Over 50 life insurance is a specific type of whole-of-life policy designed for UK residents, typically aged between 50 and 85. What truly sets it apart is its competitive acceptance. You will not be asked any medical questions or need to undergo an examination to be approved, which is why it is a popular choice for people looking to cover their final expenses.

What Exactly Is Over 50 Life Insurance?

Trying to get your head around the world of insurance can feel like a mammoth task, but an over 50 life insurance plan is refreshingly simple. It’s less of a complicated financial product and more of a straightforward promise. You pay a fixed monthly amount (your premium), and in return, the policy guarantees a fixed cash payout, known as the sum assured, when you pass away.

This payout is there to give your loved ones a financial safety net when they need it most. Its main purpose is usually to help with specific, immediate costs, rather than replacing a large income or paying off the rest of a mortgage.

The Core Purpose of This Cover

For many people, the biggest benefit of these plans is the peace of mind they bring. Knowing that a competitive lump sum is waiting for your beneficiaries can lift a huge weight off your shoulders. It can be used for all sorts of things, removing a potential financial burden.

Some common uses include:

- Covering funeral costs: The average cost of a basic funeral in the UK is now over £4,000. That is a hefty bill that a policy can easily cover.

- Settling outstanding bills: Think final utility bills, credit card balances, or any small personal loans.

- Leaving a financial gift: Many people use these plans as a way to leave a small inheritance for their children or grandchildren.

- Making a charitable donation: You can even name your favourite charity as a beneficiary to leave a meaningful legacy.

The real beauty of over 50 life insurance is how accessible it is. If you've developed health conditions later in life, traditional insurance can become expensive or you might even be turned down. acceptance completely removes that barrier.

This type of policy is a whole-of-life product. In simple terms, this means it's designed to last for the rest of your life. As long as you keep up with the monthly premiums, it will pay out whenever you pass away. This is different from term life insurance, which only covers you for a set period. And because the premiums are fixed and will never go up, it's a predictable and manageable way to plan for the future.

How These Plans Work in Practice

To really get your head around over 50 life insurance, it helps to look past the label and see how it actually functions. At its heart, this is a type of ‘whole-of-life’ insurance. All that means is it’s designed to last for the rest of your life, guaranteeing a fixed cash payout when you die, as long as you’ve kept up with your payments.

The amount you pay each month is locked in right from the start and will never go up. This predictability is a massive plus, letting you budget with confidence for the long haul without worrying about surprise price hikes down the road. It is a steady, reliable way to plan.

The Waiting Period Explained

One of the most important things to understand about an over-50s plan is the waiting period, sometimes called a moratorium period. This usually lasts for the first 12 or 24 months of the policy. It is not a hidden catch, but a straightforward trade-off for getting competitive acceptance without any medical questions.

Here’s what that means in practice:

- If you pass away from natural causes during this initial window, the full cash sum will not be paid out. Instead, your insurer will usually refund 100% of the premiums you have paid in.

- If you pass away due to an accident during this period, most insurers will pay the full cash sum straight away.

- Once the waiting period is over, you’re fully covered for death by any cause. The full, agreed-upon sum will be paid to your family.

This structure is what allows insurers regulated by the Financial Conduct Authority (FCA) to offer cover to everyone within the age limits, regardless of their health history, by managing the initial risk.

Fixed Premiums for Peace of Mind

The fact that your premiums are fixed gives you a solid foundation for financial planning. Unlike other bills that creep up with inflation, your monthly payment for over 50 life insurance stays exactly the same. Whether you take out the policy at 51 or 71, the price you agree on day one is the price you'll always pay.

This financial certainty helps ensure the cover stays affordable right through your retirement. It removes the worry of escalating costs, making it easier to stick with the policy and secure that final payout for your loved ones. What you pay is typically based on your age, how much cover you want, and whether you smoke.

It's a simple deal: you pay a fixed monthly amount for a competitive future payout. This simplicity is one of the main reasons these plans are so popular.

A Key Consideration: The Cost Over Time

While these plans are brilliantly simple and accessible, there’s one crucial aspect you have to be aware of. Depending on how long you live, it is possible to pay more in total premiums than the final cash sum your family receives.

Let’s walk through a quick example:

Say you take out a policy at age 60 with a £30 monthly premium, which gives you a £5,000 payout. If you live for another 20 years (to age 80), your total payments would come to £30 x 12 months x 20 years = £7,200. In that situation, you would have paid £2,200 more than the plan pays out.

This isn't a flaw in the product, but just how a plan that offers competitive acceptance and lifetime cover works. Recent data from a major UK broker showed the average cost for an over 50s plan was £32.64 per month for an average payout of £4,530.41, which shows that typical balance between cost and cover. You can explore more UK life insurance cost data to see how the market stacks up. It’s a trade-off that everyone thinking about these plans should carefully consider.

Is Acceptance Your Only Option?

It’s a common misconception that once you hit 50, a ‘competitive acceptance’ plan is your only route to life insurance. While these policies are absolutely a lifeline for many, they’re far from the only game in town. Getting to grips with the alternatives is crucial to finding cover that genuinely fits your life, your health, and your budget.

Alongside the competitive over 50s plan, your main options are typically Term Life Insurance and a medically underwritten Whole-of-Life Insurance policy. Each one is built for a different job and plays by a different set of rules. Your health, how much you want to spend, and what you need the money for will all point you in the right direction.

Comparing Your Life Insurance Choices

This isn't about finding the 'best' policy, but the best one for you. A healthy 58-year-old homeowner wanting to clear their mortgage has completely different needs to a 70-year-old with a few health issues who just wants to cover their funeral costs.

So, let's break down the key players:

- Over 50s Life Insurance: This is your competitive acceptance option. No medical questions asked. It provides a smaller, fixed cash sum that’s perfect for final expenses.

- Term Life Insurance: This gives you a much larger pot of cover but only for a fixed number of years (say, 25 years). You will have to answer health questions, and it only pays out if you pass away during that specific term.

- Whole-of-Life Insurance: This also covers you for your entire life, but it’s medically underwritten. That means you’ll answer health questions, which—if you're in decent health—could land you a much bigger payout for a similar monthly premium.

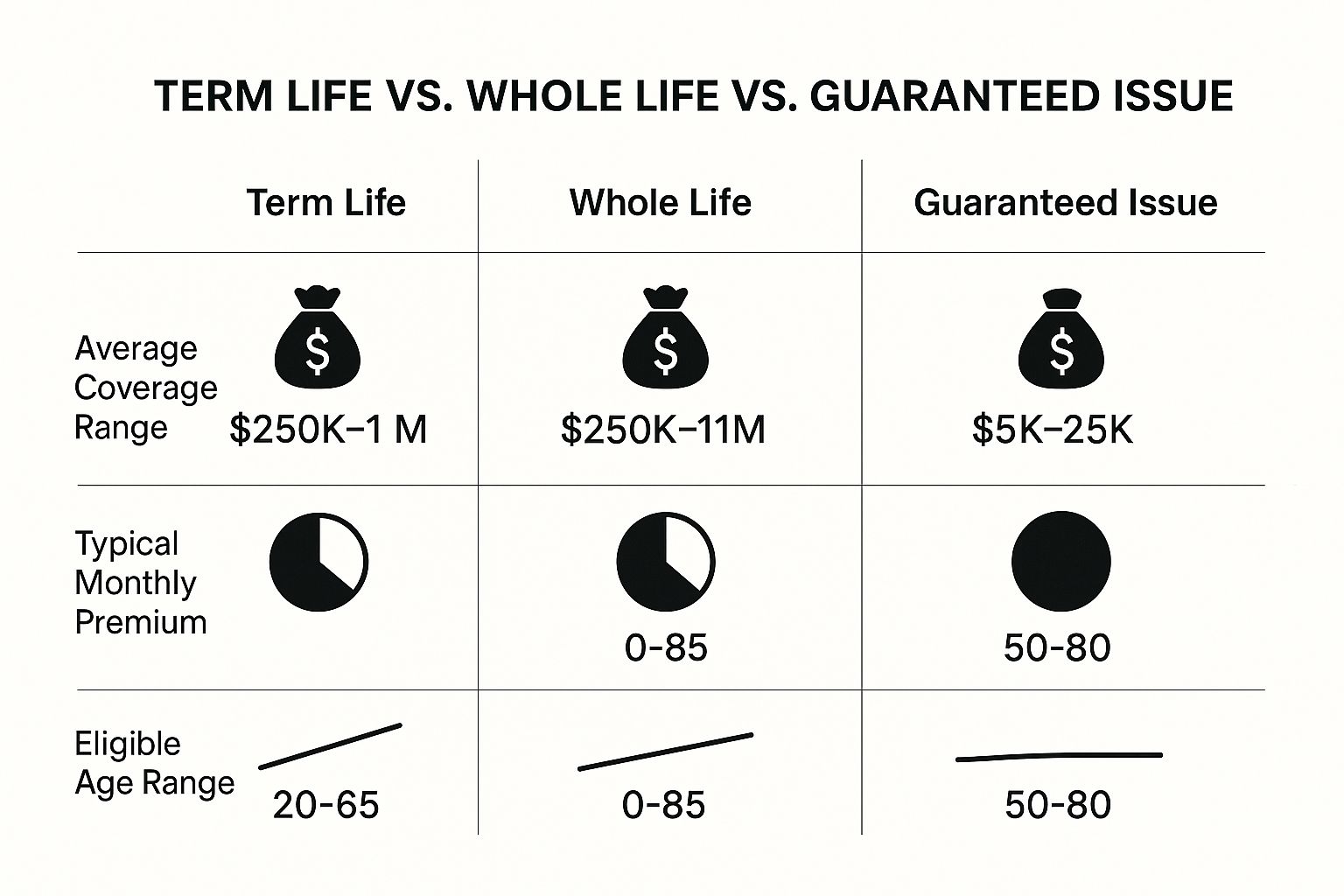

This visual helps to put the main features side-by-side, from typical cover amounts to age limits.

As you can see, while competitive plans are brilliantly accessible, underwritten policies like term and whole-of-life can get you significantly more bang for your buck if you're in good health.

To make things even clearer, let's compare the main options available to people over 50 in the UK. This table should help you quickly see the differences and figure out which path might be the most suitable for your situation.

Comparison of UK Life Insurance Options for Over 50s

This table compares key features of Over 50s Plans against other common life insurance products available in the UK to help you decide which is most suitable.

| Feature | Over 50s Life Insurance | Term Life Insurance | Underwritten Whole-of-Life |

|---|---|---|---|

| Acceptance | Guaranteed, no medical questions | Medically underwritten, health questions asked | Medically underwritten, health questions asked |

| Cover Amount | Typically smaller, up to £20,000 | Can be much larger, often £100,000+ | Can be very large, suitable for inheritance tax planning |

| Cover Duration | Whole of life (lifelong) | Fixed term only (e.g., 10, 20, 30 years) | Whole of life (lifelong) |

| Payout Guarantee | Guaranteed to pay out (after initial waiting period) | Only pays out if death occurs within the term | Guaranteed to pay out whenever death occurs |

| Best For | Funeral costs, small gifts, clearing minor debts | Covering mortgages, protecting young families | Leaving a large inheritance, inheritance tax planning |

| Cost | Can be higher per £ of cover due to competitive acceptance | Generally the most cost-effective for large cover | The most expensive option due to competitive lifelong payout |

Ultimately, the best choice hinges on what you need the insurance to do. For a simple, competitive payout for final costs, an Over 50s plan is hard to beat. But for larger financial obligations, it's worth seeing if you can get underwritten cover.

When Term or Whole-of-Life Might Be Better

If you're in relatively good health, it is a very smart move to at least explore medically underwritten options. Because the insurer has a clearer idea of the risk they are taking on, they can often offer a much larger sum assured for your money. This is a game-changer if you have big financial responsibilities.

Think about these situations:

- Covering a Mortgage: You're 55 with ten years left on the mortgage. A 10-year term life insurance policy could provide a payout big enough to clear the entire debt, something an over 50s plan with its capped payout just could not stretch to.

- Leaving a Large Inheritance: If you want to leave a substantial legacy for your family, a medically underwritten whole-of-life policy would deliver a much bigger lump sum than a competitive acceptance plan.

And do not automatically count yourself out if you have some health issues. Insurers cover a huge range of conditions. Our guide on securing life insurance with medical conditions dives into how underwriters look at different situations.

When Acceptance Is the Right Call

Despite the bigger payouts available elsewhere, there are plenty of times when a competitive acceptance over 50 life insurance plan is absolutely the perfect solution. Its biggest selling points are simplicity and accessibility.

This type of policy really shines when your goal is to cover specific, smaller costs without any hassle.

- Example 1: Funeral Planning: A 68-year-old simply wants to ensure her funeral is paid for without leaving a bill for the children. A competitive plan providing £5,000 does exactly that, no fuss involved.

- Example 2: Pre-existing Conditions: A 62-year-old has a history of serious health problems and knows he'd struggle to get standard cover. A competitive acceptance plan gives him the peace of mind that some financial protection is sorted.

In the end, it all comes down to a clear-eyed look at your health, your finances, and exactly why you want cover in the first place. acceptance is a fantastic tool, but it's vital to know it's not the only one in the box.

Understanding the Costs and Cover You Get

Alright, let's talk numbers. When it comes to any kind of insurance, the bottom-line question is always: "What is this going to cost me?" The good news is that with these competitive acceptance plans, the pricing is refreshingly straightforward.

There are no tricky medical questionnaires or long-winded lifestyle assessments. Insurers keep it simple and focus on a few key details to work out your fixed monthly payment.

What Sets Your Monthly Premium

The price you pay is set in stone the day you take out the policy. It will not go up, ever. That's why insurers need to get their sums right from the very beginning.

Here’s what they look at:

- Your age when you : This is the big one. The younger you are when you sign up, the lower your monthly payments will be for the same level of cover. A 55-year-old will always get a better deal for a £5,000 payout than a 68-year-old.

- The cash sum you choose: This is all down to you. The larger the final payout you want to leave for your loved ones, the higher your monthly premium will be.

- Your smoking status: You’ll likely be asked if you’ve smoked in the last 12 months. Non-smokers are seen as a lower risk, so they usually get offered better rates.

For a broader perspective on how these factors stack up, our guide on how much life insurance costs in the UK can give you a clearer picture.

Typical Cover Amounts and What They're For

It’s crucial to realise that over-50s plans are built for a specific job. They are not designed to pay off a mortgage or other huge debts. Instead, they provide a modest lump sum for those final expenses.

The maximum cover is usually capped, often somewhere below £20,000. Big names in the UK market like Aviva and Legal & General offer amounts in this ballpark. It’s typically more than enough to cover funeral costs, sort out any small outstanding bills, or leave a meaningful cash gift for the grandchildren.

Think of the fixed, smaller payout as the trade-off for competitive acceptance. By capping the amount, insurers can manage their risk without needing to ask intrusive health questions.

Despite the obvious benefits, it's understandable that some people have reservations. Recent market analysis shows that while 78% of UK residents over 50 worry about the value of these policies, 62% still see the upside of having some life cover in place. It just goes to show that for many, the peace of mind it offers is priceless.

Calculating Your 'Break-Even' Point

We've mentioned that if you live a very long time, you could end up paying more in premiums than the policy pays out. It's a key risk to understand, but figuring out your 'break-even' point is simple.

Let's use a quick example. Imagine you get a policy with a £6,000 payout for a monthly premium of £25.

- Calculate your annual cost: £25 (monthly premium) x 12 (months) = £300 per year.

- Find the break-even point: £6,000 (payout) ÷ £300 (annual cost) = 20 years.

In this scenario, if you keep paying for more than 20 years, you'll have paid more into the policy than your family will get back. This simple bit of maths helps you weigh up the long-term value and decide if the certainty of a competitive payout is the right move for you.

Weighing the Pros and Cons

Like any financial product, over 50 life insurance is not a one-size-fits-all solution. It has some brilliant features for certain situations, but it also has its limitations. To figure out if it is the right move for you, you need to look at both sides of the coin – the clear benefits and the potential drawbacks.

Getting a balanced view is the only way to decide if this kind of policy lines up with what you're trying to achieve for your family. Let's break down the good and the not-so-good so you can make a choice you feel confident about.

The Advantages of Over 50s Cover

For a lot of people, the appeal of these plans is massive. They offer simplicity and certainty when you want things to be straightforward, which is probably why they are so popular across the UK.

Here are the key benefits:

- Acceptance: This is the big one. If you’re a UK resident between 50 and 85, you simply cannot be turned down. For anyone with existing health issues who might struggle to get affordable cover elsewhere, this is a huge weight off their shoulders.

- No Medical Questions: The application is refreshingly simple. You will not have to go for a medical, give blood samples, or answer pages of questions about your health history. It’s far less intrusive than a traditional, underwritten policy.

- Fixed Premiums for Life: The monthly price you agree on day one is the price you'll pay forever. This makes budgeting a doddle, protecting you from surprise cost increases and keeping your cover affordable right through your retirement.

- Payout: So long as you keep your monthly payments up and you are past the initial waiting period, the policy is competitive to pay out the agreed cash sum when you pass away. Simple as that.

This mix of easy acceptance and predictable costs gives you a real sense of security. It lets you put a plan in place to handle final expenses or leave a small gift, without any of the usual fuss of ing for life insurance.

The Disadvantages and Limitations

While the pros are compelling, it is just as important to get your head around the limitations. Knowing the potential downsides means no nasty surprises for you or your family down the line. These are not hidden catches; they're just part of how this type of product is designed to work.

Keep these points in mind:

- The Waiting Period: Most of these policies come with a waiting period, typically 12 to 24 months. If you pass away from natural causes during this initial window, the full cash sum will not be paid out. Instead, the insurer will usually just refund all the premiums you've paid in.

- Inflation Erodes Value: The payout amount is fixed on the day you take out the policy and it never changes. This means inflation will eat away at its real value over time. A £5,000 payout today will buy a lot less in 20 years' time.

- You Could Pay In More Than Is Paid Out: This is a crucial one to think about. If you take out a policy and live for a very long time, it’s entirely possible to pay more in premiums than the policy will eventually pay out. It is worth trying to work out where your 'break-even' point is.

- Lower Cover Amounts: The payouts are generally smaller, usually capped at around £20,000. This is often perfect for covering a funeral but it is not designed to clear a big debt like a mortgage. If you need a larger amount and you're in decent health, other types of life insurance might offer better value.

Frequently Asked Questions (FAQ)

When you're looking into over 50 life insurance, it's only natural for a few questions to pop up. Let's tackle some of the most common ones we hear, giving you the clear answers you need to feel confident about your next steps.

Is the payout from an over-50s plan taxable?

In most cases, the money from an over-50s policy is paid out completely free from UK income tax and capital gains tax. This is great news, as it means your loved ones get every penny you intended for them.

However, the payout could be counted as part of your estate for inheritance tax purposes. If your total estate is worth more than the current threshold (£325,000 for the 2024/25 tax year), a 40% tax could be due on the amount above this limit. A simple way to avoid this is by putting life insurance in trust. This separates the policy from your estate, ensuring the money goes directly to your beneficiaries without delay or tax issues.

What happens if I can no longer afford the premiums?

This is a really crucial point to think about before you commit. Over 50s plans are designed to run for the rest of your life, so you need to keep up with the monthly payments to keep the cover active. If you stop paying, the policy will lapse. When that happens, your cover ends, your beneficiaries will not get a payout, and you will not get back any of the premiums you have already paid. That’s why it is absolutely vital to pick a monthly premium you are sure you can afford for the long haul.

Can I have more than one over-50s policy?

Yes, you certainly can. There is no legal limit on how many over-50s life insurance policies you can hold in the UK. Some people take out multiple policies with different insurers, perhaps one to cover funeral costs and another to leave as a gift. The most important factor is affordability; you must be confident you can manage the combined monthly payments for all your policies long-term.

Ready to find the right protection for your family? The team at Discount Life Cover is here to help you compare quotes from leading UK insurers, ensuring you find affordable and reliable cover.

Get a free, no-obligation quote today at https://discountlifecover.co.uk.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply