A life insurance mortgage calculator is a simple online tool designed to give you a clear estimate of the cover you need to protect your mortgage. By entering your outstanding loan balance, the remaining term, and your interest rate, it quickly calculates a recommended level of cover. This removes the guesswork, providing a data-driven figure to help you make an informed decision.

Why a Mortgage Calculator Is Your First Step

Ensuring your family can stay in their home if you were no longer around is a priority for most homeowners. However, working out exactly how much life insurance is needed to achieve this can feel overwhelming.

This is where a life insurance mortgage calculator is an indispensable first port of call. Instead of choosing a figure at random, it provides a logical starting point for protecting what is likely your largest financial commitment. Using a calculator demystifies the process from the outset, helping you understand the different types of cover available and which one best aligns with your specific mortgage.

Seeing the Numbers for Yourself

The greatest benefit of using a calculator is clarity. It allows you to see an immediate ballpark figure for the cover required and understand how it relates to your mortgage balance. This empowers you to confidently explore different policy types:

- Decreasing Term Cover: This policy is designed so the amount of cover reduces over time, in line with your repayment mortgage. Because the potential payout shrinks, it is often the most affordable option for mortgage protection.

- Level Term Cover: With this policy, the payout amount remains fixed throughout the policy's term. This is often suitable for interest-only mortgages, or if you wish to leave an additional financial cushion for your family on top of clearing the mortgage.

Seeing these options laid out with estimated costs means you can make a decision that's right for your family without needing to be an insurance expert. Ultimately, it’s about the peace of mind that comes from knowing your loved ones won't be burdened with mortgage repayments if the worst should happen.

This first step is crucial. The UK life insurance market, which is regulated by the Financial Conduct Authority (FCA), has grown significantly, partly because digital tools like these calculators have made insurance more accessible. They allow homeowners to get an accurate estimate by factoring in key variables—outstanding loan, interest rate, and term length—to ensure you can choose the right level of protection.

Getting started is easy, and our guide on calculating how much life insurance you need offers even more insight into the process.

Gathering Your Mortgage Details for an Accurate Quote

To get a genuinely useful estimate from a life insurance mortgage calculator, the quality of the information you input is vital. Think of it as: rubbish in, rubbish out. Taking a few minutes to gather the correct details from your most recent mortgage statement will make all the difference.

It is a straightforward task, requiring just a handful of key figures that define your home loan. With these details to hand, you can be confident that the quote you receive will be accurate.

Your Essential Checklist

Before you begin, locate your latest mortgage statement or log in to your online mortgage account. You will need to find these four key pieces of information:

- Outstanding Mortgage Balance: This is the total amount you still owe your lender. It is the most critical figure as it sets the baseline for the amount of cover needed to clear the debt.

- Remaining Mortgage Term: How many years and months are left until the mortgage is fully paid off? This number will determine how long your life insurance policy needs to last.

- Mortgage Interest Rate: Note down your current interest rate. This helps the calculator estimate how your loan balance will decrease over time, which is especially important for decreasing term policies.

- Type of Mortgage: Is it a repayment or an interest-only mortgage? A repayment mortgage balance reduces over time, whereas an interest-only balance remains the same until the end of the term.

Getting these four details right is essential if you want an accurate calculation. They are the foundation of your quote, ensuring the cover amount and policy length are perfectly aligned with your mortgage.

Handling Tricky Scenarios

What if your situation isn't quite so straightforward? That's common. If you have a variable or tracker interest rate, it's best to use the rate as it stands today. While it may change, this provides the most accurate snapshot for now.

For those with an interest-only mortgage, the calculator will likely recommend a level term policy, as your capital debt does not decrease. Simply enter your outstanding balance and term as you normally would. Taking a moment to get these details right ensures the quote you receive genuinely reflects your circumstances.

Making Sense of Your Calculator Results

So, you have entered your details into a life insurance mortgage calculator and are now looking at a page of numbers. You will likely see figures for a recommended cover amount and an estimated monthly premium. But what does this mean for you and your family? Let's break it down.

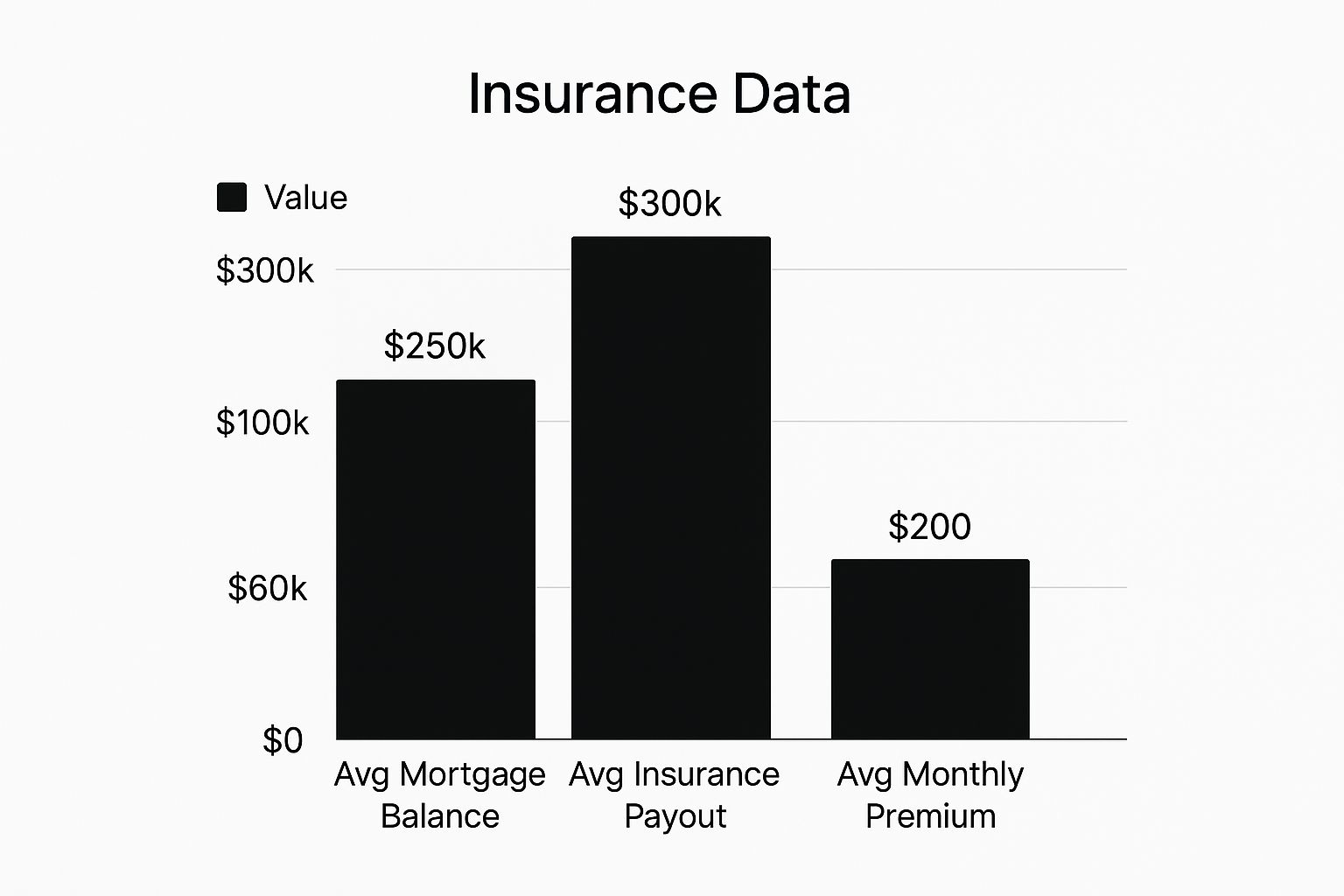

Let’s take a common example: a couple in their early thirties with a £250,000 repayment mortgage that has 25 years left to run. Entering these details into the calculator will generate an initial quote, which should be seen as your starting point. For example, a non-smoking 35-year-old might see a decreasing term quote starting from as little as £8 per month.

Here's what the results page on the Discount Life Cover calculator might look like once you've put your details in.

As you can see, the initial quote is laid out clearly, showing you a monthly premium based on the cover amount you need. It’s designed to be simple and provide the most important information upfront.

Understanding the Numbers

Those results are more than just a price tag; they are a direct reflection of the information you provided. The calculator's primary function is to align the insurance cover with your mortgage debt, ensuring one can cancel out the other if the worst were to happen.

For a standard repayment mortgage, the calculator will almost always recommend a decreasing term policy. In our example, it would suggest starting cover of £250,000 that reduces over the 25-year term, perfectly mirroring your mortgage balance as you pay it off. This is precisely why it is usually the most affordable way to protect a repayment mortgage. That premium you see? That’s the estimated monthly cost for this peace of mind.

The core idea is simple: the insurance payout should always be enough to clear the outstanding mortgage, so your family isn't left with the debt. The calculator ensures the proposed cover is perfectly aligned with this goal from day one.

Comparing Your Options

That first quote is just the beginning. A good calculator will allow you to adjust the settings to see different scenarios. For instance, what happens if you opt for level term cover instead?

- Decreasing Term: The premium will be lower because the amount the insurer (such as Aviva or Legal & General) would have to pay out reduces over time, just like your mortgage. Less risk for them means a lower cost for you.

- Level Term: The premium will be higher because the £250,000 payout amount stays the same for the whole 25 years. This could mean your family receives a tax-free lump sum on top of clearing the mortgage in the later years of the policy.

- Adding Critical Illness Cover: You will also see options to add extras like critical illness cover. Ticking this box will increase the premium, but it means you receive a payout if you are diagnosed with a specified serious illness—a completely different kind of financial safety net.

The UK insurance market is highly competitive, which is excellent news for homeowners. A life insurance mortgage calculator is your best tool in this environment, letting you compare options instantly and see how different policy features affect the price. To get a broader sense of the market, you can explore this UK insurance market overview from Aon. This helps you turn the calculator's numbers into a smart decision that genuinely fits your needs and your budget.

Choosing the Right Policy Type for Your Mortgage

A calculator tells you 'how much,' but you still need to decide on the 'what kind.' The numbers are just one part of the puzzle; choosing the policy behind them is where the real decision lies. For mortgage life insurance, the two main options are Decreasing Term and Level Term, and they each serve a different purpose.

Your choice will depend on your mortgage type and what you want to leave for your family. There is no single “best” option—only the one that fits your circumstances and finances.

Decreasing Term Cover Explained

Decreasing term insurance is designed to work in tandem with a standard repayment mortgage. The concept is simple: as you pay down your mortgage, the amount of cover reduces over time, roughly tracking your outstanding loan balance. Because the potential payout shrinks each year, the premiums are usually more affordable.

This makes it a cost-effective way to ensure the mortgage debt is cleared. If your primary goal is simply to ensure the house is paid off so your family can remain there, this is often the most direct and affordable solution.

This chart shows how a decreasing term policy can shadow your mortgage balance, providing enough cover to clear the debt for a manageable monthly premium.

As you can see, for a modest monthly cost, you secure a payout that not only covers the mortgage but can also provide a small but welcome financial buffer for your loved ones.

Level Term Cover Explained

In contrast, level term insurance provides a fixed payout amount for the entire duration of the policy. If you take out a £250,000 policy over 25 years, it will pay out the full £250,000 whether you pass away in year one or year 24. This makes it a perfect match for interest-only mortgages, where the capital debt does not decrease until the end of the term.

However, many people with standard repayment mortgages also choose level term cover. Why? Because as their mortgage balance falls over the years, the gap between the debt and the fixed payout widens. This means your family would not only clear the mortgage but also receive a significant tax-free lump sum on top, which could be invaluable for university fees, paying off other debts, or covering day-to-day living costs.

Comparing Decreasing Term vs Level Term Insurance

To make the choice clearer, it helps to see the two policy types side-by-side. Each has its place, depending on whether you're focused purely on the mortgage or want to provide a wider financial safety net.

| Feature | Decreasing Term Insurance | Level Term Insurance |

|---|---|---|

| Payout Amount | Decreases over the policy term | Stays the same throughout the policy term |

| Best For | Repayment mortgages | Interest-only mortgages or providing extra funds |

| Premiums | Generally lower and more affordable | Higher than decreasing term cover |

| Primary Goal | To pay off a specific debt (like a mortgage) | To provide a fixed sum for any purpose |

Ultimately, the right policy depends on what you need it to do. If it's all about covering the mortgage for the competitive possible cost, decreasing term is a strong contender. If you want to leave a larger legacy for your family, level term is the way to go.

The decision often comes down to budget versus benefit. Decreasing term is purely functional mortgage protection, whereas level term offers a broader financial safety net for your loved ones.

Getting this right is important. To help you explore the details further, we have put together a complete guide that examines whether you should choose level term or decreasing term life insurance. Understanding these differences is key to ensuring the policy you choose truly protects your family's future.

What Affects Your Final Premium

A life insurance mortgage calculator provides an excellent starting point with a data-driven estimate of what your policy might cost. However, it is important to remember that this initial figure is an estimate.

The final premium you are offered will only be determined after the insurer has reviewed your personal circumstances. This process is called underwriting, and it is a standard part of any insurance application in the UK. Think of the calculator's quote as an accurate guide price; the underwriting process is the final confirmation.

Key Factors Insurers Consider

Once you decide to proceed with a quote, the insurer will request more detailed information. Your answers will determine the final price, which could be slightly higher or lower than your initial estimate.

These are the main factors that will influence your premium:

- Your Age: This is one of the biggest factors. The younger you are when you take out a policy, the your premiums will almost certainly be.

- Your Health and Medical History: Insurers will ask about your general health, any pre-existing conditions (like diabetes or a history of heart problems), and your family's medical history.

- Your Lifestyle: This includes whether you smoke or vape. Smokers pay significantly more for cover. Your alcohol consumption may also be considered.

- Your Occupation: If you work in a high-risk job, such as construction or offshore work, this may affect your premium.

It is crucial to be completely honest and accurate in your application. Withholding information could lead to a claim being denied in the future, which would defeat the purpose of having the policy.

Making positive lifestyle changes, such as quitting smoking, can have a tangible impact on your premiums. Understanding what insurers look for helps manage your expectations and ensures there are no surprises when you receive your final offer.

For a deeper dive into how these factors affect pricing, you can explore our guide to term life insurance rates.

Frequently Asked Questions

Even after using a calculator and exploring your options, it's completely normal to have a few questions. It's a big decision, after all. To help you get that final bit of clarity, here are some of the most common queries we hear from homeowners.

Do I legally have to get life insurance for a UK mortgage?

No, in the UK there is no legal requirement to have life insurance to get a mortgage. However, most lenders will strongly recommend it. It provides them with the assurance that the loan will be repaid if the borrower passes away, which is why it's often a key part of financial planning for homeowners.

What happens if I remortgage or move house?

Your life insurance policy is tied to you, not to a specific property. This gives you flexibility. If you remortgage for a larger amount or move to a more expensive house, your existing cover might no longer be sufficient. This is a good time to review your policy. You can use a life insurance mortgage calculator with your new figures to see if you need to increase your cover.

Is it to get a joint policy with my partner?

For couples, a joint policy is almost always upfront than two separate single policies. It covers two people but typically only pays out once, on the first death. After the payout, the policy ends, leaving the surviving partner with no further life cover. Two single policies, while costing slightly more each month, provide two separate payouts. This offers more comprehensive long-term financial security, especially for families with children.

Ready to secure your peace of mind? At Discount Life Cover, you can compare quotes from the UK's leading insurers in minutes to find the right protection for your family and home. Get your free, no-obligation quote today.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply