UK Life Insurance Coverage Calculator – Get Your Cover Right

Start saving money on Life insurance today

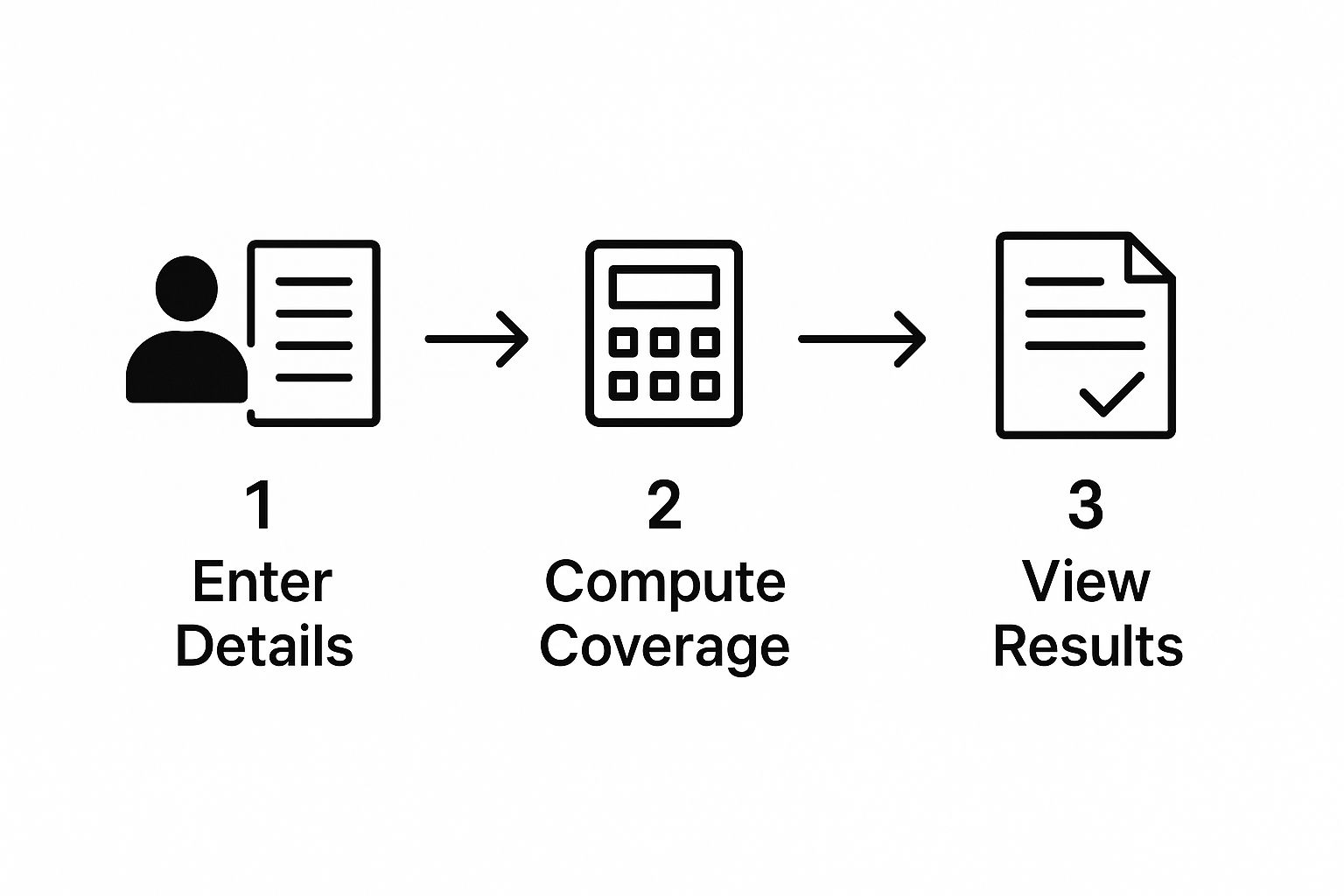

Figuring out life insurance can often feel like you're just plucking a number out of thin air. That's where a life insurance coverage calculator comes in. It's a crucial tool that takes you from pure guesswork to a place of clarity, helping you pin down exactly how much financial protection your family needs without you paying over the odds for it.

Why a Calculator Is Your First Step to Peace of Mind

Deciding on that final life insurance figure can feel a bit abstract, can't it? Should it be enough to pay off the mortgage? Should it replace your salary for the next decade? It’s a real dilemma. Many UK families get caught between two major worries: the fear of leaving their loved ones in a financial bind, and the concern of overpaying for cover they don’t really need.

This uncertainty leads many people to simply put off the decision. It's quite shocking, but a staggering number of UK adults have no life insurance cover at all. Data from the Financial Conduct Authority (FCA) and Office for National Statistics (ONS) reveals this massive protection gap across the country. You can discover more insights about this UK protection gap from WeCovr.

Using a calculator demystifies the whole process. It turns those vague concerns into a solid, concrete plan. Think of it as a practical guide that forces you to think about all the specific financial commitments that make up your life right now.

Translating Your Life into a Number

A good calculation doesn't just pull a random number out of a hat. It helps you build a financial safety net, piece by piece, making sure nothing important gets missed.

It gets you thinking about the big things, like:

- Outstanding Debts: This is mainly your mortgage, of course, but don't forget car loans or lingering credit card balances.

- Income Replacement: How much cash would your family actually need each month to keep their current lifestyle going?

- Future Costs: University fees are a big one for parents, but there could be other major expenses on the horizon.

- Final Expenses: It’s not something we like to think about, but covering funeral costs and other immediate bills is essential.

When you break it down like this, the final figure isn't just a number; it’s a meaningful reflection of what your family truly needs.

A young family with a £250,000 mortgage and two small children has completely different needs to someone in their 50s whose mortgage is almost paid off. A calculator is brilliant at quantifying these differences with real precision.

At the end of the day, using a life insurance coverage calculator gives you more than just a figure—it delivers genuine peace of mind. You'll understand exactly what you're protecting and why, ensuring the policy you choose is perfectly aligned with your family’s long-term security. It’s the most logical first step you can take towards making a confident, informed decision.

Tallying Up Your Debts and Major Liabilities

First things first, let's get a clear picture of what you owe. This is the solid foundation of your entire life insurance calculation. The goal is to create a ‘debt-free’ starting point for your family, making sure the payout goes towards building their future, not paying off the past.

It's a straightforward process, but getting it right is crucial.

As you can see, plugging in the right details gives you a clear, actionable result for the cover you need.

Start with the Mortgage

For most of us in the UK, the mortgage is the single biggest financial weight around our necks. You need to find your outstanding balance – the exact amount you still owe the lender. The easiest way to find this is on your latest mortgage statement or by logging into your online banking portal.

Once you have that number, you can think about the best policy to match it. A decreasing term policy is often a perfect fit for a repayment mortgage. Why? Because the amount of cover goes down over time, roughly in line with your shrinking mortgage balance. This makes it an incredibly cost-effective way to make sure the house is safe.

You can play around with the numbers and see how this works using a life insurance mortgage calculator.

Account for Other Significant Debts

The mortgage is the big one, but don't stop there. It's vital to list all the other major debts your family would be left to deal with. Forgetting these can leave a serious financial hole they weren't expecting.

Make sure your list includes:

- Car Finance: What’s the outstanding balance on any vehicle loans?

- Personal Loans: Jot down any unsecured loans for things like home improvements or debt consolidation.

- Credit Card Balances: Add up the total you owe across all your credit cards, especially if you tend to carry a balance from month to month.

I've put together a simple table to help you add everything up. This is the first practical step to figuring out your baseline cover.

Your Financial Liabilities Checklist

Use this simple worksheet to add up your outstanding debts. This total forms the baseline for your life insurance coverage calculation.

| Type of Debt | Outstanding Balance (£) | Years Remaining |

|---|---|---|

| Repayment Mortgage | ||

| Car Finance | ||

| Personal Loan(s) | ||

| Credit Card Balance(s) | ||

| Other Loans (e.g., student) | ||

| Total Baseline Debt |

Once you've filled that in, the total gives you a baseline figure. This is the absolute minimum cover you need to wipe the financial slate clean for your loved ones.

Imagine a homeowner in their 40s with a £180,000 mortgage, £8,000 left on car finance, and a £3,000 personal loan. Their baseline debt coverage need is £191,000. That's the starting point before we even think about day-to-day living costs.

How Debt Shapes Your Policy Choice

Understanding your debts isn't just about the numbers; it helps you pick the right policy. For most people in the UK, any life insurance calculation boils down to two core elements: clearing the mortgage and replacing lost income.

Getting specific cover for your biggest debt is often surprisingly affordable. For instance, a 33-year-old non-smoking mum with a £132,000 repayment mortgage over 27 years could get a decreasing term policy from a provider like Legal & General or Aviva to cover it for as little as £6.88 per month.

It just shows how affordable targeted cover can be. This approach ensures your biggest single debt is handled efficiently, freeing you up to plan for everything else.

Calculating Your Family's Everyday Living Costs

Once the big debts are taken care of, the focus shifts to making sure your family can carry on with day-to-day life without falling into financial trouble. This is the "income replacement" part of the puzzle, and getting the details right here is absolutely crucial.

You've probably heard the old rule of thumb: get life cover worth 10 times your annual salary. It's not a terrible starting point, but let's be honest, it's a blunt instrument. A far better way is to dig into your family's actual monthly spending to figure out what they would genuinely need.

Pinpointing Your Monthly Outgoings

The aim here is to land on a monthly figure that covers all the essential and regular expenses that keep your family's life ticking over. This isn’t just about survival; it’s about maintaining their quality of life as much as possible. It's time to grab your bank statements and start making a list.

You'll want to include all those recurring costs, such as:

- Household Bills: Think council tax, gas, electricity, water, and broadband.

- Groceries and Food: What’s your typical weekly or monthly food shop?

- Transport Costs: This covers car maintenance, fuel, insurance, and any public transport tickets.

- Child-Related Costs: Don't forget school lunches, uniforms, after-school clubs, and school trips.

- Leisure and Subscriptions: Things like gym memberships, Netflix, and family days out all add up.

Once you have a total monthly figure, you're so much closer to a realistic coverage amount. This method is infinitely more reliable than just plucking a salary multiple out of thin air.

How Long Will They Need Support For?

The next big question is, for how long will your family need this financial cushion? This is a very personal decision and often hinges on the ages of your children.

A common goal for many parents is to provide this support until their youngest child is financially independent, which is often pegged at around age 18 or 21. For instance, if you have two children aged 5 and 7, you might decide you need to cover living costs for the next 16 years, until your youngest hits 21.

Another key thing to consider is your partner's situation. Would they need to cut back their working hours or even stop working completely to look after the children? If that's a possibility, your life insurance payout will need to fill a much bigger income gap.

Let's take a real-world example. A family with two children, aged 4 and 6, works out their essential monthly outgoings come to £2,500. They want to make sure there's enough money until their youngest child turns 20, which means they need cover for 16 years.

Their calculation looks like this: £2,500 (monthly need) x 12 (months) x 16 (years) = £480,000.

That £480,000 is the specific lump sum they need just for income replacement.

This approach gives you a much sharper picture of what your family truly needs than a simple salary multiplier ever could. It turns a vague guess into a concrete, justifiable figure. When you add this to your total debt calculation, you start building a comprehensive view of the exact cover you need. In fact, any decent life insurance coverage calculator will guide you through this more detailed method.

Planning for Future Milestones and Final Expenses

A truly solid financial plan does more than just cover today’s bills and outstanding debts. It has to look ahead, anticipating those future costs that are all too easy to forget but can seriously impact your family’s long-term security.

These are the final, but absolutely crucial, pieces to add to your life insurance calculation. Getting this right now ensures the payout provides lasting stability, not just a short-term patch.

Budgeting for Your Children's Future

For most parents, one of the biggest looming costs is higher education. University tuition fees and living costs seem to only go one way—up. Earmarking a portion of your life insurance to support your children's ambitions is a powerful legacy to leave.

My advice? Be generous with your estimate. It's not just about the headline tuition fees. You need to factor in accommodation, books, and general living expenses over a three or four-year degree. Crucially, you have to account for inflation; the cost will likely be significantly higher by the time your children are actually ready to go.

And it doesn't just stop at university. You might also want to think about other major milestones, like helping out with a wedding or a deposit for their first home.

Covering Immediate Final Expenses

One of the most immediate and stressful costs a grieving family faces is the funeral. These expenses often need to be paid upfront and can place a huge financial strain on your loved ones at an already incredibly difficult time.

The average cost of a basic funeral in the UK can easily run into several thousand pounds. This figure swings quite a bit depending on where you live and the specific choices made. A key factor is understanding the different financial implications of cremation vs. burial costs, as this can dramatically influence the final bill. Adding a specific amount to your cover for these expenses provides immense practical relief. For those over 50, a dedicated Over-50s policy is often used for this purpose, guaranteeing a payout to cover funeral costs.

A dedicated sum of £5,000 to £10,000 for final expenses is a common addition. This ensures that immediate costs can be settled without your family having to dip into savings or take on debt while they wait for probate.

Other Essential Long-Term Costs

Finally, let's think about any other big costs that might crop up down the line. If your partner would need to keep working, who would look after the children? The cost of childcare—whether it's a nursery, a childminder, or after-school clubs—can be substantial and may be needed for many years.

Factoring this into your life cover calculation is vital.

It’s also worth considering how the payout might interact with your estate. You can learn more about how life insurance payouts are treated and the potential tax implications by understanding what is inheritance tax. Planning for these future milestones is what turns a good policy into a complete financial safety net.

Fine-Tuning Your Cover With Existing Assets

Right, so you’ve got a big-picture number for what your family would need. Now it’s time for the final, crucial step: refining that figure. We need to account for the financial resources you already have in place.

Getting this bit right is how you avoid paying for more insurance than you actually need, ensuring your final cover amount is both realistic and affordable.

This is basically a quick inventory of your current financial safety net. By deducting these existing assets from the total you calculated, you’ll land on a much more accurate final number for your life insurance policy.

What Goes On Your Asset Checklist?

First up, let's list your liquid assets—the money your family could get their hands on relatively quickly. These are the funds that will chip away at the total lump sum required from a life insurance policy.

Your checklist should include things like:

- Savings Accounts: Tally up any cash sitting in easy-access savings or current accounts.

- ISAs and Investments: Note down the current value of any Stocks & Shares ISAs, premium bonds, or other investment portfolios you hold.

- Existing Life Policies: If you already have another life insurance policy (perhaps a small one from years ago), add its payout value to your list.

Don't Forget About Death-in-Service Benefits

One of the most valuable—and most often overlooked—assets is a death-in-service benefit. This is a common perk offered by many UK employers. Think of it as a workplace life insurance policy that pays out a tax-free lump sum, typically two to four times your annual salary, if you pass away while employed by the company.

It's a fantastic benefit, but it’s vital to see it for what it is: a bonus, not your main policy. Remember, it's tied directly to your job. If you change employer or go self-employed, that cover vanishes overnight, potentially leaving a massive gap in your family's protection.

When you factor it into your sums, treat it as a valuable supplement that reduces the amount of personal cover you need to buy today. Our guide on calculating how much life insurance you need explores this in more detail.

Once you subtract your savings, investments, and any death-in-service payout from your family’s total required sum, you get the final, accurate figure. This is the amount of life insurance cover you actually need to buy to ensure your loved ones are fully protected without you being over-insured.

Frequently Asked Questions (FAQ)

Should I choose level term or decreasing term insurance?

This depends on what you need the policy to do. Decreasing term is designed to cover a repayment mortgage, with the cover amount reducing over time, making it cheaper. Level term provides a fixed payout throughout the policy term, making it ideal for covering family living costs or leaving an inheritance. Many people use a combination of both.

How often should I review my life insurance cover?

It's wise to review your policy every few years, and essential after major life events like getting married, having a child, moving house with a larger mortgage, or changing jobs. This ensures your cover remains adequate for your family's needs.

Is my death-in-service benefit from work enough?

Usually not. A death-in-service benefit is a great perk, typically paying out a multiple of your salary, but it’s tied to your employment. If you leave your job, you lose the cover. It’s best viewed as a supplement to a personal life insurance policy that you own and control.

Should I consider adding critical illness cover?

Adding Critical Illness Cover provides an extra layer of protection. It pays out a tax-free lump sum if you are diagnosed with a specific serious illness listed in the policy, such as a heart attack, stroke, or certain cancers. This money can replace lost income or cover medical costs, protecting your family from the financial impact of illness.

Ready to turn these calculations into real peace of mind? The team at Discount Life Cover is here to help. Get a fast, free quote today and compare options from the UK's leading insurers to find the perfect cover for your family at a price that works for you.

Get Your Personalised Quote Now

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.