A joint life insurance policy is a single financial safety net designed for two people. Think of it as a "two-for-one" deal that wraps both individuals up in one policy. However, the crucial point is that it only pays out once. This payout usually happens after the first person on the policy passes away, at which point the cover ends. For many couples, it's an affordable way to secure financial protection for their loved ones.

This guide explains what a joint life insurance policy is, how it works, and whether it’s the right choice for you and your partner.

Understanding Joint Life Insurance

Imagine a joint life insurance policy as a shared financial umbrella. It's designed to protect two people from the same storm, but you only have one umbrella. When the rain comes—in this case, the death of one partner—the umbrella is used, and the cover it provided is finished.

This straightforward approach is popular with many UK couples, homeowners, and even business partners because it streamlines everything. Instead of juggling two separate applications, two sets of medical questions, and two monthly payments, you have just one of each. More importantly, it's often than taking out two single policies, making it an attractive option if you're managing your budget carefully.

However, the single payout structure is something you need to consider carefully. Once the policy pays out after the first death, the surviving partner is left without any life cover from that policy. They would then need to for a new policy at an older age, which almost always means higher monthly premiums.

Joint Life Insurance At a Glance

To give you a quick snapshot, here's a simple breakdown of a joint policy's core features. This table helps to clarify who it’s for, how it works, and its main selling points.

| Feature | Description |

|---|---|

| Who It Covers | Two people under a single policy (e.g., married couples, civil partners, homeowners, business partners). |

| Payout Structure | Typically pays out a single, tax-free cash lump sum upon the first death of the two individuals covered. |

| Main Benefit | Often more affordable and simpler to manage than purchasing two separate single life insurance policies. |

| Policy End | The policy automatically terminates after the single payout is made, leaving the survivor uninsured under this policy. |

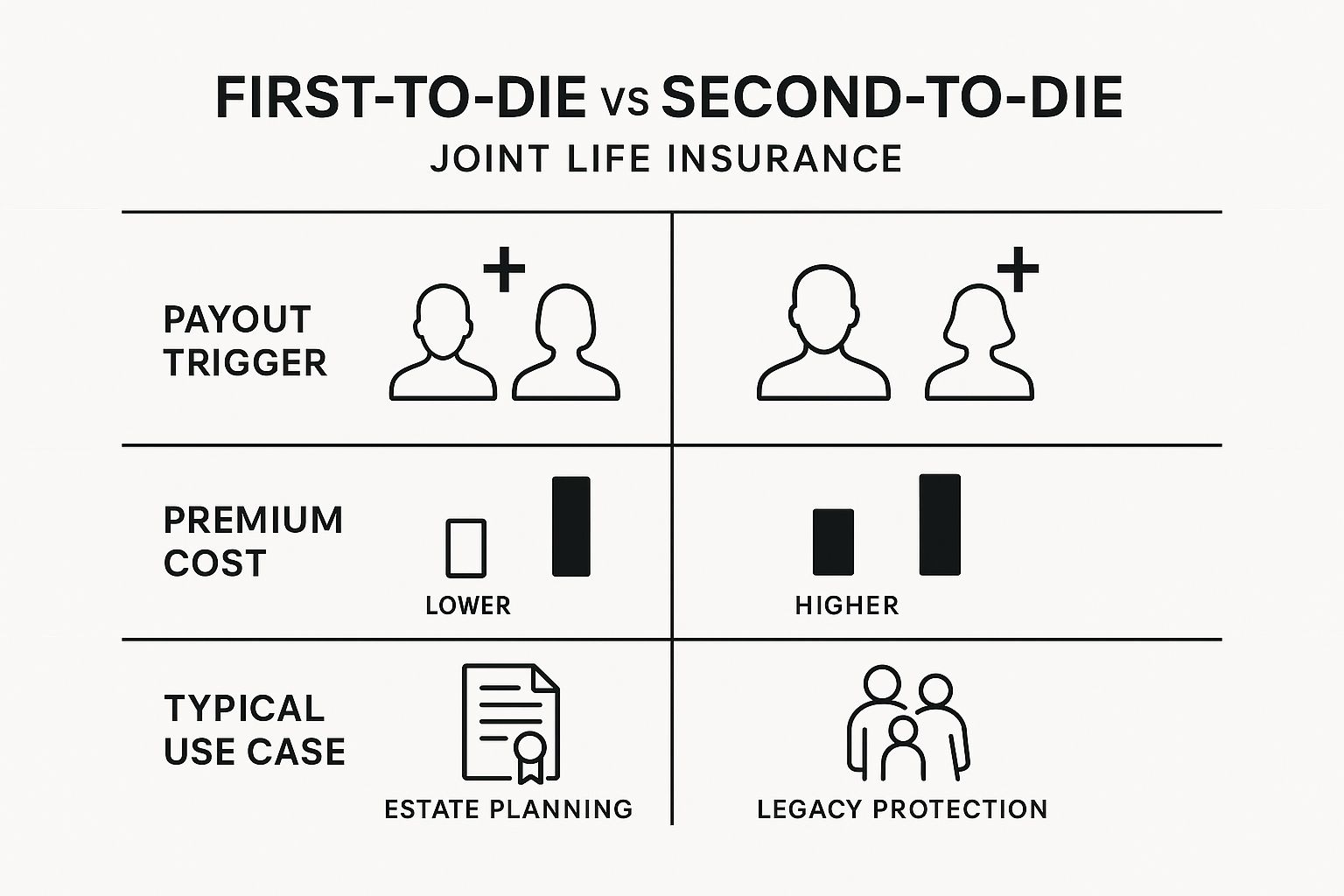

When you start looking into joint life insurance, you'll quickly come across two main types available from UK insurers: 'first death' and 'second death' policies. Understanding the difference is vital, as it dictates when the policy pays out, which has massive implications for your financial planning.

First Death Policies Explained

A 'first death' policy is by far the most common type of joint cover you'll find in the UK. Just as the name suggests, it pays out the agreed cash lump sum after the first of the two people on the policy passes away.

Once that payout happens, the policy is finished. It ends. This is a crucial point many people miss – the surviving partner is no longer covered by that policy and would have to arrange brand-new insurance for themselves if they still needed it.

Key Takeaway: First death policies are designed to provide immediate financial support for the person left behind. The money can be a lifeline, used to clear a mortgage, cover everyday living costs, or pay off other shared debts.

Think of a young couple buying their first home. A first death policy makes perfect sense. If the worst were to happen to one of them, the payout would allow the survivor to pay off the mortgage completely, lifting a huge financial weight at an incredibly difficult time.

Second Death Policies Explained

In contrast, a 'second death' policy (sometimes called a 'last survivor' policy) works differently. This type of cover only pays out after both individuals on the policy have died.

Because the payout is held back until the second death, these policies are not designed to provide a financial safety net for the surviving partner. Instead, they serve a more specific, long-term purpose.

Their main use in the UK is for inheritance tax planning. The lump sum isn't for the surviving partner; it's paid to the beneficiaries—usually the couple's children—to help them settle the inheritance tax bill on their parents' estate. This ensures the assets you've worked hard for can be passed on intact, rather than forcing your children to sell the family home just to pay the tax. For example, a retired couple with a large estate might choose a second death policy to leave a tax-efficient legacy.

Of course, the structure of these policies impacts how much they cost. For couples looking for an affordable way to get covered, joint policies can be a great option. If you want to get into the details of how these policies are priced and who gets the money, you can find out more about joint life insurance payouts to see the finer details.

Joint Life Insurance vs Two Single Policies

It’s one of the biggest questions couples ask when looking at life insurance: should we get one joint policy, or two separate single ones? On the surface, it might seem like a simple choice based on the monthly cost, but the real-world implications run much deeper. The right answer for you will depend on your financial situation, your budget, and how much flexibility you might need in the future.

A joint policy often has a lower monthly premium, which is its main selling point. But this saving comes with a big condition: it only pays out once. After the first person dies, the policy is finished, and the surviving partner is left with no life cover.

Two single policies work differently. They create two completely separate pots of money. If one partner passes away, their policy pays out as expected, but the surviving partner's policy carries on, completely untouched.

Comparing Joint Cover vs Two Single Policies

The difference between a single payout and two potential payouts is the core of this decision. While two single policies might cost a bit more each month, they offer double the potential protection. Let's dig into a quick comparison.

| Feature | Joint Life Insurance Policy | Two Single Life Insurance Policies |

|---|---|---|

| Number of Payouts | Pays out only once, on the first death. The policy then ends. | Can pay out twice—once for each individual policy when they pass away. |

| Cost | Generally monthly premiums than two single policies. | Usually slightly more expensive than one joint policy. |

| Coverage After Claim | The surviving partner is left with no life insurance cover from this policy. | The surviving partner's policy remains active and unchanged. |

| Flexibility | Difficult to split if the relationship ends. Often needs to be cancelled. | Policies are independent. Each person keeps their own cover after a separation. |

| Best For | Couples on a tight budget needing to cover a specific shared debt like a mortgage. | Couples wanting maximum long-term financial security for the surviving partner and children. |

As you can see, the initial saving on a joint policy comes at the cost of long-term security and flexibility.

Understanding the Cost and Payout Difference

Let's use a real-world example. Imagine a couple, both 35 and non-smokers, looking for £250,000 of level term cover over a 25-year mortgage term.

- A joint 'first death' policy for them might cost around £24.00 a month. This provides a single £250,000 payout.

- Two separate single policies, each for £250,000, might have a combined monthly cost of about £28.00.

For an extra £4 a month, they have doubled their family's potential financial safety net to a total of £500,000. While the joint policy is , the two single policies provide far greater long-term value and security. You can explore more about these policy comparisons and see how the numbers stack up for yourself.

Flexibility and Life Changes

Beyond the payout, you have to think about flexibility. Life is unpredictable. What happens if a couple with a joint policy separates or divorces? It can get complicated.

Splitting a joint policy usually isn't an option. The choice is often to cancel it entirely or have one person take over the payments. If it's cancelled, both people have to for brand-new cover. They'll be older, and may have developed health issues, meaning their new premiums could be significantly higher.

Two single policies, on the other hand, are completely independent. If the relationship ends, they just keep their own policies. There are no financial ties to untangle. This built-in freedom is a huge reason why many financial advisers argue that two single policies are often the smarter long-term choice, even if they cost a little more at the start.

Weighing The Pros and Cons of a Joint Policy

No insurance product is a one-size-fits-all solution, and joint life insurance is no exception. The simplicity and lower cost are tempting, but those benefits come with significant trade-offs you need to understand before signing up. The only way to know if it’s the right move for your family is to take an honest look at both sides of the coin.

The Advantages of a Joint Policy

For most couples, the biggest draw is the cost. A joint life policy is almost always than taking out two separate single policies. For young families or anyone buying their first home on a tight budget, that monthly saving can make a real difference.

It’s also easier to manage. With a joint policy, you have:

- One application form to fill out, which saves time and paperwork.

- One set of medical questions to answer.

- One monthly premium to keep track of, making it simpler to budget for.

This streamlined approach makes getting covered feel less of a chore. It’s this combination of convenience and cost savings that makes a joint plan a compelling option for many. You can explore the wider benefits of life insurance to see how this fits into your overall financial planning.

The Disadvantages of a Joint Policy

That affordability comes at a price. The single biggest drawback is the single payout structure. Once the policy pays out after the first person passes away, the cover simply stops.

This leaves the surviving partner completely uninsured by that policy. They would then have to for a brand new one, but now they’re older, the premiums will likely be higher, and they may have developed health conditions that make cover far more expensive or even difficult to obtain.

This is a huge limitation that can leave a serious gap in your family's financial protection when they are most vulnerable.

On top of that, joint policies can become complicated if your relationship changes. If you separate or divorce, you can’t just split the policy. Your only real options are to cancel it entirely – leaving you both with no cover – or have one person take over the payments and become the sole beneficiary. That lack of flexibility is a significant risk.

Who is a Joint Policy a Good Fit For?

A joint policy is not for everyone, but it can be an excellent fit in certain circumstances, particularly for couples with a single, shared financial goal.

- Covering a Mortgage: For many couples, the primary reason for life insurance is to ensure their mortgage is paid off. A joint 'first death' decreasing term policy is often the most cost-effective way to achieve this. The cover amount reduces in line with the mortgage, and the single payout is designed specifically to clear that shared debt.

- Couples on a Budget: For young families where every penny counts, a joint policy can provide essential protection at a lower price point than two single policies. It offers a crucial safety net during the years when financial commitments are high and budgets are tight.

- Estate Planning: A 'second death' joint policy is a specialist tool used for inheritance tax planning. It provides a lump sum after both partners have died, which can be used by their children to pay the inheritance tax bill on the estate, ensuring assets like the family home can be passed down intact.

Key Considerations Before You Buy

Deciding on a joint life insurance policy involves more than just looking at the monthly premium. Getting a few practical details right from the start ensures the cover works as you expect when your family needs it most.

One key consideration is whether to add critical illness cover. This add-on pays out if one of you is diagnosed with a specific serious illness listed in the policy. With a joint policy, it usually only pays out once—for the first person diagnosed. After that, the critical illness element of the policy ends. Two single policies would each have their own critical illness cover, offering a much stronger safety net.

The Importance of Writing Your Policy in Trust

This is one of the most important things you can do with any life insurance policy, yet it is often overlooked. Writing your policy 'in trust' is a simple legal arrangement that keeps the policy payout separate from your estate when you die.

This has two huge benefits:

- It avoids probate: The money goes directly to your chosen beneficiaries without getting delayed in the often lengthy legal process of probate.

- It can reduce inheritance tax: Because the payout doesn't officially form part of your estate, it usually isn't subject to inheritance tax.

Most UK insurers, including those on our panel at Discount Life Cover, offer this service for free. It’s a simple form to fill out that ensures the right money gets to the right people, right when they need it.

Honesty Is The Only Policy

When you for cover, you're protected by the Financial Conduct Authority (FCA), which ensures insurers treat you fairly. But that protection is a two-way street; it relies on you being completely honest during your application. You must disclose everything about your health and lifestyle.

If you fail to mention a pre-existing medical condition or that you’re a smoker, it could be classed as ‘non-disclosure’. This could give the insurer grounds to void the policy and refuse a claim. Being upfront is essential to guarantee the payout for your loved ones. Before you finalise anything, it's worth calculating how much life insurance you need to make sure the cover amount is enough for your family's needs.

Frequently Asked Questions

To wrap things up, let's tackle some of the most common questions about joint life insurance policies in the UK.

What happens if we separate or divorce?

This is a critical question. If a relationship ends, you cannot simply split a joint life insurance policy. The options are limited: you either cancel the policy entirely, leaving both of you without cover, or one partner agrees to take over the policy, becoming responsible for the premiums and the sole beneficiary.

Can we switch a joint policy to two single ones later?

Unfortunately, no. You cannot convert a joint policy into two single ones. If you decide later that you need individual cover, you would have to cancel the joint policy and each for a brand-new single policy. This means going through the full application process again at an older age, which will almost certainly mean higher premiums.

How does our combined health affect the premium?

When you for a joint policy, insurers assess the health and lifestyle of both applicants. The final premium is calculated based on this combined risk profile. The insurer bases the price heavily on the person who presents the higher risk, meaning that individual's age, health, or lifestyle will have the biggest influence on the price you both pay.

Ready to see how affordable protecting your family could be? The expert team at Discount Life Cover is here to help you compare quotes from leading UK insurers in minutes. Find the right cover at the right price today.

Get Your Free, No-Obligation Quote Now

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply