Ever wondered about the simplest way to put a financial safety net in place for your family? Let's talk about level term insurance. In a nutshell, it's a type of life insurance that pays out a fixed, unchanging cash sum if you pass away during the policy's set timeframe, which is known as the 'term'.

Understanding Level Term Insurance

Level term insurance is one of the most straightforward and popular forms of life cover you can get in the UK. Its main attraction? Predictability.

From the day your policy starts to the day it ends, you know exactly how much your monthly payments (premiums) will be and, crucially, precisely how much money your family would receive. There are no surprises.

Think of it like fixing your mortgage rate for a few years. You lock in a rate to shield yourself from future hikes, giving you complete certainty over your outgoings. Level term cover works in the same way, offering peace of mind that the payout won't shrink, no matter what happens in the wider economy.

For a quick overview, here are the key features of a typical level term policy.

Level Term Insurance at a Glance

| Feature | Description |

|---|---|

| Payout Amount | A fixed sum of money (sum assured) that does not change. |

| Premiums | Your monthly payments are fixed and stay the same for the entire term. |

| Policy Term | You choose the duration, typically between 5 and 40 years. |

| Simplicity | Easy to understand with no investment elements or complicated clauses. |

| Purpose | Designed to cover large, static debts or replace lost income. |

This table shows just how simple and effective this type of cover can be for protecting your family's future.

The Purpose of Level Term Cover

So, what is it actually for? This type of policy is designed to protect your loved ones from major financial shocks if you're no longer around. It acts as a vital buffer, helping them maintain their standard of living without your income.

It’s the go-to choice for covering financial commitments that don’t shrink over time.

Common uses include:

- Covering an interest-only mortgage: This is a perfect match, as the capital loan balance remains the same right until the end.

- Replacing lost income: It provides a lump sum to cover day-to-day living costs, like bills, food, and childcare.

- Paying for future expenses: Many people use it to earmark funds for big costs down the line, such as university fees.

- Settling ongoing rent payments: It can ensure your family can stay in their home without financial pressure.

Popularity and Predictability in the UK

Level term life insurance is a cornerstone of the UK's financial protection market. Its popularity comes down to its simplicity and fixed costs—you set it up and know exactly where you stand.

In fact, annual sales of term insurance in the UK peaked at 1.71 million policies in 2021. This shows just how many families rely on its predictable nature to secure their financial futures.

This fixed structure makes it an excellent choice for anyone wanting reliable, long-term financial protection without any nasty surprises. For a deeper dive, our guide to term life insurance breaks down how these policies are structured in more detail.

How a Level Term Policy Actually Works

So, you've decided level term insurance might be for you. But what does the journey from application to potential payout actually look like? Understanding the mechanics will give you complete confidence that you're putting the right protection in place. The whole process is actually quite straightforward, built around a couple of key decisions you make right at the start.

It all boils down to two fundamental choices that will shape your entire policy:

- The Sum Assured: This is the specific, fixed cash lump sum that goes to your loved ones if you pass away during the policy. Whether it's £100,000 or £500,000, this amount is locked in from day one and doesn't change.

- The Policy Term: This is simply how long you want the cover to last. You might pick 25 years to line up with your mortgage, or maybe 18 years to see your youngest child reach adulthood. It's your call.

Once those two things are set, the core promise of a level term policy kicks in. Both your monthly payment (your premium) and the final payout amount are fixed for the entire duration. This predictability is the policy's greatest strength, making it very simple to budget for over the long haul.

Setting Your Premiums The Underwriting Process

Before anything is finalised, the insurer needs to figure out what your premium will be. This happens during a process called underwriting, which is basically the insurer's way of assessing risk. It’s how they make sure the price you pay is fair and accurately reflects the chance of a claim being made.

Insurers in the UK, all regulated by the Financial Conduct Authority (FCA), will look at a handful of key factors to calculate your monthly cost. These usually include:

- Your age and health: It's no surprise that younger, healthier people generally get lower premiums.

- Your lifestyle: Things like whether you smoke or have particularly risky hobbies can increase the cost.

- Your medical history: They'll ask about any pre-existing conditions you have, as well as any serious illnesses in your immediate family.

- The sum assured and term: A bigger payout or a longer policy term will naturally mean a higher premium.

It's absolutely vital to be completely honest during the application. Hiding something about your health or lifestyle might seem harmless, but it could invalidate your policy down the line. That would mean your family gets nothing when they need it most.

The Policy in Action and What Happens Next

Once your policy is up and running, your job is simple: just keep paying the monthly premiums on time. As long as you do that, your cover stays active. If you were to pass away during the term, your beneficiaries (the people you’ve nominated to receive the money) would contact the insurer to file a claim and receive the agreed-upon sum assured.

But what if you outlive the policy term? Well, the policy just ends. That's it. You stop making payments, and the cover ceases. There's no payout because level term insurance is a pure protection product – it has no cash-in value or investment element. Its sole purpose is to provide a financial safety net during the years your family is most vulnerable.

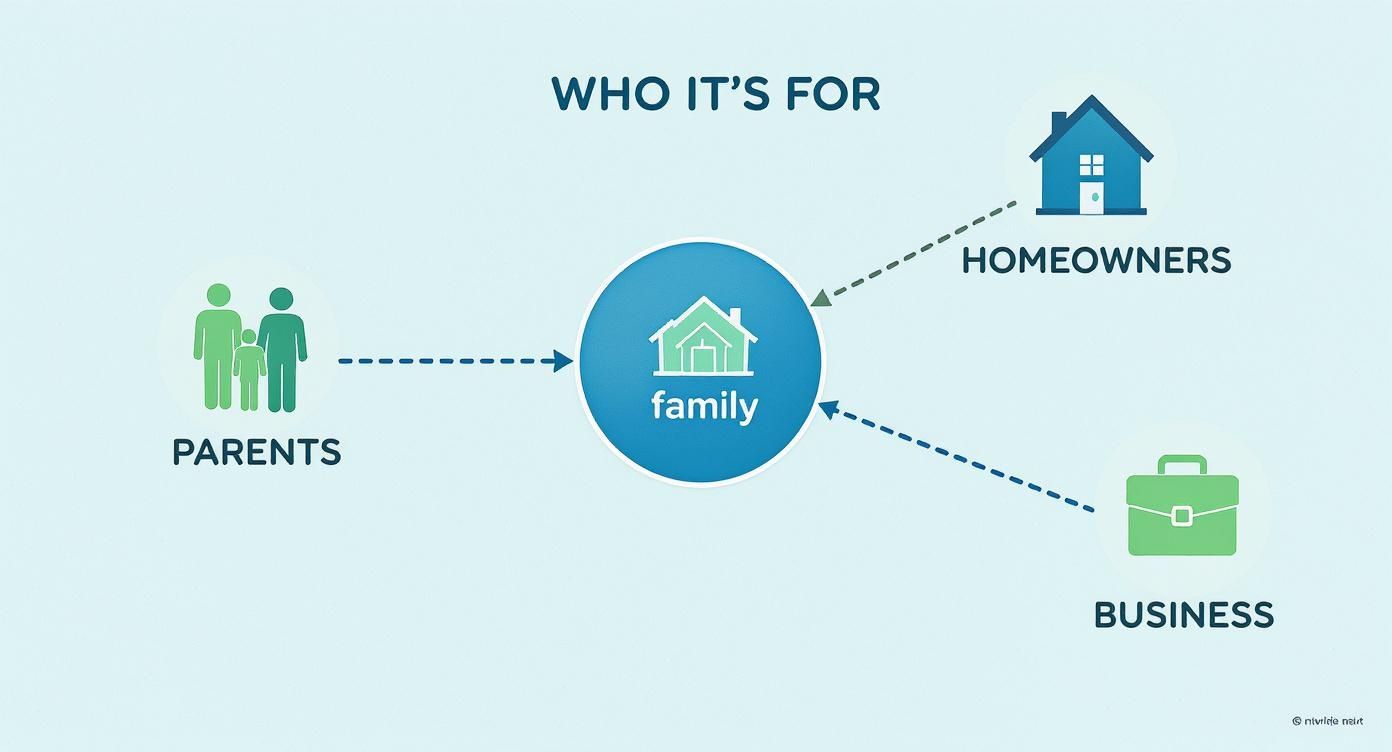

Who Is Level Term Insurance Really For?

You start to get a real feel for level term insurance when you see exactly who it’s designed to protect. The core idea is simple: a fixed payout. This makes it the perfect tool for covering specific financial responsibilities that aren't going to shrink over time. It’s a reliable safety net for anyone needing to cover consistent, long-term costs.

So, who are these people? Let's break it down with some real-world examples to show how this cover brings genuine peace of mind across the UK.

Parents with Young Families

If you have young children, your number one worry is likely making sure they’re looked after financially, no matter what happens to you. A level term policy provides a lump sum that can step in and replace your salary for years.

Think about what that money could do. It's not just about grand gestures; it’s about keeping daily life on track with as little disruption as possible.

- Daily Living Expenses: This covers everything from the weekly food shop and utility bills to school uniforms and after-school clubs.

- Childcare Costs: It ensures nursery or childminder fees are sorted, allowing the surviving parent to keep working without that extra financial strain.

- Future Education: You can earmark funds for university tuition or apprenticeships down the line, safeguarding their future opportunities.

Because the payout is fixed, you know the amount of protection won't dwindle as the kids get older and life inevitably gets more expensive.

Homeowners with Specific Mortgages

While decreasing term cover is often paired with standard repayment mortgages, level term insurance is the ideal match for homeowners with an interest-only mortgage. With an interest-only loan, the capital you owe doesn't go down over the years, so the amount needed to clear the debt stays the same. A level term policy makes sure the full mortgage balance can be paid off, at any time during the term.

It’s also a great fit for covering other big financial commitments, like rent, school fees, or just general household bills. As major UK insurer Legal & General points out, this makes it particularly suited for those interest-only mortgages and other debts that don't decrease over time.

Business Owners and Estate Planners

This type of policy isn’t just for personal protection; it's also a smart tool for business and financial planning.

- Business Partners: Owners often take out policies on each other. If one partner dies, the payout gives the remaining partners the cash to buy the deceased's shares from their estate. This is a clean, effective way to ensure the business can carry on smoothly.

- Inheritance Tax (IHT) Planning: For anyone whose estate might tip over the IHT threshold (currently £325,000), a level term policy can be a lifesaver. It provides the funds needed to cover the tax bill. By writing the policy 'in trust', the payout goes straight to your beneficiaries without being counted as part of your estate, which is a very tax-efficient move.

Comparing Level Term and Decreasing Term Insurance

When you start looking at life insurance, you'll quickly see two names pop up again and again: level term and decreasing term. They're the most common types of term life cover here in the UK, but they’re built for very different jobs. Picking the right one is absolutely essential if you want your family to be properly protected.

So, what's the big difference? It all comes down to how the final payout (known as the sum assured) behaves over the life of the policy. A level term policy is steady and predictable, with a payout that stays exactly the same from day one until the policy ends. A decreasing term policy does the opposite—the payout amount shrinks over time, usually tracking a large debt as you pay it off.

Payout Structure and Common Uses

With level term insurance, what you see is what you get. If you take out a £200,000 policy for 25 years, your loved ones will receive that full £200,000 whether a claim is made in the first year or the twenty-fourth. Simple.

This rock-solid predictability makes it the perfect fit for financial responsibilities that don't shrink, such as:

- Covering an interest-only mortgage where the capital never decreases.

- Replacing your salary to provide for your family's living costs.

- Leaving behind a specific lump sum as an inheritance.

- Helping to cover a potential inheritance tax bill.

Decreasing term insurance, on the other hand, is designed with one main job in mind: protecting a repayment mortgage. As you make your monthly mortgage payments, the amount you owe the bank goes down. A decreasing term policy is set up to mirror this, so the potential payout also reduces over time. This smart alignment ensures your family would have just enough to clear the mortgage without being over-insured, which is why it’s often the of the two.

This infographic neatly shows the kinds of people who really benefit from the stability of a level term policy.

As you can see, that fixed payout is invaluable for protecting ongoing family expenses, sorting out static property debts, or ensuring a business can carry on. If you're weighing up the pros and cons, our detailed guide on whether you should choose level term or decreasing term life insurance can help you make the right call for your circumstances.

A Quick Comparison

To make the distinction crystal clear, here’s a straightforward table breaking down the key differences. This should help you figure out which structure best lines up with what you’re trying to achieve.

| Feature | Level Term Insurance | Decreasing Term Insurance |

|---|---|---|

| Payout Amount | Stays the same throughout the policy term. | Reduces over the policy term, often monthly or annually. |

| Best For | Interest-only mortgages, income replacement, inheritance planning. | Repayment mortgages and other large debts that reduce over time. |

| Premiums | Fixed for the entire term. | Also fixed, but generally lower than level term for the same initial cover amount. |

| Main Benefit | Predictability. Your beneficiaries get a known, fixed lump sum. | Affordability. Cover is as the liability reduces. |

Ultimately, the choice comes down to what you need the money for. If the financial gap you're trying to fill stays the same size, level term is your answer. If it's for a debt that's getting smaller every year, decreasing term is likely the more cost-effective way to go.

Key Considerations Before Choosing Your Policy

Picking a life insurance policy is a big financial commitment, so it pays to understand the smaller details before you sign on the dotted line. It's not just about the payout amount and the length of the term; a few other factors can make a huge difference to how well the cover actually works for your family. Think of this as your pre-flight checklist to make sure you're making a properly informed choice.

First up, you've got to think about the sneaky impact of inflation. A level term policy gives you a fixed payout, which might look like a mountain of cash today. But stretch that out over 20 or 30 years, and the rising cost of living will definitely take a bite out of its real-world value. A sum that easily covers the mortgage and bills now might not stretch nearly as far down the road.

Joint vs Single Life Policies

For couples, one of the first big decisions is whether to get two single policies or just one joint one. A joint policy is usually a bit and pays out on the 'first death', after which the cover stops. This can be perfect for wiping out a joint mortgage, but it does leave the surviving partner without any life insurance of their own.

On the other hand, two single policies offer independent protection. If one partner passes away, their policy pays out as planned, but the surviving partner’s cover stays in place. This provides a much more robust safety net for the family's future. It might cost a fraction more, but it delivers far more comprehensive, long-term security. It's always worth weighing up your needs and seeing how the numbers stack up by comparing competitive term life insurance rates from the top providers.

Honesty is the Best Policy: When you fill out your application, it is absolutely vital to be completely upfront about your health and lifestyle. Holding back information, even stuff that seems minor, could be flagged as 'non-disclosure'. If that happens, an insurer could void your policy entirely, leaving your family with nothing when they need it most.

Writing Your Policy in Trust

One of the smartest moves you can make—and one that's surprisingly often missed—is writing your policy 'in trust'. It sounds complicated, but it's just a simple legal setup that keeps the policy payout separate from the rest of your estate. This simple step comes with two massive benefits for your loved ones:

- A Quicker Payout: The money goes directly to your beneficiaries without getting stuck in probate, a legal process that can drag on for months.

- Avoiding Inheritance Tax (IHT): A big life insurance payout could easily tip your estate over the inheritance tax threshold. By putting the policy in trust, the money goes straight to your family, completely tax-free.

Most UK insurers provide the trust forms for free and can help you complete them. This simple piece of admin ensures your payout is handled exactly as you intended.

Finding the Right Level Term Cover in the UK

Getting the right financial safety net in place for your family is often a lot more affordable than most people imagine. The price you pay – your premium – is worked out by UK insurers based on a few key details about you and the cover you want.

Understanding these factors is the first step to finding a policy that gives you proper protection without breaking the bank.

What Determines Your Premium

Insurers, all regulated by the Financial Conduct Authority (FCA), look at several things to set a fair price. The main ones are pretty straightforward:

- Your Age and Health: It's a simple fact that ing when you're younger and in good shape is the surest way to lock in lower premiums for the long haul.

- Lifestyle Choices: Whether you smoke or vape is a big one. It's seen as a higher risk, and that's reflected in the price.

- The Policy Details: This is all about what you're buying. A bigger payout (sum assured) or a longer policy (term) will naturally cost more.

At the end of the day, it all comes down to risk. The less of a risk the insurer thinks you are, the your monthly premiums will be.

The single most powerful tool you have for finding a great deal is comparison. Prices can vary dramatically between different UK insurers like Aviva, Legal & General, and Royal London for the exact same level of cover.

Shopping around is crucial. It’s the only way to be sure you aren't overpaying for the protection your family needs, helping you strike that perfect balance between solid cover and a monthly payment you're comfortable with.

The simplest way to do this is by using a comparison service. Here at Discount Life Cover, you can instantly compare quotes from the UK's leading insurers and pinpoint the best possible deal for your situation. Taking just a few minutes to compare could genuinely save you a hefty sum over the life of your policy.

Frequently Asked Questions (FAQ)

To really get to grips with how level term insurance works, let's tackle some of the most common questions people ask. These are the nuts-and-bolts details that can make all the difference.

What happens if I stop paying my premiums?

If you stop paying your monthly premiums, your policy will lapse. This means your cover ends immediately. Should the worst happen after that point, your family would not receive any payout. Keeping up with payments is essential to ensure the financial safety net remains in place.

Can I change my level term policy later on?

Generally, the key details of your policy (the sum assured and term) are fixed from the start. However, many UK insurers offer a 'Insurability Option'. This allows you to increase your cover after a major life event—like getting married, having a child, or taking out a larger mortgage—without needing further medical checks. This adds valuable flexibility as your life changes.

Does level term insurance have a cash-in value?

No, it doesn't. Level term insurance is a pure protection product. Its sole purpose is to pay out a lump sum if you die during the policy term. It has no investment element and never builds a cash value. If you outlive the term, the policy simply expires, and you don't get any premiums back. You've paid for peace of mind that, thankfully, wasn't needed.

Is the payout from a life insurance policy taxed in the UK?

The payout itself is typically paid completely free from UK income tax and capital gains tax. However, the lump sum could be considered part of your estate and become liable for Inheritance Tax (IHT) if your estate's total value exceeds the current threshold (£325,000). The simplest way to avoid this is to write your policy 'in trust', which legally separates it from your estate.

Ready to secure your family’s financial future? At Discount Life Cover, we make it easy to find the right protection at the competitive. Get your free, no-obligation quote in minutes and compare deals from the UK’s leading insurers.

Find your cheapest quote with Discount Life Cover today

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply