Let's cut through the jargon. A life insurance beneficiary is simply the person, group, or organisation you choose to receive the payout from your policy when you pass away.

Think of it like naming someone in your will to inherit your house, but specifically for your insurance policy. This simple step makes sure the money goes directly to who you want it to, exactly when they need it most. This guide will explain everything you need to know about choosing the right beneficiary for your UK life insurance policy.

Defining The Role Of A Beneficiary In Your Policy

When you take out a life insurance policy, you're putting a plan in place to provide financial support for others after you're gone. The beneficiary is the absolute centrepiece of this plan; they are the named recipient of the policy's death benefit.

This designation is a formal instruction to your insurer, telling them exactly who receives the money. It's an incredibly powerful tool because it operates outside of your will. This often means the funds can be paid out much faster, avoiding the sometimes lengthy and complicated legal process of probate. Our guide on what probate is and how it works dives deeper into this important distinction.

Choosing a beneficiary is one of the most critical parts of sorting out your finances, especially as more people realise the importance of life cover. According to the Financial Conduct Authority (FCA), millions of policies are in force across the UK, showing just how many families depend on this financial safety net for peace of mind.

Why Naming A Beneficiary Is So Crucial

If you don't name a beneficiary, the payout from your policy usually gets absorbed into your estate. This might not sound too bad, but it can trigger some serious delays and complications for your loved ones.

- Probate Delays: Your estate has to go through probate, a legal process that can drag on for months or even years before any money is distributed.

- Potential Tax Headaches: The payout becomes part of your estate's value, which could unexpectedly push it into the threshold for Inheritance Tax.

- Uncertainty for Your Family: Your loved ones could face real financial hardship while they wait for the funds to be released from the legal process.

By naming a beneficiary, you create a direct and efficient path for the payout. It’s the best way to ensure your loved ones get the financial support they need without unnecessary stress or delay. Honestly, it's one of the most important decisions you'll make when setting up your cover.

Who Can Be a Life Insurance Beneficiary?

Right, so you've got your life insurance sorted. The next big question is: who gets the money when you're gone? This person or group is your 'beneficiary', and picking the right one is crucial to make sure your final wishes are actually carried out.

It might seem obvious, but you have more options than you might think. Your choice here determines whether your legacy supports your family, keeps your business afloat, or even benefits a cause you were passionate about.

Naming Individuals

For most people in the UK, the first thought is to name a spouse, partner, or children. It's the most direct way to ensure the people who rely on you most get the financial support they need. For homeowners with a mortgage, this money can be a lifeline, covering the outstanding loan and allowing the family to remain in their home. Similarly, for parents, a payout can help cover future university fees or simply day-to-day living costs.

And we're not talking about a small number of people. In the first quarter of 2025 alone, Brits took out 452,799 new protection policies, with premiums totalling over £13.85 billion. That's a massive financial safety net, and it shows just how many families depend on this support. If you're interested in the numbers, you can dig deeper into the FCA's latest sales data report.

Putting Your Policy in a Trust for More Control

Simply naming an individual is the simplest route, but it's not always the best one, especially if there's a large payout involved or you want more say in how the money is used. This is where a trust comes into play.

Think of a trust as a protective wrapper for your policy payout. It’s a legal setup where you appoint people you trust (called 'trustees') to look after the money for your beneficiaries.

It sounds complicated, but it's a game-changer for a few key reasons:

- It sidesteps probate. The money goes straight into the trust, meaning it doesn't get tangled up in your estate or the often painfully slow probate process. Your family gets the funds much faster.

- It can avoid Inheritance Tax. By placing your policy in a trust, the payout typically isn't considered part of your estate. This simple step could save your loved ones from a hefty 40% Inheritance Tax bill.

- It protects vulnerable beneficiaries. If you're leaving money to children under 18 or a dependent who isn't great with finances, a trust is perfect. The trustees can manage the money for them, releasing funds as and when they're needed.

Naming Organisations and Others

Your options don't stop with family. You can also name other entities to achieve specific goals.

Choosing a beneficiary is a personal decision that shapes how your life insurance policy will work in practice. To help clarify the options, here's a quick rundown of the most common choices for UK policyholders.

| Beneficiary Type | Typical Use Case | Key Consideration |

|---|---|---|

| Spouse/Partner | To cover shared debts like a mortgage, replace lost income, and maintain their standard of living. | The payout forms part of their estate, which could have Inheritance Tax implications for their own beneficiaries down the line. |

| Children (over 18) | To provide a direct financial inheritance for university, a house deposit, or general financial security. | Ensure they are financially mature enough to handle a large lump sum. |

| A Trust | For beneficiaries under 18, dependents with special needs, or for Inheritance Tax planning. | Requires appointing trustees you can rely on to act in the beneficiaries' best interests. |

| Charity | To leave a legacy and support a cause you are passionate about. | The payout goes directly to the charity and is exempt from Inheritance Tax. |

| Business Partner(s) | To fund a 'buy and sell' agreement, allowing the surviving partners to buy your share of the business. | This needs to be set up correctly with a corresponding business agreement to be effective. |

This table shows there's no single "best" choice; it's all about matching the beneficiary to your specific life circumstances and financial goals.

Let's look at some of these non-family options more closely:

- Charities: If you're passionate about a particular cause, naming a charity as your beneficiary is a wonderful way to leave a final, meaningful gift.

- Business Partners: This is a savvy move for business owners. Naming a partner can provide them with the cash needed to buy out your share of the company, ensuring the business you built doesn't crumble without you. This is a core part of what's known as business protection insurance.

Ultimately, the right choice is the one that best reflects your life and your priorities. Take a moment to think through these options—it's the best way to make sure your policy does exactly what you need it to do.

Understanding Primary and Contingent Beneficiaries

Life is full of surprises, and your life insurance policy needs to be ready for them. That’s where the idea of primary and contingent beneficiaries comes in. It's best to think of it as having a main plan and a rock-solid backup plan.

Your primary beneficiary is your first choice. This is the person, people, or even an entity you’ve chosen to receive the payout from your policy. It's who you most want to protect financially.

But things don't always go to plan. What if your primary beneficiary can't receive the money? Perhaps they pass away before you, or at the same time in a shared accident. This is exactly why you need that backup plan.

The Role of a Contingent Beneficiary

A contingent beneficiary, who you might also see called a secondary beneficiary, is next in line. They are the person, trust, or organisation that gets the death benefit if your primary choice cannot.

Naming a contingent beneficiary is a simple step, but it adds a powerful layer of security to your policy. It makes sure that whatever happens, the money goes where you intended it to go, without hitting any frustrating roadblocks.

By naming both a primary and contingent beneficiary, you create a clear line of succession for your life insurance payout. This small step provides a crucial safety net, preventing your policy from defaulting to your estate.

A Real-World Example

Let's say you're a homeowner with a mortgage. You've taken out a level term life insurance policy to make sure the debt is covered if you die.

- Primary Beneficiary: You name your partner. They live with you and share all the household bills, so your goal is for them to use the payout to clear the mortgage and stay in the home you built together.

- Contingent Beneficiary: Just in case, you name your adult sibling as the backup. If something were to happen to both you and your partner, your sibling could then use the funds to handle your estate or support other family members, just as you would have wanted.

This two-layer approach is incredibly important. If you don't have a contingent beneficiary and your primary one is unavailable, the policy proceeds get paid directly into your estate. This is where things can get messy and expensive.

- Probate Delays: The money gets locked up in the legal probate process, which can drag on for months, or sometimes even longer.

- Inheritance Tax (IHT) Risk: That payout suddenly swells the value of your estate. This could easily push it over the IHT threshold, exposing it to a hefty 40% tax bill.

Simply naming a contingent beneficiary is one of the easiest ways to ensure your loved ones get the full benefit of your policy, and get it quickly. It’s a vital safety net for their financial future.

How to Name and Update Your Beneficiaries

Naming a life insurance beneficiary isn't a 'set it and forget it' task. Far from it. Your policy should be a living document that mirrors your life as it is today, not as it was five or ten years ago. Keeping your beneficiaries up to date is a simple bit of admin, but it's absolutely vital for making sure the policy works as you intended.

When you first take out a policy, your insurer will simply ask for the full legal name and contact details of the person you've chosen. It's a straightforward process, but getting the details spot-on is crucial to avoid any mix-ups down the line. The real challenge, though, is remembering to revisit that choice as your life evolves.

The Importance of Regular Reviews

It's amazing how many people overlook updating their policy, and it can lead to some truly awful situations. Recent surveys have uncovered a pretty big knowledge gap, with 27% of UK consumers admitting they're unsure about their policy's payout details. That kind of uncertainty can spark disputes and delays, completely undermining the security you were trying to provide in the first place. You can find more data on this in the UK Life Insurance Index.

So, how do you update a beneficiary? You just need to contact your insurer and fill out their required form. They'll ask for the new beneficiary's details, and the change is usually processed quickly and without fuss.

When to Update Your Beneficiary: A Checklist

Think of major life events as a trigger for a financial health check. They're the perfect reminder to make sure your cover is still lined up with what's happening in your life.

Here are the key moments when you should stop and review your beneficiary designation straight away:

- Marriage or Civil Partnership: It’s almost certain you’ll want to name your new spouse or partner as the main beneficiary.

- Divorce or Separation: This one is critical. You must remove an ex-spouse if you no longer want them to receive the payout.

- Birth or Adoption of a Child: You might want to add your children as beneficiaries or, more commonly, set up a trust for their benefit. Our in-depth guide to putting life insurance in trust explains exactly how this works to protect minors.

- Death of a Beneficiary: If your primary beneficiary passes away, you have to update your policy. This usually means naming a new primary beneficiary, perhaps by moving your contingent choice up or adding someone new entirely.

- A Beneficiary Becomes a Parent: The arrival of grandchildren might make you want to tweak your plans to include them.

Forgetting this simple task can have devastating consequences. Imagine an ex-partner receiving the funds meant for your current family. It happens. A quick annual review is all it takes to prevent these kinds of avoidable heartaches.

The Payout Process and UK Tax Implications

https://www.youtube.com/embed/4uIXe9gkKS0

When the time comes, how does your beneficiary actually get the money you’ve set aside for them?

Once you pass away, your named beneficiary needs to get in touch with your life insurance provider to start the claims process. This usually just involves filling out some claim forms and providing a copy of the death certificate. It’s designed to be as straightforward as possible.

After the insurer approves the claim, they pay out the full amount directly to your beneficiary. This payout is a tax-free lump sum. No Income Tax, no Capital Gains Tax. Simple.

But while the payout itself is tax-free, it can create a different kind of tax headache: Inheritance Tax.

Avoiding Inheritance Tax with a Trust

Here’s the catch. That big life insurance payout instantly becomes part of your beneficiary's assets, but it’s first counted as part of your estate when you pass away. If that payout pushes the total value of your estate over the Inheritance Tax (IHT) threshold, HMRC could take a hefty chunk.

For the 2024/25 tax year, the IHT threshold (or 'nil-rate band') is £325,000. Anything above this could be taxed at a whopping 40%.

Thankfully, there’s a surprisingly simple and highly effective way to sidestep this problem: write your policy ‘in trust’.

A trust is just a simple legal wrapper you put around your life insurance policy. It legally separates the policy from your estate, meaning the payout goes directly into the trust for your beneficiaries. It's never officially part of your estate, so it can't be touched by IHT.

This small step does two critical things. First, it ensures the entire payout goes to your loved ones, not the taxman. Second, it lets the money bypass the often slow and complicated probate process, meaning your family could receive the funds in weeks rather than the months (or even years) it can take for an estate to be settled.

To get a better grip on the rules, take a look at our detailed guide on what is Inheritance Tax and how it all works.

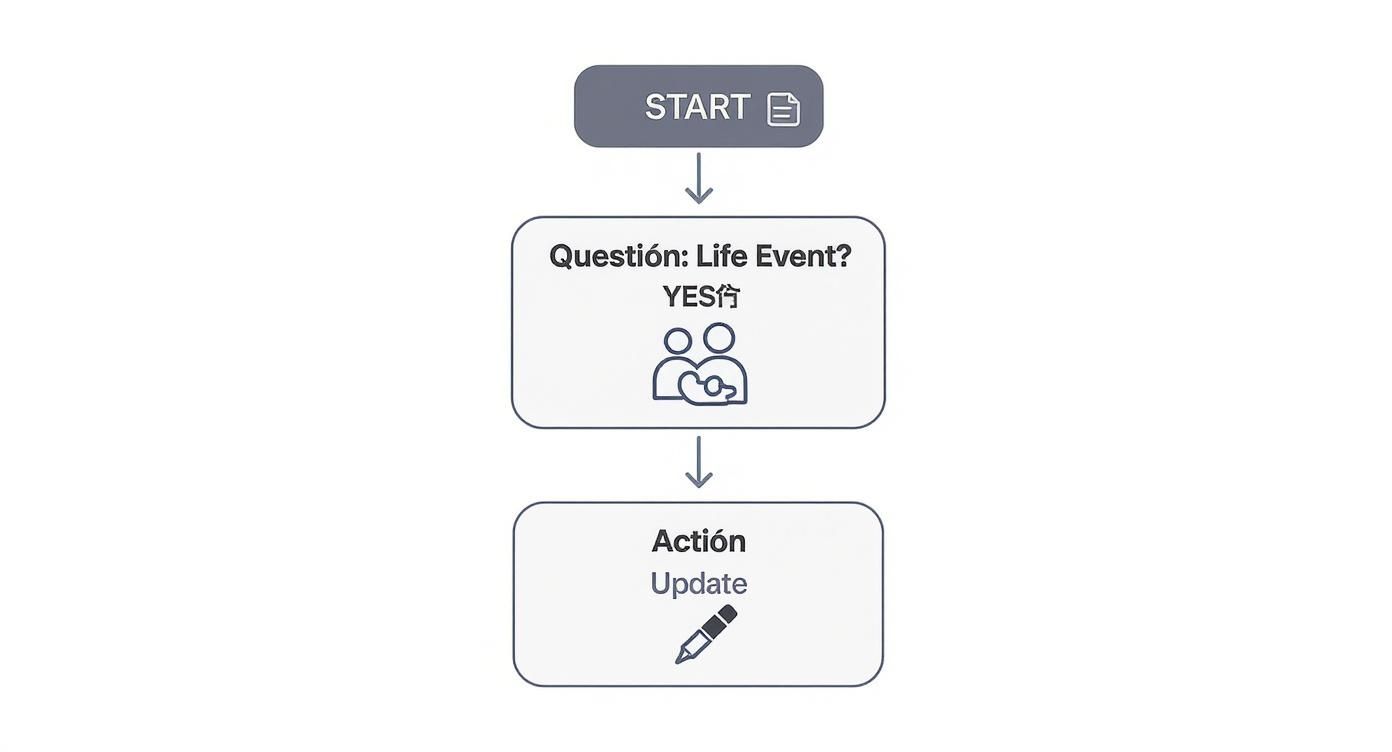

The decision tree below is a great visual reminder of the key life moments when you should absolutely be reviewing your beneficiary details to keep everything up to date.

As you can see, life changes, and your policy needs to change with it. A quick update can prevent a world of hassle for your loved ones down the line.

The Financial Impact of Using a Trust

Let's look at how this plays out with a real-world example. It really highlights the power of using a trust.

Imagine a homeowner whose estate (property, savings, etc.) is valued at £300,000. They also have a £200,000 life insurance policy.

To show the difference a trust makes, let's compare two scenarios.

Payout Scenarios With and Without a Trust

| Scenario | Policy Not in Trust | Policy Written in Trust |

|---|---|---|

| Payout Process | The £200,000 is added to the estate, bringing its total value to £500,000. | The £200,000 is paid directly into the trust, bypassing the estate entirely. |

| IHT Liability | The estate is £175,000 over the £325,000 threshold. The tax bill is £70,000 (40% of £175,000). | The estate's value remains at £300,000, which is below the threshold. The IHT bill is £0. |

| Speed of Payout | The funds are tied up in probate, which can take many months or even years to resolve. | The payout is typically made within a few weeks of the claim being approved. |

In this case, that one simple piece of paperwork—setting up a trust—saves the family a staggering £70,000 and gets them the money much, much faster.

It's also worth noting that while life insurance payouts aren't hit by Capital Gains Tax, other assets in an estate might be. If you're managing a larger estate, it's useful to understand how to calculate Capital Gains Tax in the UK.

The best part? Almost every UK insurer, such as Aviva, Legal & General, or Royal London, will help you set up a trust for free when you take out your policy. It’s one of the most powerful yet underused financial planning tools available.

Common Beneficiary Mistakes and How to Avoid Them

A small oversight when naming your life insurance beneficiary can cause major headaches for the very people you want to protect. Getting this bit right is one of the most important parts of setting up your cover, making sure your wishes are carried out smoothly when the time comes.

Think of this as a checklist to save your family from a world of unnecessary stress and financial trouble. By steering clear of these simple but common errors, you can be confident the right people get the right support at the right time.

Being Too Vague or Outdated

One of the most frequent slip-ups we see is using language that’s just too vague. Jotting down “my wife” or “my children” on the policy form simply isn't good enough and can open a can of worms legally.

You absolutely must use the full, legal name of each person you want to name. This clears up any doubt, which is especially important in more complex family setups.

Just as critical is remembering to update your policy after a big life event. A devastatingly common mistake is forgetting to remove an ex-spouse after a divorce. Unless you formally change the beneficiary on your policy, they could still be legally entitled to the entire payout, no matter what your will says or what your current situation is.

Issues with Minors and Dependents

Naming a minor (that’s anyone under 18 in the UK) as a direct beneficiary is another huge misstep. Insurers are not legally allowed to hand over a large lump sum directly to a child.

This causes serious delays. The courts often have to get involved to appoint a legal guardian just to manage the money until the child turns 18. This process can be slow, costly, and the outcome might not be what you would have wanted for managing their inheritance.

The best practice here is to set up a trust for any beneficiaries who are minors. You can then name trustees—people you've chosen and trust completely—to look after the money on the child's behalf. This ensures their financial needs are met exactly as you intended.

This approach puts you in control and shields the payout from legal hold-ups, meaning the money can start working for your children much, much faster.

Frequently Asked Questions (FAQ)

Let's clear up some of the most common questions people have about life insurance beneficiaries.

Can I name more than one beneficiary?

Yes, you certainly can. It's very common to split the payout between several people. You can decide exactly what percentage of the money each person gets, which is a popular choice for parents wanting to leave an equal share to each of their children.

What happens if my beneficiary dies before me?

This is a scenario that catches too many people out, and it's exactly why naming a contingent (or backup) beneficiary is so crucial. If your main beneficiary passes away before you and there's no backup named, the money usually gets paid into your estate. This can drag the payout into the lengthy probate process, causing frustrating delays and potential tax headaches for your family.

Does my will override my life insurance beneficiary?

No, it doesn’t – and this is one of the biggest advantages of having life insurance. Your beneficiary designation is a direct contract between you and the insurance company. This powerful feature means the payout completely bypasses your will and the whole probate system, getting the money into your loved ones' hands much, much faster.

Can I change my beneficiary?

Absolutely. Not only can you change your beneficiary, but you really should review your choice regularly. Life has a habit of changing, and your policy needs to keep up. After big events like getting married, a divorce, or having a child, it’s vital to get in touch with your insurer to make sure the right person is named on your policy.

Getting your head around what is a life insurance beneficiary is the first real step towards protecting your family’s future. Here at Discount Life Cover, we cut through the jargon to make it easy to compare quotes from the UK’s best insurers, helping you find the right cover at the right price.

Ready to put your mind at ease? Get your free, no-obligation quote today and take control of your family's financial security.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply