAQs: Common Questions About Redundancy Cover

Even when things seem straightforward, it’s completely normal to have a few questions. Let’s tackle some of the most common queries about redundancy cover with clear, direct answers.

Can I get redundancy cover if I am self-employed?

Unfortunately, the answer is almost always no. Insurers design these policies specifically for people in permanent, PAYE employment. Redundancy is a legally defined process for employees, which makes the risk measurable for an insurer. The world of self-employment and freelance work is far more unpredictable, making it nearly impossible for providers to offer this specific type of cover.

What is an initial exclusion period?

This is a set timeframe at the beginning of your policy during which you cannot make a redundancy claim, typically between 60 and 120 days. Think of it as a qualifying period. Insurers put it in place to prevent people from taking out cover only when they suspect their job is already at risk. It ensures the policy is there for genuinely unforeseen events.

It’s crucial to understand this before you buy. If you were made redundant within this initial window, you would not receive a payout, even if you have paid premiums.

Are the monthly payouts taxed?

No, they are not. In the UK, any monthly income you receive from a personal redundancy insurance policy is paid to you completely tax-free. This is a significant benefit, as it means every penny of the payout can go directly towards your essential costs like the mortgage, rent, and household bills.

What if I turn down a settlement agreement?

This can be a tricky area. If your employer offers you a settlement agreement (previously known as a compromise agreement) and you turn it down, it could jeopardise your claim. From an insurer's perspective, they might see this as you having a hand in your own unemployment, as these policies are designed for involuntary redundancy. It's vital to check the policy's terms and conditions or speak with your provider if you find yourself in this situation.

Ready to see how affordable your financial safety net could be? Get a free, no-obligation quote with Discount Life Cover today and take the first step towards securing your income.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.