When you're looking at life insurance over 50, you're generally weighing up three main players. There's Term Life Insurance, which is great for covering specific debts like a mortgage because it only lasts for a set period. Then you have Whole of Life Insurance, designed to last your entire lifetime and often used for inheritance planning. Finally, there are Over-50s Plans, which skip the medical questions and are a straightforward way to cover funeral costs.

Ultimately, the right choice boils down to your health, your budget, and what you intend the money to be used for.

Why a Detailed Life Insurance Comparison Matters After 50

Choosing life insurance in your 50s, 60s, or beyond is a completely different ball game than it was in your 30s. Back then, the focus was likely on protecting a young family. Now, your priorities have probably shifted. You might be more concerned with ensuring your partner is financially secure, clearing the last of the mortgage, or leaving a meaningful legacy for your children and grandchildren.

This is why a proper life insurance over 50 comparison is so critical. It’s not just about grabbing the cheapest policy you can find. It’s about matching the cover to your mature financial goals. Get it wrong, and you could end up paying into a policy that expires before you need it or one that simply doesn't provide the financial buffer your loved ones will actually require.

Understanding the Growing Market

The demand for life insurance among the over-50s is stronger than ever. In fact, recent figures show the UK life insurance market grew by 7.1%, partly because of our ageing population and a greater focus on health. Insurers have certainly taken notice. Over 63% of policies now come with flexible features designed specifically for older customers. You can read more about the UK insurance industry's growth.

While more choice is a good thing, it also adds a layer of complexity. This guide is here to cut through the jargon and give you a clear, side-by-side comparison of your main options.

Your Main Options at a Glance

Getting your head around the different types of cover can feel overwhelming at first, but most policies fall into one of three distinct camps. Knowing how they differ is the first, most important step.

| Policy Type | Best For | Medical Questions? |

|---|---|---|

| Term Life Insurance | Covering specific debts like a mortgage or loan within a set timeframe. | Yes, fully underwritten. |

| Whole of Life Insurance | Leaving a competitive inheritance or covering funeral costs, with lifelong cover. | Yes, fully underwritten. |

| Over-50s Plan | Securing a small, fixed payout for funeral expenses, especially with health issues. | No, acceptance is competitive. |

Each of these policies serves a unique purpose. The best one for you will hinge entirely on your personal circumstances and financial situation.

Understanding Your Three Main Policy Options

Before we get into a direct life insurance over 50 comparison, we need to get the basics down. Think of it like this: each policy is a different tool designed for a specific job. If you try to use a hammer to turn a screw, you're not going to get the best result. It's the same with life insurance.

For those of us over 50 in the UK, the market really boils down to three core paths. Let’s walk through them, looking at how they actually work in the real world. Once you get a feel for what each one is built for, you'll be able to compare quotes and features with real confidence.

Term Life Insurance

Term life insurance is the most straightforward cover you can get. You choose an amount of money (the sum assured) and a set length of time (the term), which could be anything from 5 to 40 years. If you pass away during that specific period, your family gets a tax-free payout. If you live past the end date, the policy simply expires, and there’s no payout. Simple as that.

Because it has a definite end date, term insurance is often the most budget-friendly option, particularly if you’re in good nick. It’s designed to act as a financial safety net when your loved ones need it most.

Real-World Scenario: Covering the Mortgage

Picture David, who is 54 and has 11 years left on his mortgage. He takes out a term policy for 12 years to match the outstanding debt. If he were to pass away within that window, the payout would clear the mortgage, meaning his family wouldn't have to worry about losing their home. Once the mortgage is gone, that specific financial risk disappears, which is why a fixed-term policy works so well.

Whole of Life Insurance

Just like the name suggests, whole of life insurance covers you for your entire life. There’s no end date. As long as you keep paying the premiums, a payout is competitive when you pass away, whenever that may be. This certainty makes it more expensive than term cover, but it’s designed to solve a completely different set of financial problems.

You’ll often see these policies used as part of a bigger financial plan, like dealing with inheritance tax or ensuring a specific cash legacy is left behind for the next generation.

Key Takeaway: The big difference between term and whole of life boils down to one word: certainty. Term cover is a ‘what if’ safety net for a set time. Whole of life is a ‘when’ guarantee of a payout, no matter what.

We dive deeper into this in our guide comparing whole life vs term insurance. Getting this distinction right is absolutely crucial for your family's financial future.

Real-World Scenario: Inheritance Planning

Let’s look at Margaret, 65. She’s built up a decent estate with property and savings, but she knows it will trigger an inheritance tax bill. To stop her children from being forced to sell assets to pay HMRC, she takes out a whole of life policy. By writing it 'in trust', the payout goes straight to her beneficiaries and bypasses her estate, giving them the cash needed to settle the tax bill without any fuss.

Over-50s Plans

A Over-50s Plan is technically a type of whole of life insurance, but it comes with one massive selling point: there are no medical questions. If you're a UK resident between 50 and 80 (sometimes up to 85), you're competitive to be accepted. This makes it a lifeline for anyone with pre-existing health conditions who might be quoted sky-high prices or even declined for other types of cover.

But this easy access comes with a few trade-offs you need to know about:

- Smaller Payouts: The cover amount is usually much lower, often capped around £20,000. It's really designed to cover funeral costs or leave a small cash gift.

- Waiting Period: Most plans have a "waiting period" of one or two years. If you pass away from natural causes during this initial time, the insurer won’t pay the full amount but will typically refund the premiums you've paid. Accidental death, however, is usually covered from day one.

Real-World Scenario: Covering Funeral Costs

Consider John, who at 68 has a history of heart trouble and has been turned down for other policies. His main concern is not leaving his kids with a funeral bill. A competitive over-50s plan gives him the peace of mind he’s looking for. He knows that once he’s past the initial 12-month waiting period, a fixed sum is competitive to be paid out to cover those final expenses, no matter what his medical records say.

A Side-by-Side Look at Your Over 50s Life Insurance Choices

Now that we’ve covered the basics of the three main policy types, it’s time to put them head-to-head. When it comes to a life insurance over 50 comparison, it's less about finding a single "best" policy and more about understanding the crucial trade-offs between them.

Each type of cover is built for a different person with a different goal in mind. By weighing them up against what really matters—cost, medical checks, and the final payout—you can see which one truly fits your life. Let's break down those differences so you can make a decision you feel good about.

The Head-to-Head Comparison

To get straight to the point, let's look at how Term, Whole of Life, and Over-50s plans really stack up against each other. This table cuts through the noise and highlights the most important distinctions you need to think about.

Life Insurance Over 50 Policy Comparison

Here's a straightforward look at how the main insurance options compare, helping you see at a glance which path might be right for your specific needs.

| Feature | Term Life Insurance | Whole of Life Insurance | Over-50s Plan |

|---|---|---|---|

| Medical Eligibility | Full medical underwriting is required. Your health and lifestyle directly affect premiums and whether you're accepted. | Full medical underwriting is also needed. Like term cover, your health is a key factor in working out the cost. | No medical questions asked. Acceptance is competitive for UK residents in the 50-80 age bracket. |

| Premium Structure | Premiums are usually lower as the cover only lasts for a set time. They are often fixed for the policy term. | Premiums are higher than term cover because a payout is certain. They can be fixed for life or reviewable over time. | Premiums are fixed for life, but you often stop paying at a certain age (like 90) while your cover continues. |

| Payout Size (Sum Assured) | Can offer very high payouts, often in the hundreds of thousands, designed to clear large debts like a mortgage. | Also provides large payouts, making it a good fit for significant inheritance tax planning or leaving a substantial legacy. | Payouts are much smaller, typically capped between £10,000 and £20,000, and are meant for funeral costs or small gifts. |

| Typical Use Case | Clearing a mortgage, providing for children until they're on their own two feet, or settling outstanding loans. | Inheritance tax planning, leaving a competitive lump sum to loved ones, or funding long-term care needs. | Covering funeral expenses, paying off small bills, or leaving a modest cash gift to family. |

| Key Consideration | The policy has an end date. If you outlive the term, there's no payout, and getting new cover will be much more expensive. | The monthly cost is higher. It’s a lifelong financial commitment, so you need to be sure you can afford it. | The waiting period. Most plans have a 1-2 year initial period where only premiums are refunded for death by natural causes. |

This comparison shows there's no one-size-fits-all answer. The "right" choice is deeply personal and depends entirely on your health, budget, and what you want to achieve for your family.

Medical Eligibility: The Big Decider

For many of us over 50, the first and most significant hurdle is the medical check. Both Term and Whole of Life policies demand full medical underwriting. This involves the insurer asking detailed questions about your health, your family's medical history, and your lifestyle (like smoking or drinking), and they might even want a look at your GP records.

If you’re in good health, this process can unlock very competitive prices for a large amount of cover. But if you have pre-existing conditions like diabetes, a history of heart trouble, or cancer, you could be looking at much higher premiums—or even be declined cover altogether. This is where Over-50s Plans offer a completely different route.

By getting rid of medical questions entirely, Over-50s Plans provide an accessible safety net for those who might otherwise struggle to get insured. This competitive acceptance is their single biggest selling point.

Premiums vs. Payouts: The Crucial Trade-Off

When you start looking at the cost, the trade-offs become crystal clear. Term insurance is generally the most affordable because the insurer is banking on you outliving the policy term. Whole of Life costs more simply because the payout is competitive—the insurer knows they will have to pay out one day.

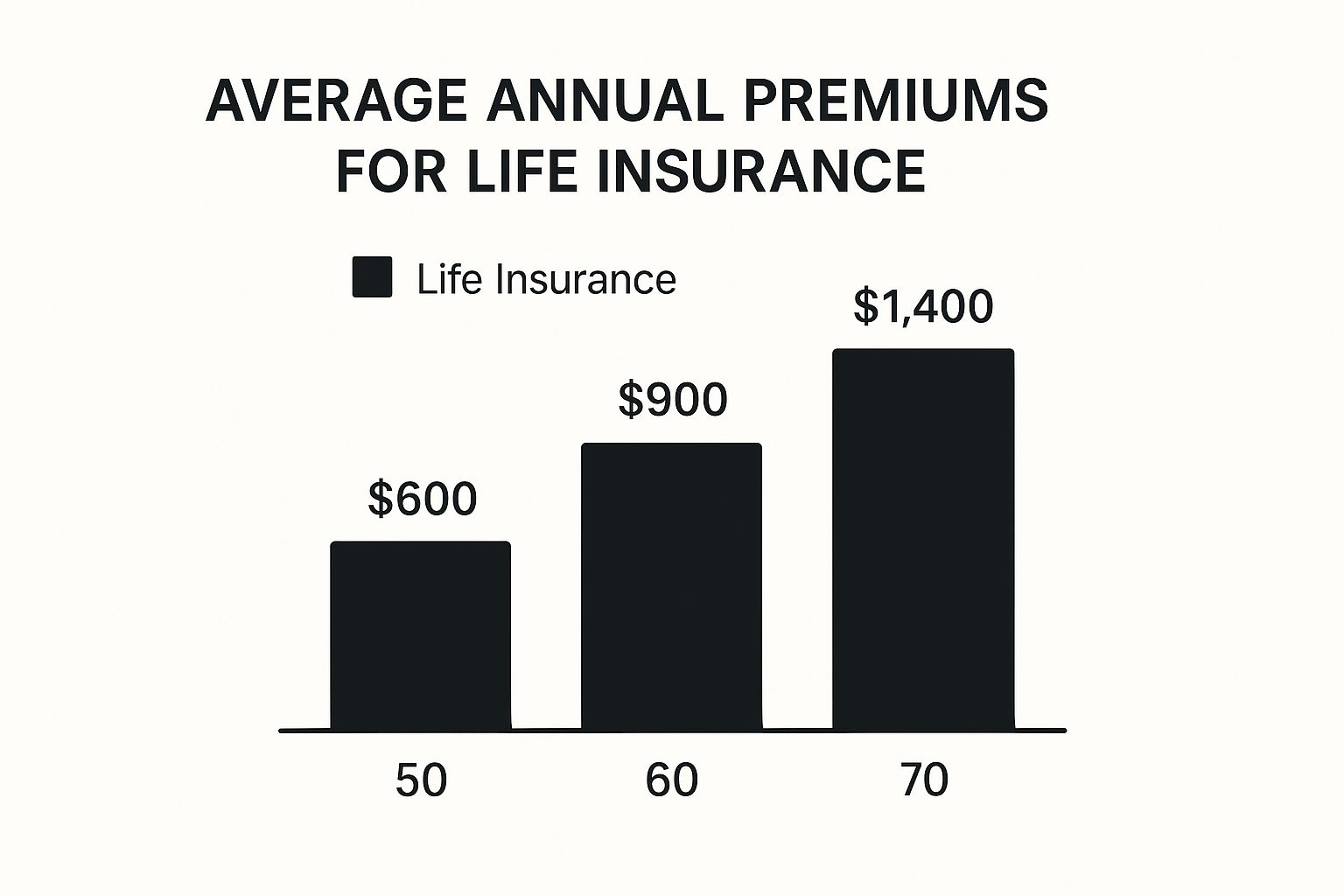

This infographic shows just how much premiums can change as we get older, underlining why it's often better to lock in cover sooner rather than later.

As you can see, the cost of life insurance climbs noticeably with age, which reflects the higher risk for the insurer.

Over-50s Plans have their own unique financial setup. While the premiums are fixed and often seem low, it's possible to pay more into the policy than the final lump sum, especially if you live a long time. For instance, a popular option like the SunLife Over 50 plan for a 60-year-old non-smoker might cost around £20 a month. This could secure a payout of between £4,561 and £5,217, depending on the insurer and whether the waiting period is 12 or 24 months. You can explore more details about popular over-50s plans at Reassured.co.uk.

This makes it absolutely vital to weigh the certainty of being accepted against the potential return on your payments.

Choosing Based on Your Goal

At the end of the day, the best choice comes down to what you are trying to achieve. Your main financial goal should be the lens you use for your own life insurance over 50 comparison.

- Need to clear a specific debt with an end date? A Term Life Insurance policy is almost always the most cost-effective tool for the job. You match the policy term to your loan, and once it's paid, the need for that cover is gone.

- Want to leave a competitive legacy or cover an inheritance tax bill? A Whole of Life Insurance policy gives you the certainty needed for long-term estate planning. The competitive payout ensures your family gets the funds they need, whenever that day comes.

- Worried about funeral costs and have some health issues? A Over-50s Plan offers peace of mind without any medical hurdles. It’s a simple way to make sure your final expenses are sorted without burdening your family.

Each policy has its moment to shine. The key is to be honest about your health, your budget, and exactly what financial problem you want the insurance to solve for your loved ones. That clarity will point you directly to the right type of cover.

Matching the Right Policy to Your Life Stage

It’s one thing to read about policy features, but it's another thing entirely to see how they fit into real life. A direct life insurance over 50 comparison really comes alive when you can see yourself in the examples.

Ultimately, your own circumstances, financial commitments, and what you want for the future are what truly matter. So, let's step away from the theory and look at a few relatable scenarios. By matching specific policies to different people, we can bridge the gap between insurance jargon and making a practical choice.

Scenario 1: Covering a Remaining Mortgage

Meet David and Sarah, both 52, with ten years left on their mortgage.

David and Sarah are in a position many people find themselves in. Their kids are grown up and self-sufficient, leaving the £90,000 on their mortgage as their only major financial loose end. What keeps them up at night is the thought of one of them passing away unexpectedly in the next decade, leaving the other to shoulder the mortgage payments alone.

For their situation, the most logical and budget-friendly option is a decreasing term insurance policy.

Here’s why it’s a perfect fit:

- It mirrors the debt: The payout from a decreasing term policy is designed to shrink over time, roughly in line with their shrinking mortgage balance.

- It’s affordable: Because the potential payout gets smaller each year, the premiums are much lower than you'd find with level term or whole of life cover.

- It has a clear end point: They only need the protection for the next ten years. A policy with a fixed 10-year term aligns perfectly with their financial risk, meaning they won’t be paying for cover they no longer need once the house is theirs outright.

A decreasing term policy is specifically engineered for repaying debts like a mortgage. It provides a targeted safety net that expires at the same time the financial risk does, making it an efficient choice.

Once their mortgage is paid off, their need for this specific type of cover simply vanishes. At that point, they can take a fresh look at their finances and decide if they need a different kind of policy for other goals, like funeral planning.

Scenario 2: Leaving a Legacy

Meet Margaret, 68, who wants to leave a competitive gift for her grandchildren.

Margaret is a widow in good health. Her home is paid off, her pension is comfortable, and her own children are well-established. Her main goal now is simple: she wants to leave a competitive lump sum of £50,000 to be split between her three grandchildren, giving them a head start with a house deposit or university fees.

She isn't worried about a debt with a finish line; what she needs is the certainty that the money will be there for them, no matter when she passes away. This makes a whole of life insurance policy the ideal tool for the job.

Here’s why it’s the right choice for her goal:

- payout: Unlike term insurance, a whole of life policy guarantees a payout whenever she dies, as long as she keeps up with the premiums. This certainty is absolutely essential for her legacy planning.

- Inheritance tax planning: By writing the policy 'in trust', the £50,000 payout can go straight to her grandchildren, completely bypassing her estate. This means it avoids inheritance tax and the often lengthy probate process.

- Fixed premiums: At 68 and in good health, she can lock in a premium that will never change, making it a predictable and manageable part of her budget for the rest of her life.

For Margaret, the higher monthly cost compared to term insurance is a worthwhile investment. It buys her complete peace of mind, knowing her financial gift will reach her grandchildren exactly as she intends.

Scenario 3: Ensuring Funeral Costs Are Covered

Meet John, 62, who has some health issues and wants to ensure his funeral is paid for.

John has Type 2 diabetes and a history of high blood pressure. He's looked into traditional life insurance, but the quotes he's received have been sky-high because of his health. His main worry is a simple one: he doesn't want his kids to be landed with the burden of his funeral costs, which he figures will be around £5,000.

For John, a competitive over-50s plan offers the perfect solution and some much-needed reassurance.

Here's why this policy is the best fit for his circumstances:

- acceptance: There are no intrusive medical questions to answer. John's health conditions have no bearing on his eligibility or his premium, which is a massive relief for him.

- Affordable and fixed payments: He can secure a policy that pays out around £5,000 for a manageable monthly premium that is fixed for life and will never go up.

- Peace of mind: He knows that as long as he lives past the initial one- or two-year waiting period, the payout is competitive. This takes a huge weight off his shoulders, ensuring his final wishes can be carried out without causing financial stress for his family.

John understands that over his lifetime, he might end up paying more in premiums than the final payout. But for him, the value is in the competitive acceptance and the solid assurance that his funeral is taken care of. That's what matters most.

These examples really show that the 'best' policy is always the one that fits your life. By getting clear on your own financial goals, health, and what you want to protect, you can make a much smarter decision and find the right cover for you.

Frequently Asked Questions About Life Insurance Over 50

Can I afford the cover, and is it good value?

Affordability is a major concern, especially with competitive over-50s plans where it's possible to pay more in premiums than the final payout sum. However, the 'value' isn't just a simple calculation. For many, the peace of mind knowing that funeral costs or other final expenses are covered is the primary benefit. Term insurance is generally the cheapest option for a large amount of cover over a set period.

Should I write my policy in trust?

For most people, yes. Writing your policy in trust is a simple process, usually done for free when you take out the policy. It legally separates the payout from your estate, which means the money can be paid directly to your beneficiaries without going through probate and won't be subject to inheritance tax. This can save your family a significant amount of time, stress, and money.

What about adding critical illness cover?

Many term and whole of life policies allow you to add critical illness cover. This add-on provides a tax-free lump sum if you are diagnosed with a specific serious illness listed in the policy. It can provide a crucial financial buffer while you are still alive, helping to cover medical bills or replace lost income. While it increases your premium, it offers an extra layer of financial protection.

Can I get life insurance if I have a medical condition?

Yes, it is often possible. For term or whole of life policies, you will need to declare your medical conditions. Insurers like Aviva, Legal & General, and LV= will assess your application and may offer cover at a higher premium. If you are declined or the premiums are too high, a competitive over-50s plan is an excellent alternative as it guarantees acceptance without any medical questions. You can learn more about getting life insurance with medical conditions in our detailed guide.

How to Compare Quotes and Secure Your Policy

Now that you've got a handle on the different types of cover, it's time to find the right policy at the best possible price. The most straightforward way to do this is by using a comparison service. This lets you see quotes from a wide range of UK insurers all in one place, saving you the hassle of contacting each one separately.

To get started, you'll need a few personal details ready. Insurers will want to know your age, whether you smoke, your general health, and how much cover you're looking for. This information is key to getting quotes that are actually relevant to you. If you're curious about potential costs, using an over 50 life insurance calculator is a great way to get a quick estimate.

As you begin to compare term life insurance rates, remember that the cheapest option isn't always the best one. Look closely at the policy details to ensure it truly matches what you and your family need.

The Application Process

Found a quote you're happy with? The next step is the application itself, and this is where honesty is non-negotiable. You must be completely upfront and truthful, especially about your health history and lifestyle choices.

A word of caution: Trying to hide a pre-existing medical condition or the fact that you smoke is a risky game. If the insurer discovers this later, they could void your policy entirely, as per Financial Conduct Authority (FCA) regulations on non-disclosure. That means no payout for your loved ones when they need it most.

Once your application is in, the insurer's underwriting team will review it. They may even ask to see your GP records to confirm the details you’ve provided. Of course, this step is skipped for competitive acceptance over-50s plans. After you get the green light, your policy documents will arrive, and your cover will officially start. Taking the time to get this right ensures the financial safety net you've set up is completely secure.

Ready to put this knowledge into action? The team at Discount Life Cover can help you compare quotes from across the market in minutes, ensuring you find the right protection for your family's future.

Get Your Free, No-Obligation Quote Today

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply