Finding the cheapest term life insurance in the UK comes down to a few core principles. The single best way to secure a low price is to get a policy sorted while you're young and healthy. Why? Because you lock in the competitive possible monthly payments, known as premiums, for the entire duration of the policy.

Your Guide to Affordable Term Life Insurance

Think of term life insurance as a straightforward financial safety net. It’s designed to pay out a tax-free lump sum if you die during a specific, fixed period (the 'term'). It is almost always the most affordable type of life insurance because it has a clear end date and doesn't build up a cash value, unlike more complex whole-of-life policies.

This guide will walk you through practical, real-world strategies for finding cheap term life cover that’s right for the UK market. We'll skip the jargon and get straight to what matters for homeowners, parents, and anyone looking to protect their loved ones without breaking the bank.

Understanding the Core Principles

Getting a great price isn’t about stumbling upon a secret deal; it’s about making sure the policy fits your life perfectly. The final premium you pay is determined by a few key factors:

- Your age and health: It’s a simple fact that younger, healthier applicants almost always get the competitive quotes.

- The type of cover: Different policy structures, like level or decreasing term, have different price tags for a reason.

- Your lifestyle: Insurers regulated by the Financial Conduct Authority (FCA) will ask about habits like smoking or high-risk hobbies.

- The policy details: The amount of cover (the sum assured) and the policy length (the term) are the biggest drivers of cost.

Let's put that into perspective. A 30-year-old homeowner taking out a policy to cover their mortgage will likely pay much less than a 50-year-old for the exact same amount of cover. It's all about risk from the insurer's point of view – and the younger you are, the lower the perceived risk.

Term life insurance provides essential protection for a specific period, making it a cost-effective choice for covering key life stages like raising children or paying off a mortgage. The goal is to match your cover to your financial responsibilities.

Of course, securing affordable life insurance is just one piece of the financial puzzle. For more general financial wisdom, you might want to explore some broader money-saving guides that cover a whole range of topics. Right now, though, our focus is squarely on helping you find the most suitable and cheapest term life insurance for your situation.

How Policy Types Influence Your Premiums

Choosing the right type of policy is probably the single biggest decision you'll make in the hunt for the cheapest term life insurance. It directly dictates what you’ll be paying each month. Here in the UK, it usually boils down to two main options: level term and decreasing term insurance. Each one is built for a different purpose.

The basic difference is quite simple. With level term insurance, the payout amount (what the industry calls the 'sum assured') stays the same for the entire policy. If you take out a £200,000 policy for 20 years, your family gets £200,000 whether you die in the first year or the nineteenth.

That consistency is why it's a great choice for covering things that don't shrink over time, like an interest-only mortgage. It's also ideal for leaving a stable financial pot for your family to handle everyday living costs, childcare, or future university fees.

Level Term Cover for Consistent Protection

Imagine a young family with two children under five. They might opt for a 20-year level term policy for £250,000. The main goal here is peace of mind. If one of the parents were to die, the surviving partner would have a reliable sum of money to manage daily life until the children are financially independent. A fixed payout provides that security.

Because the insurer's risk doesn't change over the life of the policy, the premiums for level cover are naturally higher than for decreasing cover. You're paying for that certainty.

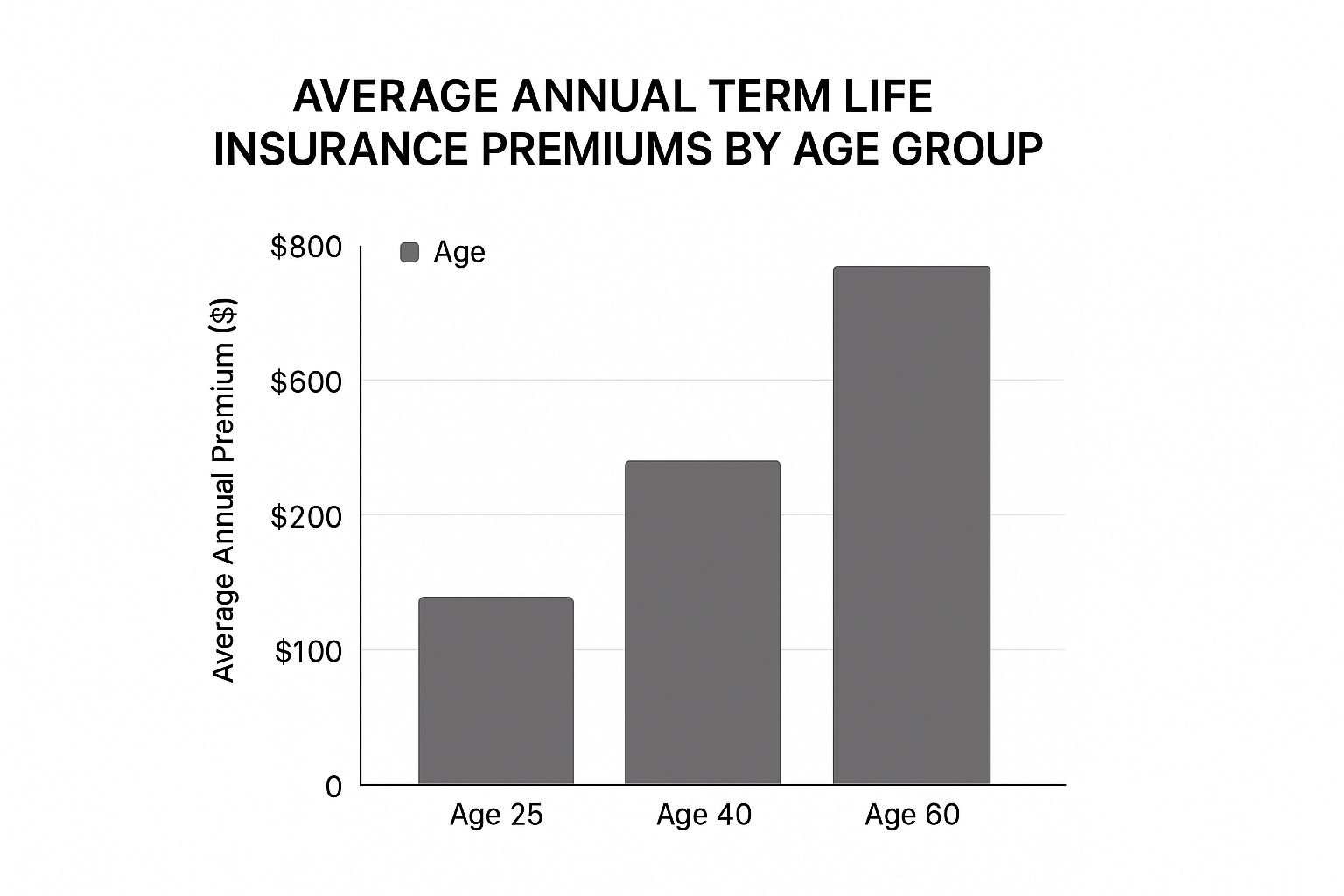

This chart drives home how premiums can climb as you get older, showing just how much you can save by getting cover sorted sooner rather than later.

As you can see, putting off the decision can end up costing you significantly more over the long run.

Decreasing Term Cover for Shrinking Debts

On the other hand, you have decreasing term insurance. This is specifically designed with a repayment mortgage in mind. The sum assured goes down over time, roughly matching the outstanding balance on your home loan.

Since the potential payout gets smaller every year, the risk for the insurer also drops. The result? Significantly premiums.

This makes it an incredibly popular and wallet-friendly choice for homeowners. Data from a major UK provider revealed the average annual cost for decreasing term cover was around £356. That’s less than £30 a month for the average policyholder aged 47.

To give you a clearer picture, here’s a quick side-by-side look at the two main policy types.

Level Term vs Decreasing Term at a Glance

This table breaks down the core differences to help you see which might be the right fit for your situation.

| Feature | Level Term Insurance | Decreasing Term Insurance |

|---|---|---|

| Payout Amount | Stays the same throughout the policy term. | Reduces over the policy term. |

| Primary Use | Covering interest-only mortgages, family living costs, inheritance tax planning. | Covering repayment mortgages and other shrinking debts. |

| Cost | More expensive due to the consistent level of risk for the insurer. | Cheaper because the insurer's potential payout decreases over time. |

| Best For | Providing a fixed, predictable financial safety net for your loved ones. | Clearing a specific large debt, primarily your mortgage. |

Choosing the right policy comes down to what you need to protect.

For many people, especially first-time buyers, decreasing term cover is the perfect middle ground. It provides enough protection to clear the biggest household debt without making you overpay for cover you won't need in 10 or 15 years' time.

Ultimately, your personal circumstances will guide your choice. If you want to dive deeper, you can explore our guide on whether you should choose level or decreasing term life insurance. Matching the policy to your financial commitments is the smartest first move you can make to find cover that's genuinely affordable.

How Your Age and Health Shape Your Final Quote

When an insurer calculates your life insurance quote, two things matter more than anything else: your age and your current health. These two factors are the foundation of their risk assessment. Understanding how they work is the key to finding the cheapest term life insurance possible.

The single best thing you can do to get a lower premium is when you’re young. When you do, you lock in that rate for the entire policy term, which could be 20, 30, or even 40 years. That good timing can save you thousands of pounds in the long run.

Let’s look at a real-world example. Imagine two people ing for the exact same £150,000 level term policy over 25 years. A healthy, non-smoking 30-year-old might get a quote for around £8 per month. In contrast, a 50-year-old with the same clean bill of health could be looking at premiums of £45 per month or more for identical cover.

Over the full 25-year term, the 30-year-old pays a total of £2,400. The 50-year-old, on the other hand, pays a staggering £13,500. It's a massive difference that drives home the financial benefit of getting covered sooner rather than later.

Lifestyle and Medical History Make a Big Difference

Beyond your date of birth, insurers put you through a detailed underwriting process. This is where they ask questions about your medical history, your family’s medical background, and your lifestyle choices.

Your answers here directly influence the final price. A few things are almost competitive to push your premiums up:

- Smoking or using nicotine products: This is one of the biggest red flags for insurers. It can easily double the premium compared to what a non-smoker would pay.

- A high-risk job or hobby: If you work at height or enjoy scuba diving, insurers see that as an increased risk.

- Pre-existing medical conditions: Conditions like diabetes, high blood pressure, or a history of heart problems will be looked at very closely.

It is crucial that you are completely honest on your application. Hiding a medical condition or not mentioning that you smoke could mean a future claim is denied, making the entire policy worthless. If you do have health issues, it doesn’t automatically rule you out. You can still find great value by looking into life insurance for people with medical conditions.

A Quick Word on Over-50s and Plans

As you get older, finding affordable cover can become trickier. You’ll see adverts for ‘competitive acceptance’ over-50s plans that don't ask medical questions. While they provide a way for people with serious health problems to get cover, they are often poor value for money if you're in reasonably good health.

Over-50s plans almost always offer a much smaller payout for a much higher premium compared to a standard, fully underwritten term life policy. If you're healthy enough to answer medical questions, you will nearly always get a and better deal elsewhere.

The bottom line is simple: the younger and healthier you are when you , the better the deal you will lock in for yourself and your family.

Practical Ways to Lower Your Life Insurance Costs

Beyond factors like your age and health, there are several smart adjustments you can make to your policy that will bring the monthly cost down. Finding the cheapest term life insurance isn't about cutting corners; it's about fine-tuning the details so you’re not paying for more cover than you actually need. Small tweaks can add up to serious savings over the life of the policy.

The first step is to figure out the right amount of cover, or sum assured, for your specific situation. You might have heard the rule of thumb about aiming for 10 times your annual salary, but it's better to be more specific. Think about your outstanding mortgage, any other debts, and the future costs your family would face, like childcare or university fees.

It’s surprisingly common for people to over-insure themselves, leading to unnecessarily high premiums. By taking a few minutes to calculate what your family would genuinely need, you can sidestep this mistake and keep your policy affordable.

Adjust Your Policy Term

The length of your policy, known as the term, has a massive impact on your premiums. A longer term means the insurer is liable for a longer period, which increases their risk and the price you pay. A straightforward way to trim your premium is to shorten the term.

Let's say you've just taken out a 25-year mortgage. The default move is to select a 25-year policy term to match. But could a 20-year term work just as well? This could still cover the critical period when your children are most dependent, while shaving a noticeable amount off your monthly payments.

Shortening your policy term by just five years can sometimes reduce your premium by 15-20% or more. It’s a powerful lever for balancing proper protection with what you can afford.

Consider Joint vs Single Policies

If you're in a couple, the choice between a joint policy and two single policies is a big one. A joint life policy covers two people but only pays out once—usually when the first person dies—and then the policy ends. Because it's one policy covering two lives with a single potential payout, it’s almost always than buying two separate policies.

That cost saving comes with a trade-off. The surviving partner is left without any life insurance cover right after a claim. On the other hand, two single policies, while costing more upfront, provide two separate payouts. This means if both partners were to die, the children would get a payout from each policy, effectively offering double the protection.

For anyone on a tight budget, a joint policy can be a brilliant way to get essential cover in place. If you want to dive deeper, you can learn more about finding the right budget life insurance options for your family.

Improve Your Health Before Applying

This is one of the most direct ways to slash your premiums: get healthier before you . Insurers reward healthy habits with lower prices.

- Quit Smoking: Giving up smoking is the single biggest health change you can make. Insurers will typically class you as a non-smoker after 12 months without nicotine. This one change can cut your premiums by up to 50%.

- Lower Your BMI: If you are overweight, working to get your Body Mass Index (BMI) into a healthier range can also lead to a much better quote.

- Reduce Alcohol Intake: Showing that you drink responsibly will also work in your favour when the underwriters are looking at your application.

By taking these proactive steps, you present yourself as a lower risk to insurers, which translates directly into premiums.

How to Compare Quotes and Find the Best Deal

Here's the truth about finding the best value life cover: it all boils down to comparing the market.

Premiums for the exact same cover can vary wildly between household names like Aviva, Legal & General, and LV=. This is one area of finance where brand loyalty rarely pays off, so shopping around isn't just a good idea—it's essential.

The quickest way to get a clear picture is by using a comparison service or an independent broker like us at Discount Life Cover. Rather than spending hours filling out the same forms on multiple insurer websites, you do it once and get a snapshot of the in minutes. It saves a massive amount of time and often uncovers deals you might not find on your own.

Looking Beyond the Lowest Price

While the goal is to get a great deal, the cheapest quote isn't automatically the best one. You need to look at the bigger picture to make sure you're getting a solid policy from a company you can trust.

A crucial number to check is an insurer's claims payout record. Most big UK insurers are transparent about this, and you'll typically see figures around 97-98%. A high payout rate is a good indicator that they'll be there for your family when it matters most. It's also worth searching for customer reviews on independent sites to see how they handle the claims process from a real-world perspective.

A cheap policy from a company with a poor claims history is a false economy. Your focus should be on finding the best value, which combines a low premium with the reassurance of a reliable and financially strong insurer.

Understanding Policy Add-Ons

As you compare quotes, you'll see offers for optional extras you can add to your main policy. While they increase the premium, they can add valuable layers of protection.

Two of the most common add-ons are:

- Critical Illness Cover: This pays out a tax-free lump sum if you're diagnosed with a specific serious illness listed in the policy, like certain cancers, a heart attack, or a stroke. It provides a financial buffer while you focus on recovery.

- Waiver of Premium: If you're signed off work due to illness or injury for a long period (usually six months or more), this benefit kicks in. The insurer pays your monthly life insurance premiums for you, so your cover stays active.

Ticking these boxes will push your costs up, but for many, that extra peace of mind is worth it. A smart move is to compare quotes both with and without these extras to see the exact price difference and decide if the added security fits your budget.

Frequently Asked Questions (FAQ)

Can I get life insurance without a medical exam in the UK?

Yes, some insurers offer 'competitive acceptance' policies, often marketed as over-50s plans. They skip the health questions and medical exams. However, these policies are almost always more expensive and offer a much lower level of cover than a standard policy that requires medical underwriting. For most healthy individuals, answering medical questions is the best way to secure the cheapest rate.

What if my circumstances change after I take out a policy?

Life insurance policies generally cannot be altered once they are active. If your needs change—for example, you have another child or take on a larger mortgage—you usually need to cancel your existing policy and take out a new one. The new policy's premiums will be based on your current age and health, which often means it will be more expensive. This is why it’s important to get the right cover from the start.

Is it to pay for life insurance annually instead of monthly?

In many cases, yes. Most UK insurers add a small charge for processing monthly Direct Debits. By paying your premium in one annual lump sum, you can often save around 4-5% over the course of the year. Always compare the monthly and annual payment options when you get a quote to see the potential savings.

Key Takeaway: A life insurance policy is a long-term commitment. Always review your options carefully, as small details like the payment frequency or the decision to complete a medical questionnaire can lead to significant long-term savings.

As you think about how term life insurance fits into your wider financial plan, you might also want to consider the implications of death and estate taxes. A life insurance payout can sometimes be used to help your beneficiaries manage these costs, so it’s a topic worth understanding.

Ready to find out how affordable your cover could be? At Discount Life Cover, we make it easy to compare quotes from the UK's leading insurers in just a few minutes. Get your free, no-obligation quote today and take the first step towards protecting your family's future.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply