How much does an average funeral cost? A UK guide

Start saving money on Life insurance today

Losing a loved one is tough enough without the added worry of a hefty funeral bill. Knowing what to expect financially is the first step in taking control, allowing you to plan a fitting tribute without the stress of unexpected costs.

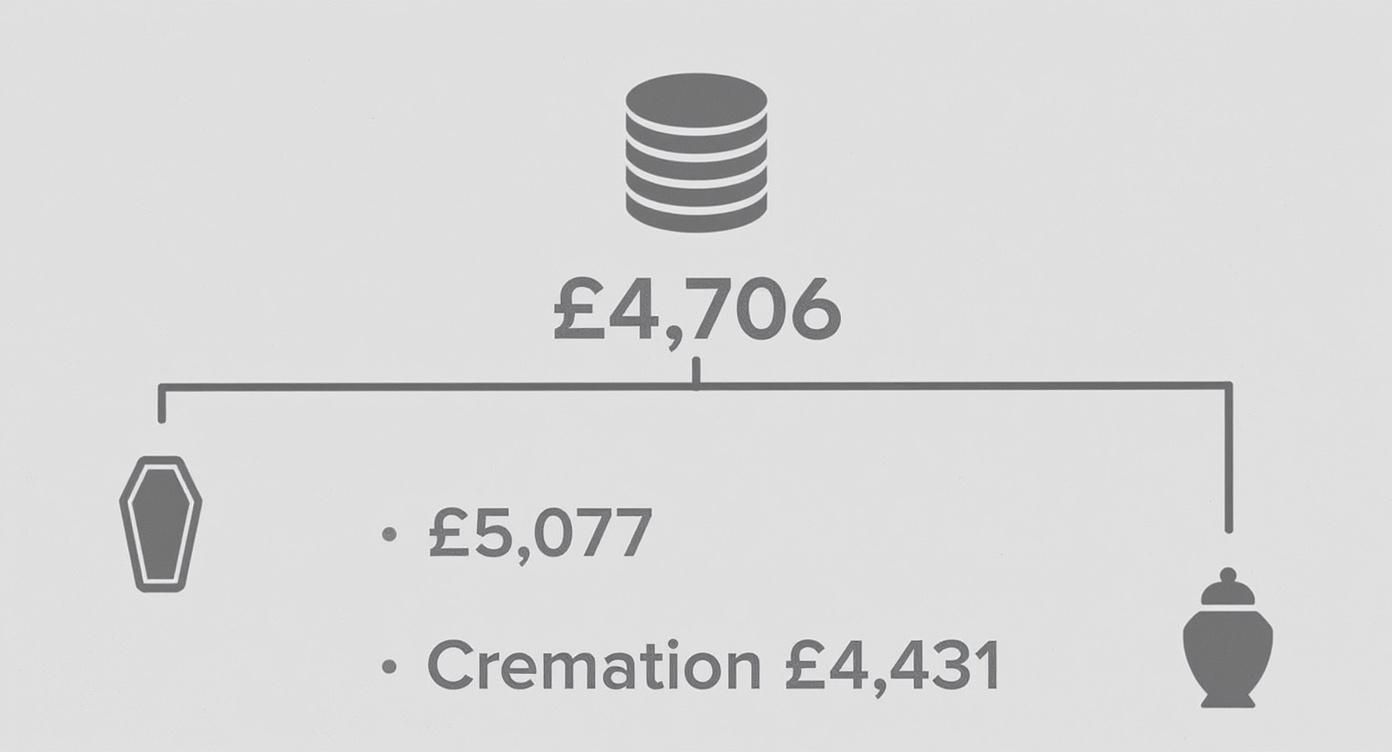

So, let's talk numbers. Right now, a traditional burial in the UK will set you back an average of £5,077, while a cremation is a bit less, at around £4,431. These aren't small figures, and they highlight a steady upward trend in funeral expenses.

What Is the Average Cost of a UK Funeral?

When you’re grieving, the last thing you want is a financial shock. Getting a clear idea of how much an average funeral costs provides a solid starting point for planning. It helps you make clear-headed decisions during what is an incredibly emotional time, ensuring you can say goodbye properly without taking on unmanageable debt.

Recent figures put the average cost of a basic funeral in the UK at around £4,706. That’s a 5.7% jump from the previous year. This price generally covers the funeral director's professional services and the essential third-party fees, like paying for the crematorium or the person leading the service. For a deeper dive into these numbers, you can explore more about UK funeral cost trends.

Key Cost Differences

The single biggest decision that will shape the final bill is the choice between burial and cremation. The price difference between the two can be quite significant.

- Burial: This is usually the more expensive path. The costs quickly add up when you factor in buying a burial plot, the fee for digging the grave, and any ongoing maintenance charges for the cemetery.

- Cremation: This tends to be a more affordable option, mainly because you avoid the substantial expense of a burial plot. That said, the final cost still depends on the kind of service you choose to have alongside it.

While these national averages are a great benchmark, it's important to remember they're just a guide. The final amount you'll pay can shift dramatically based on where you are in the UK and the personal touches you decide to include in the service.

Understanding the average costs is the first step towards effective financial planning. It transforms an unknown expense into a manageable figure, allowing families to prepare and avoid financial strain during a period of grief.

To make this even clearer, here's a simple table summarising the average costs.

UK Average Funeral Costs at a Glance

This table gives you a quick snapshot of the typical costs you can expect for different funeral types across the UK. It’s a helpful way to set realistic expectations before we get into the nitty-gritty of what these figures actually cover.

| Funeral Type | Average Cost |

|---|---|

| Traditional Burial | £5,077 |

| Traditional Cremation | £4,431 |

| Average Basic Funeral | £4,706 |

Seeing the numbers laid out like this really helps frame the conversation. In the next section, we'll break down exactly what goes into these costs, so you know precisely what you're paying for.

Understanding Your Funeral Bill: A Detailed Breakdown

When a final funeral bill arrives, it's easy to feel a bit overwhelmed. But taking a moment to understand exactly what you're paying for can give you a sense of clarity and control. A typical bill is usually split into two main parts: the fees for the funeral director's professional services and the third-party costs, often called ‘disbursements’.

Getting your head around the difference is key. The funeral director's fees cover all the elements they manage directly, which means you have some room to make choices and be flexible. Disbursements, on the other hand, are pretty much fixed costs that are paid to other organisations on your behalf.

Funeral Director Fees

This slice of the bill covers the professional expertise, care, and practical arrangements provided by the funeral home. It’s essentially what you pay the director for their experience in managing the entire process with dignity and respect.

These services usually include:

- Collection and Care: The professional service of bringing the person who has died into their care and preparing them for the funeral.

- The Coffin: This is a significant item that can vary hugely in price depending on the material and design you choose.

- Hearse and Transport: This covers the use of a hearse for the day of the funeral and any other vehicles you might need.

- Arrangement and Admin: This is for the time and expertise that goes into coordinating every aspect of the service, from handling paperwork to offering guidance.

Third-Party Costs and Disbursements

Disbursements are the essential, non-negotiable fees that the funeral director pays out to others. Think of the funeral director as simply passing these costs on to you without adding any markup. They are a necessary part of any funeral, whether you're planning a burial or a cremation.

Common disbursements include:

- Cremation or Burial Fees: The charge from the crematorium or cemetery for the service itself.

- Minister or Celebrant Fees: The payment for the person who will be conducting the ceremony.

- Doctor's Fees: These may be required for cremation certificates.

For burials, the biggest third-party cost is often the burial plot. The price for the exclusive right of burial can add thousands to the final bill, which is the main reason why burials tend to be more expensive than cremations. This infographic gives a really clear comparison of the average costs.

As you can see, that choice between a burial and a cremation is the single biggest factor affecting the overall cost. The numbers back this up: the average UK cremation costs around £3,980, while a burial comes in at an average of £5,198 – a difference driven largely by those plot fees. You can find more details on these cost breakdowns at Funeral Partners.

By breaking down the bill, you can clearly see which costs are fixed and which are variable. This knowledge empowers you to make informed decisions that honour your loved one while staying within a manageable budget.

It’s also important to remember that the funeral bill is often settled by the deceased's estate. This process is managed during probate, and understanding your responsibilities is vital. For more information, check out our guide on what probate is and how it works.

How Location Shapes Funeral Prices Across the UK

You might think a funeral costs roughly the same no matter where you live, but your postcode actually plays a huge role in the final bill. We're not talking about a small difference here, either—the variation from one region to another can easily run into thousands of pounds. Understanding how much an average funeral cost fluctuates geographically gives you a much clearer, more realistic picture for budgeting.

This price gap isn't just random. It's tied directly to things like the local economy, property values, and what the local council charges for its services. For instance, it's no surprise that areas with sky-high land prices have more expensive burial plots, which pushes the cost of a traditional burial way up.

Why Prices Vary So Much

So, what's behind these big regional differences? A few key factors create a financial map that looks very different depending on where you are in the UK.

- Property and Land Value: This is the big one, especially for burials. A burial plot in a packed city like London is always going to cost far more than one in a quiet, rural part of Scotland or Wales.

- Crematorium Fees: Local councils and private companies set their own prices for cremations, and these can vary based on their running costs and local demand.

- Funeral Director Overheads: The cost of doing business—things like rent for the premises and staff wages—is naturally higher in more expensive areas. Funeral directors have to pass these costs on in their professional fees.

The difference is pretty stark when you look at the numbers. Funerals are most expensive in London, averaging £5,449, which is a 5.4% jump from the previous year. At the other end of the scale, Northern Ireland is the most affordable region, with an average cost of £3,441. That’s a massive 58% difference between the UK's most and least expensive places to arrange a funeral. You can dig deeper into these regional funeral cost differences to see the full picture.

Knowing your local average is crucial. It takes you from a vague national estimate to a personal, practical figure you can actually use for proper financial planning.

Average Funeral Cost by UK Region

To really bring this home, the table below gives a snapshot of how funeral costs stack up across different parts of the United Kingdom. It shows just how much your location can swing the final bill.

| UK Region | Average Funeral Cost |

|---|---|

| London | £5,449 |

| South East & East of England | £4,668 |

| Yorkshire and the Humber | £4,489 |

| Wales | £4,175 |

| Scotland | £4,136 |

| Northern Ireland | £3,441 |

Getting your head around these regional variations helps you set realistic expectations right from the start. It means you’re budgeting for the reality on your doorstep, not a national average that might be miles off.

Navigating the Optional Funeral Costs

While the funeral director's fees and third-party costs make up the core of the bill, it's often the personal, optional extras that really push the final figure up. These are the choices you make to create a farewell that feels truly unique and memorable. Getting your head around these potential additions is the key to budgeting properly and figuring out how much an average funeral cost will be for your family.

These optional costs are anything but frivolous; they're meaningful ways to honour someone you loved. The goal here isn't to put you off them, but to give you a clear-eyed view of the potential expenses. That way, you can decide what truly matters without feeling the financial squeeze later on.

Common Personalisation Costs

When you're putting a service together, there are several common 'extras' that can add up. Each one serves a special purpose in making the day a fitting tribute.

- Floral Tributes: Flowers are a classic way to show love and remembrance. Costs can start from £50 for a simple family arrangement but can easily run into several hundred pounds for more elaborate casket sprays and big displays.

- Order of Service Booklets: These printed guides for everyone attending can set you back between £100 and £300. The final price tag depends on how many you need, how fancy the design is, and the quality of the paper.

- Catering for the Wake: Hosting a gathering after the service is a lovely way to celebrate the person's life. Catering costs can vary wildly, but a realistic starting point is to budget for £15-£25 per person.

- Newspaper Death Notices: Popping an announcement in a local or national paper can cost anywhere from £100 to over £300.

Significant Memorial Expenses

Looking beyond the service itself, you might consider larger, lasting memorials. These often represent some of the most substantial expenses you'll face. For a lasting and personal tribute, families might consider investing in custom memorial jewelry as part of their optional funeral costs.

Another major cost is the headstone or memorial plaque.

A simple, flat grave marker might start from around £1,000, but a more traditional, upright headstone can easily cost between £2,000 and £5,000, or even more. It all comes down to the material, size, and how intricate the inscription is.

By being aware of these optional costs upfront, you can have a much more informed chat with your family and the funeral director. It allows you to prioritise what's most important for your tribute, making sure you create a beautiful farewell that fits your budget and avoids any nasty financial surprises down the line.

Smart Ways to Plan and Pay for a Funeral

Knowing the costs is one thing, but figuring out how to actually pay for them is what really matters. A solid plan is the key to protecting your family from a sudden financial shock at an already difficult time.

The good news is, there are a few practical ways to get prepared. Putting a plan in place now means your loved ones can focus on saying goodbye, not scrambling to pay bills.

Often, the first place people look is the deceased’s estate—that means using money from their bank accounts or savings to settle the funeral bill. The catch? Accessing these funds isn’t always instant. Legal hurdles like probate can tie up the money for weeks or even months, leaving your family to find the cash upfront. This is exactly why a bit of forward-thinking makes all the difference.

Proactive Financial Planning

Getting ahead of the game is all about putting a financial safety net in place long before it’s ever needed. This puts you in the driver's seat, letting you decide on your final wishes while removing the financial guesswork for your family. One of the most common and effective ways to do this is with the right kind of insurance policy.

Life insurance, in its different forms, is designed to pay out a tax-free lump sum when you pass away. While this money can be used for anything, many people set it up specifically to cover funeral expenses and other final bills. The trick is to understand the options and find the one that fits your circumstances.

Over 50s Life Insurance Explained

For anyone aged 50 and over, an Over 50s Life Insurance plan is often a fantastic solution. Its biggest selling point is just how simple and accessible it is.

An Over 50s plan offers competitive acceptance for UK residents aged between 50 and 85. This means you can’t be turned down because of your health, and you won’t even have to answer any medical questions to get approved.

The policy itself is incredibly straightforward. You pay a fixed monthly amount, and in return, a fixed cash sum is competitive to be paid out when you die. Your family can then use this money to cover the funeral, making sure the funds are available right when they're needed. The claims process is usually quick and simple for your loved ones; you can find out more by reading our guide on how to claim on a life insurance policy.

Comparing Your Insurance Options

While Over 50s cover is a great tool, it’s not the only one in the box. It helps to see how it stacks up against other types of life insurance.

- Term Life Insurance: This covers you for a fixed period of time (the 'term'), like 20 or 30 years. It pays out if you die within that timeframe but offers nothing if you outlive it. It's often used by homeowners to ensure their mortgage is cleared if they pass away unexpectedly.

- Whole of Life Insurance: Just as the name suggests, this policy covers you for your entire life. It’s usually more expensive than term insurance but comes with a competitive payout, no matter when you pass away.

An Over 50s plan is really a type of whole-of-life policy, but it’s been specifically designed for older applicants. The payout amounts are often smaller and better suited to covering funeral costs, and its competitive acceptance makes it a reliable choice for those who might find it tricky to get other types of cover. Ultimately, by planning ahead, you’re giving your family the most valuable gift of all: peace of mind.

Common Questions About Funeral Costs

To wrap things up, let's tackle some of the questions we hear all the time when people are trying to get their heads around how much an average funeral cost might be. This should give you some clear, straightforward answers to help you feel a bit more confident.

What Is the Cheapest Funeral Option in the UK?

Hands down, the most affordable option is a direct cremation. It’s a very simple, no-fuss approach where the cremation happens without a funeral service or ceremony beforehand.

Essentially, the person who has passed away is collected and cared for, then cremated privately. The ashes are then returned to the family. From there, you're free to hold your own personal memorial service whenever and wherever you like, which can be a much more budget-friendly way to say goodbye.

Are Funeral Costs Tax Deductible?

This is a common point of confusion. For most of us, funeral expenses are not tax deductible from our personal income tax returns.

However, there is a silver lining. The cost of the funeral can be deducted from the value of the deceased's estate before Inheritance Tax is worked out. This reduces the total value of the estate, which could potentially lower the tax bill. If you want to get a clearer picture of how this works, it’s worth understanding the basics of Inheritance Tax in the UK.

What Happens If a Family Cannot Afford a Funeral?

It's a dreadful situation to be in, but if there isn't enough money in the estate and the family can't cover the costs, there is help available.

- Funeral Expenses Payment: If you're receiving certain benefits, you might be eligible for a government payment. It's designed to help with funeral costs, though it might not always cover the full amount.

- Public Health Funeral: In cases where there are no relatives or friends who can arrange the funeral, the local council or hospital has a legal duty to step in and arrange a simple burial or cremation.

Don't be afraid to have an honest chat with the funeral director about your budget. They've seen it all before and can often suggest ways to keep the costs manageable.

The key takeaway here is that planning ahead is the single best way to avoid this kind of financial stress. Things like an Over 50s Life Insurance plan are specifically designed to pay out a fixed cash sum to cover these exact expenses, making sure your family isn't left in a bind.

What Is the Most Expensive Part of a Traditional Funeral?

If you're planning a burial, the single biggest cost is almost always the burial plot itself. The fee for the 'exclusive right of burial' can run into thousands, especially in crowded areas like London.

For both burials and cremations, though, the funeral director's professional fees usually make up the largest slice of the pie. We're talking well over half of the final bill in many cases. The choice of coffin can also be a surprisingly big expense, with prices all over the map depending on the materials and design.

Planning for the future is one of the kindest things you can do for your family. A life insurance policy can provide the money needed to cover funeral costs, so your loved ones don't have to worry about finding the funds at an already difficult time.

At Discount Life Cover, we make it easy to compare quotes from the UK's leading insurers. Get a free, no-obligation quote today and give yourself some peace of mind.

Get Your Free Life Insurance Quote Now

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.