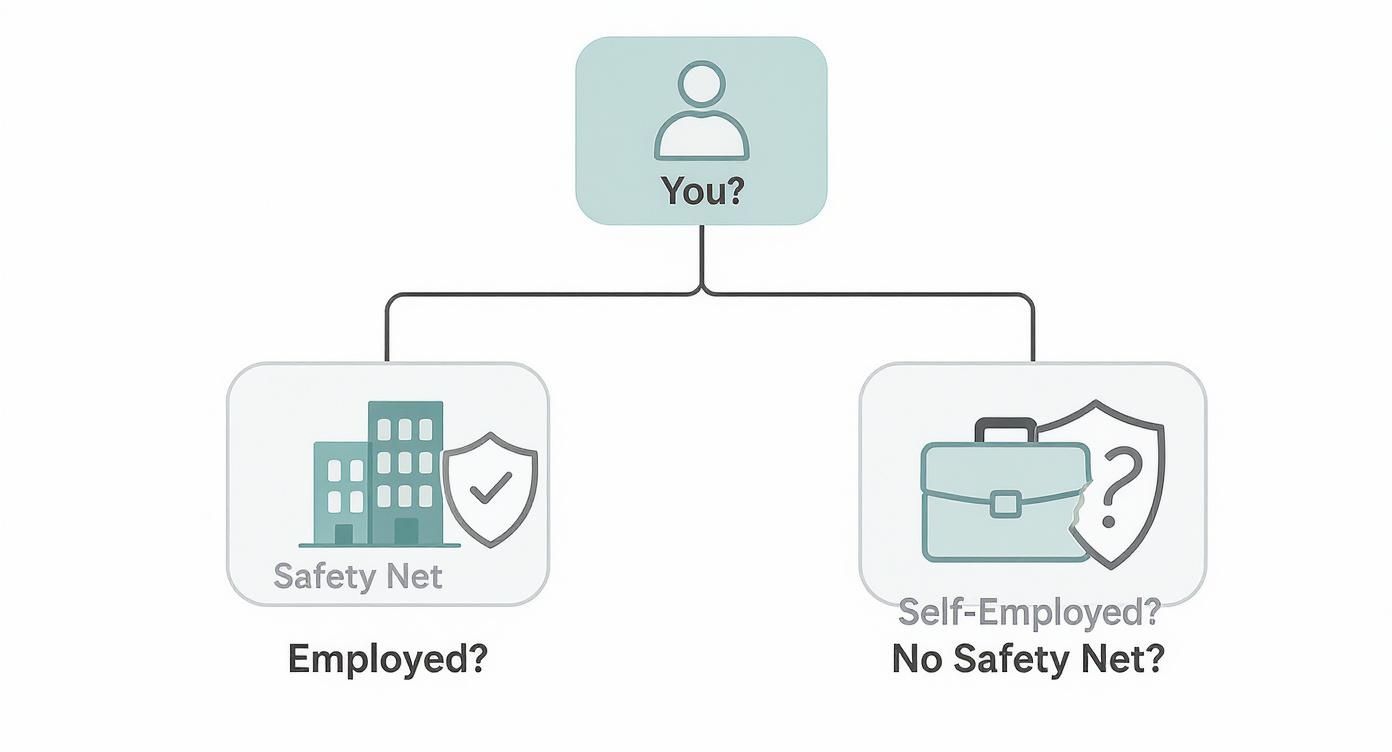

For anyone running their own business in the UK, thinking about life insurance isn't just a good idea—it's a cornerstone of financial responsibility. When you're employed, you often benefit from a death-in-service benefit or company sick pay. But when you're self-employed, you are the one who has to build that safety net. A personal policy is absolutely essential to protect your family, your home, and the business you've worked so hard to build.

Why Life Insurance Is a Business Essential

When you work for yourself, the line between your personal and business finances can become blurred very quickly. The income you generate doesn't just pay the mortgage; it keeps the business running, pays suppliers, and covers all those day-to-day operational costs. If you were no longer around, both your family's finances and your business's future could be in serious trouble, almost overnight.

This is why life insurance for self employed people is much more than just a personal precaution. It’s a critical business decision.

Without an employer to provide a safety net, it's completely down to you to create your own financial backstop. If you were to pass away unexpectedly, your family would not only lose your income but could also be left responsible for business debts, like loans or outstanding supplier invoices.

The Risks of Going Unprotected

Going without the right cover in place can leave your family or business partners facing daunting challenges. They might have to find the money for:

- Covering a mortgage or rent: The last thing you want is for your family to worry about keeping a roof over their heads.

- Settling business debts: This could be anything from bank loans and leases to credit card bills taken out in your name or secured against the family home.

- Replacing lost income: A lump sum can give your loved ones the breathing space to manage daily costs and figure out their next steps.

- Funding childcare or education: Ensuring your children’s futures are secure without financial strain is often a top priority.

A well-structured life insurance policy is the foundation of a solid financial plan. It delivers a tax-free lump sum that gives your family the financial cushion they need during an incredibly difficult time.

Thinking about the bigger picture is also smart. Life insurance covers the ultimate worst-case scenario, but it's just one piece of the puzzle. It's well worth developing strong strategies for business continuity planning to make sure every part of your operation is protected.

And while this guide focuses on life cover, it's just as important to think about what would happen if you couldn't work due to illness or injury. You can find out more about safeguarding your earnings in our guide on income protection for the self-employed. Taking this two-pronged approach—protecting both your life and your income—gives you and your family truly robust security.

Choosing the Right Life Insurance Policy

When you’re self-employed, picking the right life insurance policy isn't just a box-ticking exercise; it's about matching the cover to your real-world financial commitments. Without the cushion of employer benefits, the decision you make is fundamental to protecting your family and, in many cases, your business. The choices can feel a bit overwhelming at first, but they usually boil down to a couple of main categories, each built for a different purpose.

It’s clear that more and more self-employed people in the UK are realising this. Term life insurance is by far the most popular option, making up 57% of policies for its straightforward, affordable protection. But it's not the only game in town. We're also seeing a 3.6% increase in whole-life policies and a significant jump in over-50s plans, which now account for 21.5% of new sales. This tells us people are looking for a wider range of protection to fit their unique situations.

This infographic really drives home the difference in the financial safety net between an employee and someone who works for themselves.

It’s a stark reminder of why, when you’re the boss, you also have to be your own safety net. Let’s break down the policies that can help you build it.

Term Life Insurance: Your Flexible Foundation

For most self-employed people, term life insurance is the go-to starting point. Why? Because it’s simple, cost-effective, and does exactly what it says on the tin. It covers you for a fixed period (the 'term'), say 25 years, and if you pass away during that time, your loved ones get a tax-free lump sum.

Within term insurance, you have two main types to consider:

- Level Term Insurance: The payout amount is fixed from day one and never changes. A £200,000 policy will pay out £200,000 whether you pass away in the first year or the last. It’s perfect for covering an interest-only mortgage or giving your family a lump sum to replace your lost income.

- Decreasing Term Insurance: This one is designed specifically to cover a big debt that gets smaller over time, like a standard repayment mortgage. The potential payout shrinks each year, roughly tracking what you still owe the bank. As the insurer's potential payout reduces, so does your premium, making it a option.

Real-World Example: A Freelance Graphic Designer with a Mortgage

Sarah, a 35-year-old freelance designer, has a young family and a £250,000 repayment mortgage. She takes out a decreasing term policy over 25 years. This gives her peace of mind that if anything happened to her, the mortgage would be completely paid off, securing the family home.

Getting the policy structure right is a huge part of the process. Our guide on how to choose the best life insurance dives deeper into these decisions with more practical tips.

Whole of Life Insurance: For Lifelong Peace of Mind

Unlike term cover which has an expiry date, a whole of life policy guarantees a payout whenever you pass away, provided you've kept up the payments. Because that payout is a certainty, not a 'what if', these policies naturally come with a higher price tag.

This isn't really for covering temporary debts. It's more about creating a lasting financial legacy. People often use it for:

- Covering funeral costs: A competitive payout means your family won’t be hit with a sudden, hefty bill for funeral expenses.

- Inheritance tax planning: For business owners with a larger estate, a whole of life policy can be written into a trust. This keeps the payout separate from your estate, giving your beneficiaries the cash they need to settle any inheritance tax bill without having to sell assets.

- Leaving a competitive inheritance: It’s a straightforward way to make sure a specific sum of money is passed down to your children or grandchildren, no matter what.

It's a powerful tool, especially for self-employed individuals wanting to ensure their personal wealth is passed on as smoothly as possible.

Comparing Life Insurance Policies for the Self-Employed

Choosing between these options can be tricky, as each serves a different purpose. This table breaks down the key differences to help you see which might be the best fit for your circumstances.

| Policy Type | Best For | Payout Type | Typical Cost |

|---|---|---|---|

| Level Term Insurance | Replacing lost income, covering interest-only mortgages, providing a fixed lump sum for family. | Fixed lump sum that doesn't change. | Low to moderate. |

| Decreasing Term Insurance | Covering a repayment mortgage or other large loan that reduces over time. | Payout decreases over the policy term. | Lower than level term. |

| Whole of Life Insurance | Inheritance tax planning, covering funeral costs, leaving a competitive legacy for loved ones. | lump sum whenever you pass away. | Higher than term insurance. |

Ultimately, the 'best' policy is the one that aligns with what you want to protect—be it your home, your family's lifestyle, or your legacy.

Adding Extra Layers of Protection

Think of your life insurance policy as the foundation. You can then build on it with extra cover for more comprehensive protection. The most popular addition by far is Critical Illness Cover.

This add-on pays out a tax-free lump sum if you’re diagnosed with a serious illness specified in the policy while you are still alive. For a self-employed person, this can be an absolute lifeline. It provides the cash to pay bills, modify your home, or access private medical care, letting you focus on getting better without the stress of watching your business and personal savings disappear.

How Insurers View Self-Employed Applicants

Applying for life insurance when you're self-employed can feel like a bigger hurdle than for someone in a PAYE role, but it really shouldn’t be. UK insurers are very familiar with freelancers, sole traders, and limited company directors; they simply need to build a clear picture of your financial stability and overall risk.

Frankly, the process is less about scrutinising your career choice and more about verifying your earnings and health. An insurer's main goal is to understand how much cover you need and can comfortably afford. They also want to assess any risks tied to your job and lifestyle to work out a fair premium. With the right documents ready, the application can be just as smooth as anyone else's.

Proving Your Income

For an employee, a simple payslip shows a consistent monthly income. For the self-employed, income often fluctuates. That’s totally normal. To get an accurate picture of your earnings, insurers will typically ask for evidence from the last two to three years.

This allows them to calculate an average, smoothing out any unusually high or low earning periods. Being prepared with the right paperwork makes this step much faster.

You will likely need to provide:

- SA302 forms or Tax Year Overviews: These are official documents from HMRC that summarise your declared income and the tax you've paid. You can download them directly from your government gateway account.

- Certified business accounts: If you operate as a limited company, insurers will want to see your finalised accounts, usually prepared by an accountant. This helps them understand your salary, dividends, and the overall profitability of your business.

- Accountant's reference: In some cases, a letter from your accountant confirming your earnings can also be a big help.

Having these documents organised before you is the single best thing you can do to speed up the process. It shows the insurer you have a stable, well-documented business and removes any guesswork from their calculations.

Factors That Influence Your Application

Beyond your income, insurers look at the same key factors as they would for any other applicant. Your business is just one part of a larger assessment that helps them determine your premium.

These other crucial elements include:

- Your Health and Lifestyle: Insurers will ask detailed questions about your medical history, whether you smoke, your alcohol consumption, and your general fitness. Honesty here is critical, as non-disclosure can invalidate your policy.

- Your Occupation: Some jobs carry more risk than others. A freelance writer working from home will likely face lower premiums than a self-employed roofer or scaffolder who works at height.

- Your Age: It’s a simple fact: the younger and healthier you are when you , the your premiums will be. This is a key reason to consider getting cover sorted sooner rather than later.

All these details are fed into an underwriting process. This is the term insurers use for assessing risk. The outcome determines not only whether you are offered cover but also the final price you will pay.

Different providers weigh these factors differently, which is why comparing quotes is so important. You can get a clearer idea of how these factors affect your price by comparing current term life insurance rates from across the market.

Ultimately, insurers are looking for stability and predictability. A well-managed business with consistent, provable income and a healthy director is seen as a good risk. By presenting your financial situation clearly and honestly, you can navigate the application process with confidence and secure the vital protection your family needs.

Protecting Your Income While You're Alive

Life insurance is fantastic for giving your loved ones a financial safety net after you’re gone. But what happens if you’re still here, but a serious illness or injury completely knocks you off your feet and stops you from working? It doesn't help with the bills now.

For anyone self-employed, losing your ability to earn an income—even for a few months—can be a financial catastrophe. This is where a couple of other types of cover become just as vital as life insurance.

Think of your earning ability as your single most valuable asset. Life insurance protects your family from losing that asset forever. But Income Protection and Critical Illness Cover are designed to shield it while you're still alive. Essentially, they act as the sick pay you don't get when you're the boss.

Critical Illness Cover Explained

Critical Illness Cover does exactly what it says on the tin. It pays out a one-off, tax-free lump sum if you’re diagnosed with one of the specific, serious conditions listed in your policy. You'll often find it bundled as an add-on to life insurance, but sometimes you can get it as a standalone policy.

That cash injection can be a lifeline during an incredibly tough time, and you can use it for whatever you need most. For instance, you could:

- Pay off your mortgage or wipe out other large debts.

- Cover the costs of private medical treatment or specialist care.

- Make necessary adaptations to your home, like installing a ramp or stairlift.

- Handle day-to-day living costs while you’re out of action.

- Give yourself the financial breathing space to recover without worrying about the business.

Every insurer has its own list of illnesses they cover, but most will include the big ones like certain types of cancer, heart attacks, strokes, and multiple sclerosis. It’s absolutely crucial to read the policy documents so you know exactly what is and isn’t covered.

Income Protection: The Ultimate Safety Net

While Critical Illness Cover gives you a lump sum for a specific diagnosis, Income Protection Insurance works quite differently. Its job is to replace a chunk of your monthly income if any illness or injury stops you from working.

Instead of a single payout, you get a regular, tax-free monthly income. This continues until you're well enough to get back to work, you reach retirement age, or the policy term ends. For self-employed people, this is an incredibly powerful tool because it directly replaces the salary you can no longer generate yourself.

Think of Income Protection as your own personal sick pay scheme. It provides a reliable, ongoing income stream to cover your bills, mortgage, and other essentials, protecting your entire financial world from the impact of being unable to work.

You can typically cover around 50-70% of your pre-tax earnings—this is capped to give you an incentive to return to work when you're able. When you set up the policy, you'll also choose a 'deferral period', which is just the waiting time before payments kick in. This can be anything from four weeks to a year, and the longer you can wait, the lower your monthly premiums will be.

Why This Cover Is Non-Negotiable for the Self-Employed

For anyone running their own business, the financial shock of a health crisis is a massive threat. The hard reality is that over a third of self-employed people in the UK could see their business and livelihood destroyed by a serious health event. This risk is why policies with critical illness add-ons now represent a significant portion of all life insurance sold, showing a clear demand for this kind of protection.

Someone on a PAYE salary might have company sick pay to fall back on for a few months. But as a sole trader or freelancer, your income slams to a halt the moment you can't work. Having a plan B isn't a luxury; it's a core part of being your own boss.

Of course, solid insurance should go hand-in-hand with smart financial management, like maximizing sole trader tax deductions to keep your business healthy. When you combine savvy financial habits with robust insurance, you create a truly resilient plan.

Ultimately, while life insurance protects your legacy, income protection and critical illness cover protect your present. They are what ensure a health problem doesn't have to become a complete financial disaster.

How to Get Cheaper Premiums

Getting the right life insurance for self employed people is a must, but it shouldn't break the bank. The good news is, there are plenty of practical things you can do to bring down your monthly payments without watering down your cover. At the end of the day, insurers price your policy based on risk – the less of a risk you appear to be, the less you'll pay.

Simple tweaks to your lifestyle can make a surprisingly big difference. Insurers always offer better rates to non-smokers, and they'll look more kindly on you if you only drink in moderation. Getting a bit fitter, keeping an eye on your weight, and properly managing any ongoing health issues will also translate into quotes.

Fine-Tuning Your Policy Details

It's not all about your health, though. The way you actually structure your policy plays a huge part in what it costs. The best part is, you're in the driver's seat for these decisions, which means you can strike that perfect balance between solid protection and a premium you can live with.

A few key adjustments can make a real difference:

- Choose the Right Term Length: Don't just pull a number out of thin air. It's much smarter (and ) to match the policy's term to your biggest financial responsibility. For instance, if you've got 22 years left on your mortgage, a 22-year term is a much better fit than a 30-year one and will cost you less.

- Opt for Decreasing Term Cover: If your main reason for getting cover is to make sure your repayment mortgage gets paid off, a decreasing term policy is almost always the cheapest way to do it. The amount of cover goes down as your loan balance does, making it a more budget-friendly option than level term insurance.

- Consider a Joint Policy: For couples, taking out a single joint policy is often than buying two separate ones. Just be aware of the trade-off: it only pays out once (usually on the first death), and then the cover stops, leaving the surviving partner uninsured.

The UK life insurance market is pretty flexible these days. In fact, data for 2025 suggests that over 63% of policies come with flexible payment options, like paying monthly or annually. This is a massive help when you're self-employed and your income isn't always predictable. Discover more insights about UK insurance statistics on coinlaw.io. This adaptability makes it much easier to juggle your cover alongside the ups and downs of running a business.

The Power of Placing a Policy in Trust

Here's one of the most effective tricks in the book, yet so many people miss it: placing your life insurance policy in a trust. It’s a straightforward legal step that keeps the policy payout separate from your estate when you die.

Writing your policy into a trust is usually a free service offered by insurers and is a powerful way to ensure your beneficiaries receive the full payout quickly and efficiently, without it being liable for Inheritance Tax.

What this means in real terms is that your family can get their hands on the money much, much faster – no waiting around for probate. Plus, the whole sum goes directly to them, making every penny of your cover count.

Compare, Compare, and Compare Again

If you take away just one thing, let it be this: the single most powerful way to find affordable life insurance for self employed people is to compare quotes from as many providers as possible. Every insurer has its own rulebook for assessing risk. One provider might see you as a standard case, while another could slap a hefty extra charge on your premium for the exact same cover.

Using a service like Discount Life Cover lets you see prices from all over the market in one go. It’s the quickest way to pinpoint the insurer offering the best value for your specific situation, and it could easily save you hundreds, if not thousands, of pounds over the years.

Seeing It in Action with Real-World Scenarios

Theory is one thing, but seeing how life insurance for the self-employed works in the real world makes everything click. Let's walk through a few common situations to see how different people might tackle getting cover. These examples should help bring the concepts to life and let you see which path might look a bit like your own.

Just remember, the premium estimates here are purely for illustration. Your actual quote will come down to your specific health, lifestyle, and which insurer you go with.

Scenario One: The Freelance Web Developer

Meet Aisha, a 34-year-old freelance web developer. She's married with two young children and they've just bought a family home with a £300,000 repayment mortgage. Her main goal is simple: make sure her family can stay in their home and the children are looked after financially if she's no longer around.

- Her Need: To clear the mortgage and leave a financial cushion for her family until the children can stand on their own two feet.

- Her Likely Choice: A decreasing term insurance policy for £300,000 over 25 years would perfectly match and pay off the mortgage. To handle the family's living costs, she might also take out a separate level term policy for £150,000 over 20 years. This would replace her lost income while the children are growing up.

- Estimated Monthly Premium: For a healthy non-smoker in her mid-30s, this combined cover could land somewhere around £25–£40 per month.

This two-policy approach is smart. It lets Aisha match specific cover to specific needs, which often works out than one single, massive policy.

Scenario Two: The Self-Employed Electrician

Next up is David, a 54-year-old self-employed electrician. His children are grown up and have flown the nest, and the mortgage is almost gone. His main worry is much simpler: he doesn't want to leave his wife with a hefty funeral bill and would like to leave a small, competitive inheritance for his grandchildren.

- His Need: To cover final expenses and leave a definite gift.

- His Likely Choice: David could go for a whole of life insurance policy. A smaller sum, maybe £20,000, would be enough. This guarantees a payout whenever he passes away, which is exactly what he wants. An over 50s plan could also be a straightforward option, as they guarantee acceptance without medical questions and are ideal for covering funeral costs.

- Estimated Monthly Premium: For a whole of life policy at his age, he'd be looking at roughly £45–£65 per month. An over 50s plan would likely be in a similar ballpark for a smaller benefit.

Scenario Three: The Limited Company Director

Finally, let's look at Chloe, a 42-year-old director of her own successful marketing agency. The business has a chunky £100,000 loan that she personally competitive. If she passed away, that debt could land on her estate or her business partner. On top of that, she wants to protect her family's lifestyle.

- Her Need: Protect the business from her competitive loan and provide financial security for her family.

- Her Likely Choice: Chloe could set up a key person insurance policy through her business to cover the £100,000 loan. For her personal protection, a level term policy for £400,000 would give her family a substantial lump sum to live on and maintain their quality of life.

- Estimated Monthly Premium: For her personal level term cover, a healthy 42-year-old like Chloe might expect premiums in the region of £30–£50 per month. The business policy would be a separate cost paid for by the company.

Frequently Asked Questions

When you're self-employed, navigating the world of life insurance can feel a bit different. You've got unique questions, and that's completely normal. Here, we tackle some of the most common queries we get from freelancers, contractors, and business owners across the UK.

Can I get life insurance with a fluctuating income?

Yes, absolutely. This is probably the number one worry we hear, but insurers are well-versed in the realities of self-employed life. They don't expect a neat and tidy P60 every year like they would from a PAYE employee.

What they need is a fair picture of your earnings over time. To do this, they'll usually ask to see your income records for the last two or three years. This helps them calculate an average, smoothing out any standout boom-or-bust periods and arriving at a figure that truly reflects your financial situation.

Getting your documents in order beforehand makes the whole process a breeze. You'll typically need:

- Your SA302s: This is the official tax calculation from HMRC that shows your declared earnings.

- Tax Year Overviews: A simple summary of your tax position, which you can grab from your HMRC online account.

- Business Accounts: If you're a limited company director, your finalised accounts show your salary, dividends, and the health of the business.

Having this ready proves your financial stability and helps the insurer give you a confident 'yes' without any fuss.

Is life insurance a tax-deductible expense?

For most self-employed people, the short answer is no. If you operate as a sole trader or you're in a partnership, your personal life insurance policy is paid for out of your own pocket (with post-tax income). HMRC sees it as a personal product, not a business expense.

There is one major exception, though, and it’s for limited company directors. A special type of policy called a Relevant Life Plan can be a game-changer. Your business can pay the premiums, and in most cases, they're treated as an allowable business expense. It's an incredibly tax-efficient way to secure life cover, but it’s a specific product. We always recommend chatting with a qualified financial adviser to see if it’s the right fit for you.

What happens if I go back to a 'normal' job?

Nothing at all! Your personal life insurance policy is yours and yours alone – it isn't tied to your job title or how you earn your money.

If you decide to wind down your business and return to employment, your cover continues without a single change. Just keep up with your monthly premiums, and your protection stays firmly in place. Whether you become an employee, switch careers, or hang up your boots for retirement, that policy sticks with you, providing continuous peace of mind.

Ready to find the right protection for you and your family? The expert team at Discount Life Cover can help you compare quotes from leading UK insurers to find the perfect policy at the competitive.

Get your free, no-obligation quote today at Discount Life Cover.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply