Whole Life vs Term Insurance: A UK Guide

Start saving money on Life insurance today

Choosing between life insurance policies boils down to one key question: do you need protection for a specific period or for your entire life? Term life insurance is designed to cover you for a set number of years, while whole of life insurance provides lifelong protection. The right choice depends on matching the policy to your financial goals, whether that’s covering a mortgage for a fixed time or leaving a permanent legacy for your family.

Comparing Your Two Main Life Insurance Options

Trying to decide between whole of life and term insurance can feel overwhelming, but it gets much simpler when you understand what each is built for. Think of it like choosing a vehicle. Term life insurance is like a reliable family car – perfect for covering you while the children are growing up and you're paying off the mortgage. Whole of life, on the other hand, is more like a classic car you plan to keep forever and pass down. Both are excellent, but they serve different purposes.

To make the right decision for your family's future, it’s vital to understand the fundamental difference between term and permanent life insurance. This is a significant choice, so it pays to be well-informed.

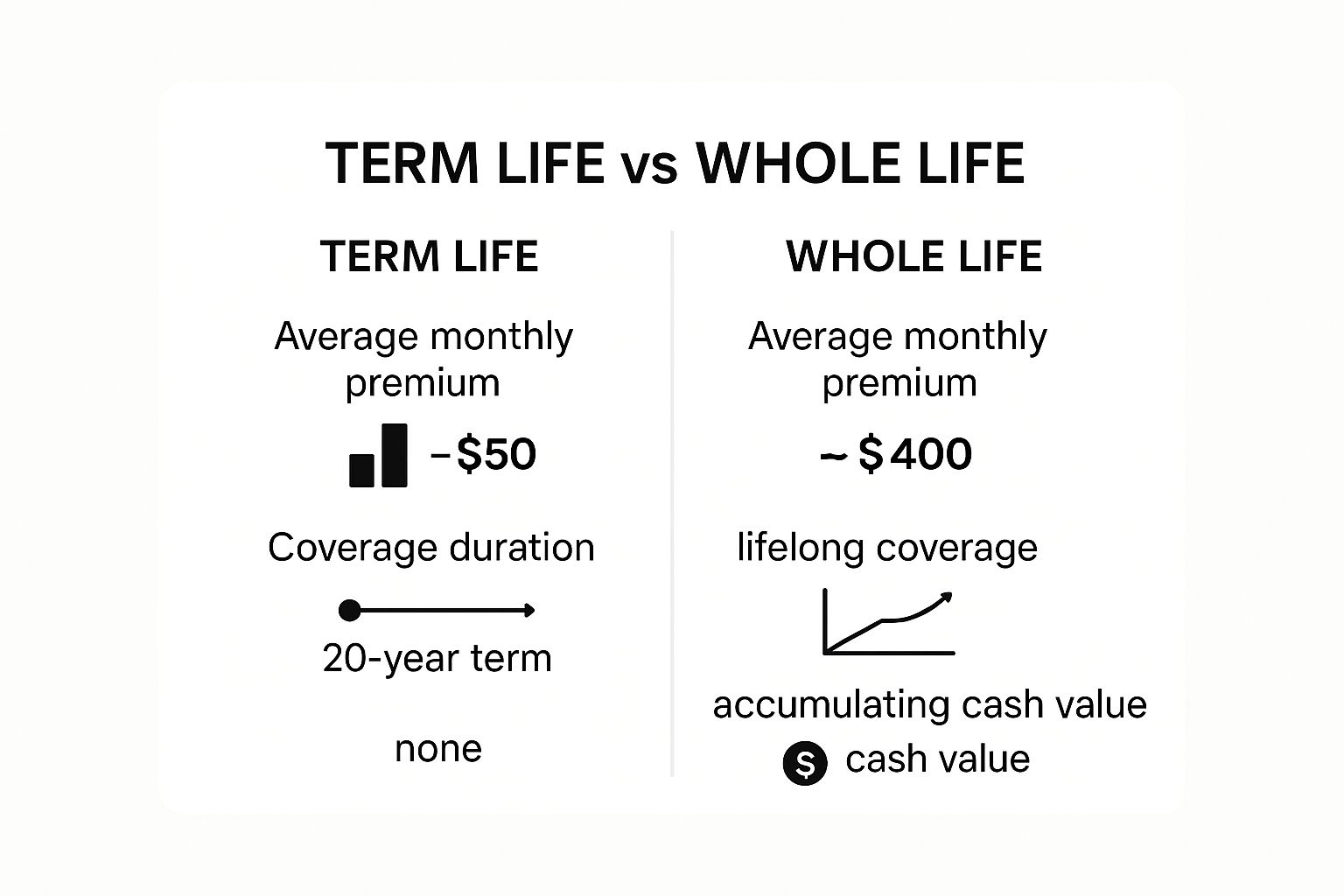

The visual below gives you a quick snapshot of the core differences in cost, how long the cover lasts, and what you get for your money.

As you can see, term life is by far the more affordable option for cover over a defined period. The much higher premiums for whole of life reflect its lifelong guarantee and, in some cases, an investment element.

Key Differences at a Glance

If you're looking for a straightforward, side-by-side comparison, this table cuts straight to the chase. It breaks down the main features of each policy so you can see exactly how they stack up.

| Feature | Term Life Insurance | Whole of Life Insurance |

|---|---|---|

| Cover Duration | A fixed period you choose, such as 10, 20, or 30 years. | Permanent cover that lasts for your entire life. |

| Main Purpose | Covers specific financial obligations, such as a mortgage or the cost of raising children. | Provides a competitive inheritance, covers funeral costs, or helps with inheritance tax planning. |

| Payout Guarantee | Only pays out if you pass away during the policy term. | Guaranteed to pay out whenever you pass away, as long as premiums are up to date. |

| Cost | Much lower premiums, making it an affordable option for most families. | Significantly higher premiums due to the lifelong cover and other features. |

| Investment Element | None. It’s pure life cover, plain and simple. | Some policies build a cash value over time, which you may be able to borrow against or withdraw. |

This table gives you a clear overview, but the best choice always depends on your individual circumstances, your budget, and what you want your life insurance to achieve.

How Term Life Insurance Works

Think of term life insurance as pure, focused protection for a set period. It’s not designed to last forever. Instead, you choose a specific timeframe—the ‘term’—and if you pass away during that window, your loved ones receive a tax-free lump sum.

This fixed duration is its biggest advantage. It means you can match your cover precisely to your most significant financial commitments. A classic example is a young family buying their first home with a 25-year mortgage; they can take out a term policy for the same 25 years to ensure the debt is cleared no matter what happens.

The Main Types of Term Cover in the UK

Term insurance isn't a one-size-fits-all product. In the UK, it comes in a few different forms, each built for a specific purpose. Understanding the three main types is the first step to making a smart choice.

- Level Term Insurance: With this policy, the payout amount (the 'sum assured') and your monthly premiums are fixed for the entire term. It’s a great fit for covering an interest-only mortgage or leaving a specific lump sum for your family to live on.

- Decreasing Term Insurance: Here, the amount of cover gradually reduces over the years, usually in line with a repayment mortgage. Because the insurer's potential payout gets smaller over time, the premiums are typically cheaper than for level term cover.

- Increasing Term Insurance: This option is designed to protect against inflation. The sum assured grows each year, often linked to an index like the Retail Prices Index (RPI), to protect the real-world value of the payout.

Deciding between them can feel like a big decision. We dive deeper into the details in our guide comparing level or decreasing term life insurance.

What Happens When the Term Ends?

So, what happens when the policy term is up? It’s simple: the cover ends. If you’ve paid all your premiums and outlived the policy, there’s no money back and your beneficiaries do not receive a payout.

This is a fundamental difference between term and whole of life insurance. Term cover is not an investment or a savings plan. It's straightforward protection that only pays out if you die during the agreed-upon period.

Some policies might offer a 'renewal' option, which lets you extend the cover without another medical assessment. Be warned, though—your new premiums will be recalculated based on your older age and will almost certainly be much higher. For most people, term insurance is simply the most affordable and sensible way to protect their family during the years they need it most.

Understanding Whole of Life Cover

Unlike term insurance, which provides temporary protection, whole of life insurance is built for certainty. The clue is in the name: it covers you for your entire life. This means it guarantees a payout to your loved ones whenever you pass away, as long as the premiums have been paid.

This lifelong guarantee is what sets it apart. It’s not just a safety net; it’s a long-term financial planning tool. The conversation shifts from covering temporary debts like a mortgage to creating a permanent legacy.

Because the payout is competitive, whole of life cover is usually used for specific financial planning goals. It's about leaving behind a definite sum of money for a particular reason, with the absolute knowledge that the policy will pay out one day.

Common Uses For Whole of Life Policies

In the UK, this type of policy is most effective when used for clear, long-term objectives that don't have an expiry date. Its structure makes it the perfect fit for situations where a competitive future sum is essential.

Here are a few common reasons people choose whole of life cover:

- Covering an Inheritance Tax (IHT) bill: For estates valued above the current tax-free threshold, a whole of life policy can provide the exact lump sum needed to settle the bill. This ensures your beneficiaries inherit what you intended, not what's left after HMRC takes its share.

- Leaving a planned legacy: It’s a straightforward and reliable way to leave a specific amount of money to children, grandchildren, or a chosen charity, creating a lasting gift.

- Paying for funeral expenses: A smaller whole of life policy, often known as an Over 50s plan, can ensure funeral costs are covered without forcing your family to dip into their savings during a difficult time.

Whole of life insurance isn't just about protection; it's a strategic tool for estate planning. Its certainty allows you to plan your financial legacy with confidence, knowing a specific amount will be there for your loved ones.

Justifying the Higher Premiums

Let's be upfront: whole of life premiums are significantly higher than those for term insurance. That cost difference comes down to one simple fact—the lifelong guarantee. The insurer, such as Aviva or Legal & General, knows it will be paying a claim eventually.

Your premiums are funding that competitive death benefit. In some policies, they also contribute to an investment element that can grow over time, making it a more complex financial product.

So, is the higher cost worth it? That depends entirely on your objectives. If your focus is on solid estate planning or leaving a competitive inheritance, the price simply reflects the permanent nature of the solution. To get a feel for the numbers, using a whole of life insurance calculator is a great way to see how the premiums might fit within your budget and legacy plans.

Comparing the Costs of UK Policies

When you get down to the details, the cost is often what swings the decision between whole life vs term insurance for most UK families. Let's be clear: the price gap between these two isn't small. Understanding the logic behind this difference is crucial for making an informed choice.

Term life insurance is built to be affordable because the cover has an expiry date. You are essentially paying for protection for a set period. If you are still alive when the policy term ends, the insurer does not pay a claim, which is why they can offer it so cheaply.

On the other hand, a whole of life policy is priced on the certainty that the insurer will eventually pay out. This guarantee means the premiums have to be significantly higher to cover not just the death benefit, but also the costs of managing the policy for the rest of your life.

A Real-World Premium Comparison

Let's put some numbers to this to see how it plays out in reality. A healthy, 30-year-old non-smoker could get £250,000 of level term cover over 25 years for around £10-£15 per month.

Now, compare that to a whole of life policy. For the same person, securing a competitive payout of £250,000 could cost £200 per month or more. The difference is substantial. This perfectly illustrates the central trade-off: you get a much bigger safety net for your money with a term policy, but that protection won't last forever. You can explore more on the average UK life insurance costs to get a broader perspective.

The question isn't simply "which is cheaper?" but "what am I actually paying for?" With term insurance, you're paying for pure, no-frills protection. With whole of life, you're paying a premium for a competitive payout and lifelong peace of mind.

Key Factors That Influence Your Premiums

No matter which policy you lean towards, UK insurers will look at a handful of personal factors to calculate your premium. These details help them build a picture of the risk involved in covering you.

Your final quote will be shaped by:

- Age: The younger you are when you apply, the less you'll pay.

- Health: Insurers will need to know about your medical history, including any pre-existing conditions.

- Lifestyle: Factors like your job, high-risk hobbies, and whether you smoke or drink regularly all play a part.

- Amount of Cover: A larger payout (sum assured) will naturally come with a higher premium.

- Policy Type: Even within term insurance, a decreasing term policy will be cheaper than a level term policy for the same starting amount.

Knowing what drives the cost puts you in a much stronger position when you're getting quotes.

Matching Your Policy to Your Life Stage

Understanding the mechanics of whole life versus term insurance is one thing. The real question is, how do these policies fit into real life? The best choice hinges entirely on your personal circumstances, your financial goals, and where you are on your journey.

Let's look at some practical, real-world situations to see how these policies work for different people.

When Term Life Insurance Is the Logical Choice

Term insurance is most effective when you need a large amount of cover for a specific period without a high cost. Think of it as a financial safety net for major but temporary responsibilities.

Here are a few examples where term cover is often the right call:

New Parents: When you have young children, your main worry is ensuring they are looked after until they become financially independent. A 20-year term policy is perfect for this, providing a lump sum large enough to cover childcare, school fees, and living costs if you were to die unexpectedly.

Homeowners with a Mortgage: This is the most common reason people get term insurance. A decreasing term policy can be set up to mirror your mortgage, with the payout reducing as you pay off your loan. It’s a straightforward way to ensure your family can clear the mortgage and keep their home.

People with Pre-existing Medical Conditions: For those with health issues like diabetes or high blood pressure, term insurance is often the most accessible and affordable option. While premiums may be higher, it provides crucial protection that might be prohibitively expensive with a whole of life policy.

The common thread here is a clear end date. For parents, it's when the children are independent. For homeowners, it's when the final mortgage payment is made. Term insurance protects your loved ones during these crucial, but finite, periods.

When Whole of Life Insurance Makes Sense

Whole of life cover is a permanent solution built for financial goals that don’t disappear after 20 or 30 years. That competitive payout makes it a powerful tool for long-term planning.

Consider these scenarios where a whole of life policy is often a better fit:

Estate Planning and Inheritance Tax: If your estate is large enough to attract a significant Inheritance Tax (IHT) bill, whole of life is an effective tool. By placing the policy 'in trust', the payout can go directly to your beneficiaries to cover the tax liability, ensuring they inherit the full value of your estate.

Providing for a Dependent with Special Needs: For parents of a child who will need lifelong financial support, a whole of life policy offers peace of mind. It guarantees that the necessary funds will be there to provide for their care, no matter when you pass away.

Leaving a Guaranteed Legacy or Covering Funeral Costs: Whether you want to leave a specific gift for your grandchildren or simply ensure funeral expenses are covered, whole of life insurance (including Over 50s plans) provides a simple, certain way to make sure a set sum of money is left behind.

These situations all call for certainty and permanence, which is exactly what a whole of life policy delivers.

Making Your Final Insurance Decision

So, how do you decide between whole life vs term insurance? It boils down to a fundamental trade-off. Are you looking for affordable, high-value cover for a specific timeframe, or a competitive lifelong payout for legacy planning? Your answer depends on your budget, long-term goals, and what you need to protect.

Term insurance is your cost-effective safety net for temporary but significant financial obligations, like a mortgage or raising children. Whole of life insurance, on the other hand, is built for permanence—it provides certainty for needs that don't have an expiry date, like covering an inheritance tax bill or leaving a competitive gift.

Finding the Right Balance for Your Needs

You don't always have to pick just one. For many people, a hybrid strategy offers the best of both worlds.

A common blended approach looks like this:

- A large term policy to cover big debts like the mortgage, making sure the family home is secure.

- A smaller whole of life policy to handle final expenses, such as funeral costs, so your family isn't left with a bill during a difficult time.

This combination gives you robust protection where you need it most, without the hefty premium of a single, massive whole of life policy.

The UK insurance market is always changing, with life insurance premiums growing by 7.1% in recent years. This reflects a shift in what people need and how regulations are evolving. While many still opt for the straightforward efficiency of term insurance, a growing number see whole of life as a stable, lifelong financial asset. You can discover more about UK insurance industry statistics at CoinLaw.io.

Ultimately, life insurance isn't a "set it and forget it" decision. It's crucial to review your cover whenever your life circumstances change—if you have another child, move house, or change career.

Remember, all UK insurers are regulated by the Financial Conduct Authority (FCA), which gives you valuable consumer protection. By taking the time to assess your needs, you can confidently choose the right protection to secure your family's future.

Frequently Asked Questions (FAQ)

Choosing between whole life and term insurance can bring up many questions. To help you find clarity, here are answers to some of the things we're asked most often.

Can I have both a whole of life and a term life policy?

Yes, absolutely. Holding both types of policies at the same time is a smart and popular strategy in the UK. It allows you to create a tailored plan that fits your life and budget. You could use a term policy to handle large, temporary debts like your mortgage, while a smaller whole of life policy covers competitive costs like funeral expenses.

What happens if I can no longer afford the premiums?

If your financial situation changes, it's crucial to know your options. With a term life policy, if you stop paying, the cover will 'lapse' and simply end. For a whole of life policy, you may be able to surrender it and receive a 'cash surrender value', though this could be less than the total premiums you've paid. Your first step should always be to speak with your insurer, as they are regulated by the FCA and may offer options like reducing your cover to make premiums more affordable.

Is Critical Illness Cover included?

No, critical illness cover is very rarely included as standard with either term or whole of life insurance. It is almost always an optional add-on that you can include for an additional cost. It pays out a tax-free lump sum if you are diagnosed with a specific serious illness listed in the policy, providing financial support if you are unable to work.

Will I need a medical exam to get cover?

It depends on your age, your health, and the amount of cover you are applying for. For many younger, healthy applicants seeking a modest amount of cover, UK insurers often do not require one. However, for larger policies or if you have pre-existing medical conditions, the insurer may request a report from your GP or arrange for a nurse to conduct a brief health screening.

Ready to weigh up your options and find the right protection for your family? The team at Discount Life Cover is here to help. Get a free, no-obligation quote today and see just how affordable peace of mind can be.

Compare Life Insurance Quotes Now

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.