Having children changes everything. Suddenly, you are responsible for a tiny person whose entire future rests on your shoulders. The best life insurance for parents UK wide isn't about finding a complicated financial product; it's simply a plan to make sure they'll be okay financially, even if you're not around to provide for them. Think of it as the ultimate safety net, protecting them from money worries when they would be at their most vulnerable.

Why Life Insurance Is a Non-Negotiable for Parents

As a parent, your primary role is to protect your children. We spend our days worrying about scraped knees and making sure they eat their greens, but it's just as vital to think about their long-term security. Life insurance isn't a morbid plan for a worst-case scenario. It’s about making sure your family's future is secure, no matter what life throws at you.

A policy is a promise to your family. It’s a promise that the mortgage will still get paid, that there will be money for university, and that everyday life can carry on without the crushing weight of financial chaos after losing a parent.

Securing Your Children's Future

At its heart, a life insurance policy pays out a tax-free lump sum to your loved ones if you pass away while you're covered. This cash payout is designed to handle all the major financial responsibilities that would otherwise fall on your partner or family's shoulders.

So, what can it actually cover?

- Mortgage Repayments: The biggest worry for most. This ensures your family can stay in their home without the fear of having to sell up.

- Daily Living Costs: It replaces your lost income to cover everything from the weekly shop and utility bills to new school shoes and after-school clubs.

- Childcare and Education: This can fund anything from nursery fees and school trips right up to future university tuition, making sure their opportunities are never limited by money.

- Outstanding Debts: It can be used to clear car loans, credit card balances, or any other personal loans that could otherwise become a huge burden.

Putting this financial backstop in place is one of the most powerful and selfless things you can do as a parent. You can dive deeper into the specific ways a policy helps by exploring the 5 benefits of life insurance.

The Reality of the Protection Gap

Despite how crucial it is, a shocking number of parents in the UK don't have any cover. Recent research from Which? found that a massive 39% of parents have no life insurance or death-in-service benefits from their job, leaving their families completely exposed.

This is a scary thought, especially when you realise that thousands of children lose a parent each year and many families are juggling significant mortgage debts that average over £145,000. For more context, you can read the full research about parental insurance gaps.

Ultimately, arranging life insurance for parents UK isn't just another financial transaction. It’s about giving yourself peace of mind today, knowing you’ve done everything you can to secure your children's tomorrow.

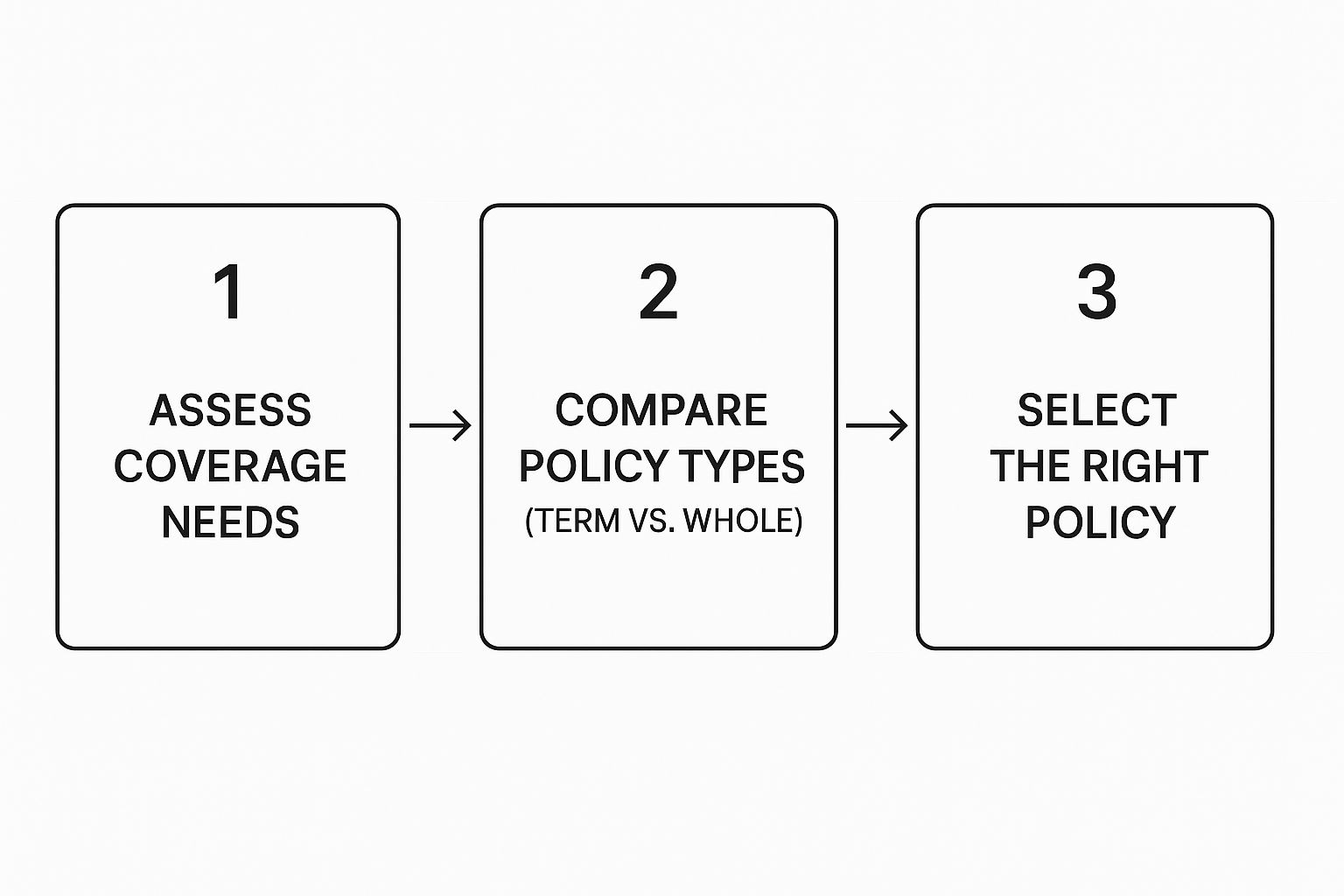

Navigating Your Life Insurance Options

Feeling a bit lost in a sea of policy names and insurance jargon? You're not the only one. When you first start looking into life insurance, the options can seem complicated, but they all boil down to one simple goal: making sure your family is financially secure if you're no longer around.

Let's cut through the noise and look at the main types available to UK families, focusing on what they actually do.

The most common and usually most affordable choice for parents is Term Life Insurance. This provides protection for a set amount of time – a 'term' – that you choose yourself. This could be the 25 years it'll take to pay off your mortgage, or the 18 years until your youngest child is likely to be financially independent. If you pass away during this term, your family gets the payout. If you outlive the term, the policy simply expires, and you don't get anything back.

The Two Main Types of Term Insurance

Term insurance isn't a one-size-fits-all deal; it comes in two main varieties that serve slightly different purposes. Understanding the difference is the key to picking the right protection.

Level Term Insurance: With this type, the payout amount (or 'sum assured') is fixed for the entire length of the policy. Whether you pass away in year one or year twenty, the lump sum your loved ones receive is exactly the same. This makes it perfect for covering costs that don't shrink over time, like replacing your income for day-to-day living, covering childcare bills, or setting aside money for university fees. It provides a predictable and reliable safety net.

Decreasing Term Insurance: This policy does what it says on the tin – the potential payout gets smaller over time. It's specifically designed to cover a large debt that you're paying off, most often a repayment mortgage. As you pay down your home loan, the amount of cover needed to clear it also drops, and the policy is set up to mirror this. Because of this structure, it’s usually the of the two term options.

Comparing Term Life Insurance Policies for Parents

To make it even clearer, here’s a quick side-by-side look at how Level Term and Decreasing Term stack up.

| Feature | Level Term Insurance | Decreasing Term Insurance |

|---|---|---|

| Payout Amount | Stays the same throughout the policy term. | Reduces over the policy term. |

| Best For | Covering living costs, education fees, or an interest-only mortgage. | Covering a repayment mortgage or other large, reducing debt. |

| Typical Cost | Generally more expensive than decreasing term cover. | Often the most affordable life insurance option. |

Whole of Life Insurance

Another option you might come across is Whole of Life Insurance. Unlike term insurance, this policy is permanent. It’s designed to run for the rest of your life and guarantees a payout whenever you pass away, as long as you’ve kept up with the monthly premiums.

Because the payout is a certainty, these policies are significantly more expensive than term insurance. They are typically used for specific long-term goals, like covering funeral costs or leaving behind a competitive inheritance.

Joint Policies vs Two Single Policies

When looking into life insurance for parents UK couples often face a key decision: is it better to get one joint policy or two separate single ones?

A joint life insurance policy covers two people but only pays out once – typically on the first death. After that payout, the policy ends, which can leave the surviving partner with no life cover. While this is often slightly upfront than buying two single policies, it can create a serious protection gap down the line.

For example, imagine a couple has a joint policy. One partner sadly passes away, and the payout helps the survivor manage financially. However, the surviving partner now has no life insurance and might find it much harder and more expensive to get a new policy because they're older or have developed a health condition.

Opting for two single policies gives you far more comprehensive protection. If one partner dies, their policy pays out, but the surviving partner's policy continues. This ensures the children are still protected if the second parent were to pass away later, with a second payout available. It might cost a little more each month, but the double layer of security is often a price well worth paying.

How Much Cover Does Your Family Really Need?

Figuring out the right amount of life insurance isn't about plucking a number out of thin air. It's about building a clear, practical picture of what your family would actually need to feel secure.

A simple framework can help you account for all the major financial responsibilities you'd leave behind. This way, you can be sure you haven’t overlooked any crucial costs that your family would suddenly have to manage on their own.

The DIME Method: A Simple Calculation

A popular and easy way to calculate your cover is the DIME formula. It’s a simple acronym that prompts you to add up four key areas of your financial life to get a solid baseline for your cover amount.

Let's break it down:

- D is for Debts: First, tally up all your outstanding non-mortgage debts. This means everything from car loans and credit card balances to any personal loans.

- I is for Income: How much of your annual income would need replacing, and for how long? A common rule of thumb is to multiply your yearly salary by the number of years until your youngest child turns 18 or 21.

- M is for Mortgage: For most families, this is the single biggest debt. Add the full remaining balance of your mortgage to the total.

- E is for Education: Think about the future costs of your children's education. This could be anything from private school fees to future university tuition and living expenses.

By adding these four figures together (Debts + Income Replacement + Mortgage + Education), you get a comprehensive estimate of the life insurance cover your family would need to maintain their current lifestyle.

Putting It into Practice: A Family Example

Let’s see how this works with a real-world scenario. Meet the Jacksons, a couple with two young children, aged three and five.

Here’s how they might calculate their needs using the DIME method:

- Debts: They have a £10,000 car loan and £5,000 on credit cards, totalling £15,000.

- Income: The main earner brings in £45,000 a year. They want to cover this until their youngest is 18 (a 15-year period), so that’s £45,000 x 15 = £675,000.

- Mortgage: Their outstanding mortgage balance is £200,000.

- Education: They estimate they'll need about £50,000 per child for university costs, so that's £100,000 in total.

Adding it all up: £15,000 + £675,000 + £200,000 + £100,000 = £990,000.

That figure might seem huge, but it shows the true cost of securing a family's future. For a more detailed walkthrough, you might find our guide on calculating how much life insurance you need helpful.

This calculation gives you a strong starting point. By breaking it down into manageable chunks, you can confidently choose a sum that truly protects the people you love most.

What Affects Your Policy Cost?

Ever wondered how insurers calculate your monthly premium? It's not a mystery. An insurer's job is to assess risk – the likelihood they'll have to pay out a claim. This risk profile ultimately shapes the price you pay.

Several key personal details and policy choices go into this assessment. Understanding them means you can make smarter choices and find the best possible value.

Your Age and Health

Your age is one of the biggest factors. Put simply, younger parents tend to get lower rates because, statistically, they are less likely to pass away during the policy's term. The younger and healthier you are when you , the your cover will be.

Of course, your current health and medical history play a massive part too. Insurers will need to know about:

- Pre-existing conditions: Such as diabetes, heart conditions, or a history of cancer.

- Family medical history: Especially any hereditary conditions like heart disease.

- Height and weight: Your Body Mass Index (BMI) is a quick way to gauge potential health risks.

Being in good health will always secure you the most favourable premiums.

Lifestyle Choices

Your day-to-day habits give insurers a clear picture of your personal risk profile. The choices you make can have a direct impact on how much you pay.

Smokers and vapers, for instance, will always pay significantly more for life insurance than non-smokers. To be classed as a non-smoker, you'll usually need to have been completely nicotine-free for at least 12 months. Quitting smoking is the single most powerful thing you can do to lower your life insurance premiums, often cutting the cost by as much as half.

Other lifestyle factors also come into play, such as your alcohol consumption, whether you take part in hazardous sports (like scuba diving or rock climbing), and even your occupation. An office worker will typically pay less than a construction worker who faces greater risks each day.

Your Policy Details

Finally, the details of the policy you build will directly affect the price. The two main levers here are the amount of cover you need and how long you need it for.

- Cover Amount (Sum Assured): This is the payout your family would get. A policy for £500,000 will naturally cost more than one for £150,000.

- Policy Term: This is the length of time you want the cover to last. A 30-year term will be more expensive than a 20-year term.

The type of policy you choose matters, too. As mentioned, a Decreasing Term policy is usually than a Level Term one, and adding optional extras like Critical Illness Cover will increase the monthly premium.

Adding Critical Illness Cover

Life insurance is a fantastic safety net, but it's designed to pay out only when you pass away. What happens if you get seriously ill or injured and can't work? This is where adding extra layers of protection can be a lifeline.

One of the most valuable additions you can make to your life insurance is Critical Illness Cover. It's designed to pay out a tax-free lump sum if you're diagnosed with a specific, serious medical condition defined in your policy. While the exact list varies between insurers like Aviva, Legal & General, and Zurich, they typically cover major illnesses like certain types of cancer, heart attacks, and strokes.

How Critical Illness Cover Works

Imagine you're a parent with a mortgage and young children depending on you. If you were diagnosed with a serious illness that needed months of treatment, the last thing you'd want to worry about is money.

A payout from a critical illness policy gives you financial breathing space. The lump sum can be used for whatever your family needs most at a tough time.

- Paying the mortgage: To ensure your biggest bill is covered while you're not earning.

- Funding specialist medical care: It could open doors to treatments or therapies not available on the NHS.

- Adapting your home: You could pay for things like ramps or a stairlift to help with recovery.

- Replacing your lost income: It can simply cover the day-to-day bills so your family's lifestyle doesn't have to take a hit.

This financial cushion helps manage the immediate shock of a serious diagnosis, reducing stress so you can concentrate on your health.

Waiver of Premium: An Important Add-On

Another incredibly useful—and often inexpensive—option to look into is Waiver of Premium. This add-on is simple but powerful. If you're unable to work for a prolonged period (usually six months or more) because of illness or an accident, the insurer will step in and pay your monthly life insurance premiums for you.

Think of it as insurance for your insurance. It makes sure your vital life and critical illness policies don't get cancelled at the very moment you and your family need them most, just because you can no longer afford the payments.

Why Writing Your Policy in Trust Is a Smart Move

This is one of the most important yet easily missed steps for parents setting up life insurance. So, what does 'writing a policy in trust' actually mean? Think of it as putting your life insurance payout into a secure legal wrapper. You give clear instructions on who holds the keys (your trustees) and who it is for (your beneficiaries, like your children).

It’s a simple legal step, usually free to set up with your insurer, but it comes with powerful advantages.

Bypass Probate for a Faster Payout

When you pass away, everything you own – your money, property, and possessions – is bundled into your 'estate'. This estate typically has to go through a lengthy legal process called probate before anything can be distributed. This can take months, sometimes even years.

A life insurance policy written in trust, however, sits outside your estate. This means the payout can completely bypass the probate process. Your trustees can make a claim and get the funds much faster, often within weeks, ensuring the money is there when your family needs it most.

Control Who Receives the Money

A trust is a clear legal instruction. You name specific beneficiaries (your children, for example) and trustees (people you trust to manage the money for them until they're old enough). This removes any doubt about where the money should go.

Potentially Reduce Inheritance Tax

For larger estates, Inheritance Tax (IHT) can take a significant portion of what your children receive. As of the 2024/25 tax year, IHT is charged at 40% on the value of an estate above the £325,000 threshold.

Because a policy in trust isn't considered part of your estate, the payout is generally not subject to IHT. This simple step can protect the full value of your policy, making sure every penny goes to your family instead of the taxman. It's a crucial piece of the puzzle when planning your life insurance for parents UK strategy. For more details on this topic, our guide on putting life insurance in trust explains everything you need to know.

Frequently Asked Questions

When you're thinking about life insurance, a lot of questions can come to mind. Here are clear, direct answers to some of the most common queries we hear from parents.

Is life insurance expensive for parents?

It’s often far more affordable than people imagine, especially if you are young and in good health. Premiums for a substantial amount of cover can start from just a few pounds a month, which is a small price for significant financial security.

Will I need a medical exam?

Not always. Many UK insurers, regulated by the Financial Conduct Authority (FCA), can assess your health based on your application form. A full medical exam is usually only required if you're ing for a very large amount of cover or have certain pre-existing health conditions.

Can a stay-at-home parent get life insurance?

Yes, and it is highly recommended. A stay-at-home parent provides immense value through childcare, home management, and more. A life insurance payout can help the surviving partner afford these vital services, keeping the family's life as stable as possible.

What happens if I can't afford my premiums?

If you stop paying, your cover will lapse and the policy will end, meaning no payout for your family. If you find yourself struggling with payments, it is crucial to speak to your insurer or a financial adviser. There might be options available to help you keep your cover in place.

Ready to secure your family's future? The simplest way to understand your options and find the best value is to compare quotes. At Discount Life Cover, we make it easy. Get a personalised, no-obligation quote in minutes and take the first step towards complete peace of mind.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply