Choosing life insurance can feel like a major decision, but it boils down to one simple goal: creating a financial safety net for the people you care about most. To get it right, you need to understand your financial commitments, get to grips with the main types of policies, and compare quotes that fit your budget. Follow this path, and you can be confident your loved ones are protected.

Why Bother With Life Insurance Now?

Most of us start thinking about life insurance when a major life event occurs. Buying a house, starting a family, or simply wanting to ensure you leave something behind – these are the moments that bring financial protection into focus.

At its core, life insurance is a straightforward contract between you and an insurance company. You pay a set amount regularly (your premium), and in return, they promise to pay out a tax-free lump sum to your family if you pass away while the policy is active.

That payout can be a lifeline. It helps your loved ones handle everything from paying off the mortgage to covering daily living costs or saving for university fees, all without the stress of suddenly losing your income.

A Quick Look at the UK Market

The good news for consumers is that the UK life insurance market is highly competitive. According to recent data, the total UK insurance market grew by 6.8%, with life insurance premiums increasing by 7.1%.

What does this mean for you? It shows that more people are recognising the importance of this financial protection, especially amid economic uncertainty. Insurers like Aviva, Legal & General, and Zurich are competing for your business by offering more flexible policies and better cover options. It is a good time to be looking for a policy. You can find more detail on these UK insurance industry statistics and see how they might affect you.

A common myth is that life insurance is only for the wealthy or older individuals. The truth is, it’s most crucial for anyone whose death would create a significant financial gap – such as young families with a mortgage or anyone with financial dependants.

Before you dive in, it’s helpful to ask yourself a few basic questions. Thinking about these now will provide a solid foundation for the next steps and make the process of finding the right life insurance much simpler. They’ll help you focus on exactly what—and who—you need to protect.

Key Questions to Get You Started

This checklist is designed to organise your thoughts before you start looking at policies. Answering these questions will make your research and any conversations with advisers far more productive.

| Area to Consider | The Core Question to Answer |

|---|---|

| Your Dependants | Who relies on you financially? (e.g., partner, children, elderly parents) |

| Major Debts | What is the outstanding balance on your mortgage and any other large loans? |

| Future Costs | Are there significant future expenses to plan for, like university fees? |

| Income Replacement | How much of your annual income would your family need to replace? |

| Your Budget | Realistically, what can you afford to pay in monthly premiums? |

Once you have a handle on these points, you will have a much clearer picture of what you are looking for, which is half the battle won.

Calculating How Much Cover You Actually Need

Figuring out the right amount of cover is perhaps the most important step in learning how to choose life insurance. It can feel like pulling a number out of thin air, but there is a simple logic to it.

The main idea is to arrive at a single figure that would clear your largest debts and provide for your family if you were no longer around.

Let's walk through a common, real-world example. Consider parents with a £250,000 repayment mortgage and two young children. Their main priority is ensuring the mortgage is paid off and the children are supported until they are financially independent.

Adding Up Your Liabilities

First, get a handle on all your outstanding financial commitments. Tallying these up provides a solid baseline for the minimum amount of cover you should consider.

Think about these key areas:

- Mortgage: For our example family, that’s £250,000. If you have an interest-only mortgage, you will want to cover the full capital amount.

- Other Debts: This includes any car loans, credit card balances, or personal loans that would need to be settled. Let’s add £10,000 for these.

- Funeral Costs: The average UK funeral can cost around £4,000, an immediate expense your family would have to cover.

Adding those together gives us a starting figure of £264,000. This amount would clear their major debts, but what about day-to-day living?

Estimating Future Living Expenses

Next, you need to think about the income your family would need to replace. This is where you look to the future and consider all the daily costs that your salary currently covers.

For our family, they might want to provide enough for their children until they have completed university. If they estimate they will need £20,000 a year for the next 15 years to cover living costs, childcare, and future education, that’s another £300,000.

This brings their total estimated need to £564,000.

One thing people often forget is to subtract any existing safety nets. If you have a decent amount of savings or a 'death-in-service' benefit from your employer, you can deduct this from your total. It’s a simple way to ensure you don't over-insure yourself and pay higher premiums than necessary.

For a more detailed breakdown, you can use our guide on calculating how much life insurance you need, which walks through these steps with more specific examples. This process turns an abstract worry into a clear, tangible financial goal.

Understanding Different UK Life Insurance Policies

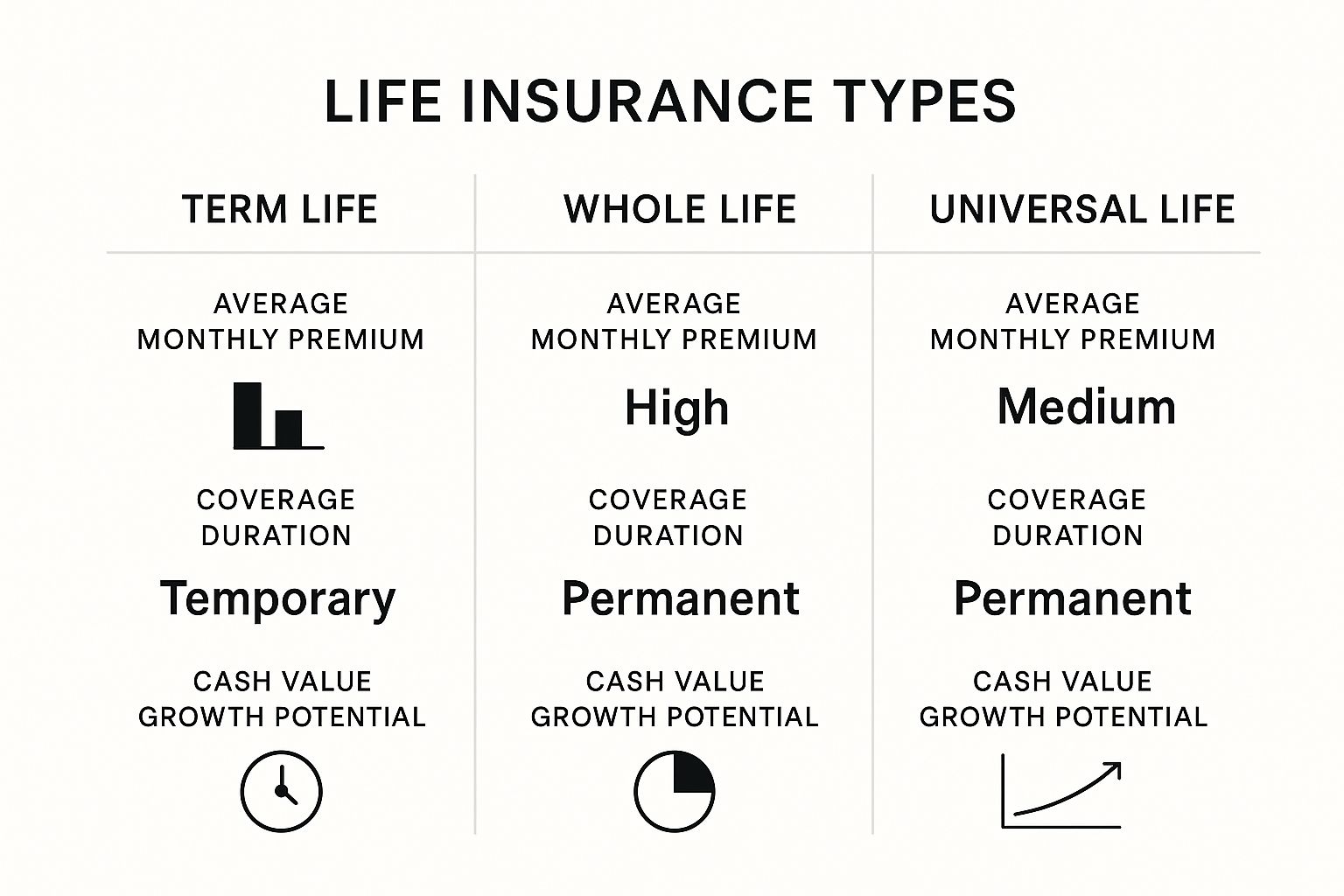

Once you’ve figured out how much cover you need, the next step is to make sense of the different policies available. The jargon can seem overwhelming at first—term, whole of life, decreasing—but each type is simply a tool designed for a specific purpose.

Understanding the basics is key to figuring out how to choose life insurance that does what you need it to do.

In the UK, the vast majority of policies you will encounter are either term insurance or whole of life insurance. Let's break those down.

Term insurance is by far the most common and affordable option for most people. It covers you for a set period—the 'term'—which you decide upfront, for example, 25 years to match your mortgage. If you were to pass away within that period, the policy pays out. If you outlive the term, the cover stops, and you don't get anything back.

Level vs Decreasing Term Insurance

Even within term insurance, you have a couple of key choices. Each one is geared towards protecting different financial needs.

Level Term Insurance: With this policy, the payout amount (the 'sum assured') remains the same from day one until the end of the policy. A £200,000 policy will pay out the full £200,000, whether you pass away in the first year or the last. This makes it a solid choice for things like covering an interest-only mortgage or leaving a definite lump sum for your family to live on.

Decreasing Term Insurance: This is slightly different. The payout amount reduces over time, usually in line with a repayment mortgage. The logic is straightforward: as you pay off your mortgage debt, the amount of cover needed to clear it also reduces. Because the potential payout for the insurer gets smaller each year, these policies are almost always than level term cover.

Choosing between them comes down to what you are trying to protect. If you are weighing up these options, our guide on whether you should choose level term or decreasing term life insurance breaks it down further.

To make things even clearer, here’s a quick side-by-side comparison of the most common policies.

Level Term vs Decreasing Term vs Whole of Life

| Policy Feature | Level Term Insurance | Decreasing Term Insurance | Whole of Life Insurance |

|---|---|---|---|

| Payout Amount | Stays the same throughout the term. | Reduces over the term. | Fixed amount, competitive payout. |

| Best For | Interest-only mortgages, family income. | Repayment mortgages, covering loans. | Inheritance tax planning, leaving a legacy. |

| Policy Duration | Fixed term (e.g., 10-40 years). | Fixed term (e.g., 10-40 years). | Your entire life. |

| Cost | More expensive than decreasing term. | Typically the cheapest option. | Significantly more expensive. |

| Payout Guarantee | Pays out only if you die during the term. | Pays out only if you die during the term. | A payout is competitive upon death. |

As you can see, term policies are built for temporary needs and come with much lower premiums, whereas whole of life is a lifelong commitment with a very different price tag.

Whole of Life and Other Options

Whole of Life insurance is a different type of product. As the name suggests, it is designed to cover you for your entire life. This means it comes with a competitive payout whenever you pass away.

Because that payout is a certainty, these policies are much more expensive. They tend to be used for specific financial planning purposes, like covering an expected inheritance tax bill or leaving a competitive sum of money as a legacy.

It's a common misconception that everyone needs lifelong cover. For most families, particularly those with a mortgage and young children, term insurance provides the necessary protection during the most crucial years at a much more manageable cost.

You might also come across a few other specialised policies:

Over 50s Plans: These are a type of whole of life policy designed to offer a competitive lump sum, often to help cover funeral costs. For UK residents aged 50-85, acceptance is usually competitive with no medical questions, but the payout is typically much smaller than a standard policy.

Critical Illness Cover: This is not strictly life insurance but is often sold as an add-on. It pays out a tax-free lump sum if you are diagnosed with one of the specific serious illnesses listed in the policy, such as a heart attack or certain types of cancer. It can be a financial lifeline during recovery but will increase your monthly premium.

How Your Health and Lifestyle Affect Your Premium

When you for life insurance, the provider assesses one thing: risk. The application form is their main tool for this, and the information you provide about your health and lifestyle directly influences the calculation of your monthly premium.

From their perspective, they are weighing up the probability of a claim being made while the policy is active. Therefore, any factor that statistically points to a shorter life expectancy will likely result in higher premiums.

What Insurers Look At

UK insurers will ask a detailed set of questions about your personal circumstances. Being honest is not just good advice—it is a legal requirement.

Here are the key factors they focus on:

- Your Age: This is arguably the most significant factor. The younger you are when you take out a policy, the it will be, as you are statistically less likely to experience health problems.

- Your Health and Medical History: They will ask about any pre-existing conditions, such as diabetes or high blood pressure, and any serious illnesses you have had in the past. You will need to be prepared to share details from your medical records.

- Your Weight and Height (BMI): Your Body Mass Index is used as a general indicator of your health. A BMI outside the 'healthy' range can lead to higher premiums.

- Whether You Smoke or Vape: This is a major consideration. Smokers and users of nicotine products will always pay significantly more than non-smokers—often double the price, due to the well-known health risks.

- Your Alcohol Consumption: Insurers need to know how many units you drink per week to assess potential health risks associated with excessive alcohol intake.

- Your Occupation and Hobbies: A high-risk job (e.g., working at heights) or participation in hazardous hobbies (e.g., scuba diving) may increase your premiums.

It is also worth knowing that managing your health can positively impact your rates. For example, if you are actively managing a condition like heart disease, it can work in your favour. You can Find out more about effective lifestyle changes for heart health to see how this works in practice.

You must be completely truthful with the insurer on your application. If you fail to disclose a medical condition or that you smoke, and this is discovered later, they can cancel the policy and refuse to pay out. This could leave your family with nothing when they need it most.

For example, consider two 40-year-old men, both seeking the same amount of cover. One is a non-smoker with a healthy BMI and no medical conditions. The other is a smoker and is overweight. The second man’s premiums could easily be two or three times higher. This illustrates how much your personal situation shapes the price you pay.

Finding the Best Value in Today's Market

Once you have worked out what you need and understand the difference between term and whole of life policies, the next step is finding a provider. When learning how to choose life insurance, it's easy to focus solely on the cheapest monthly premium. However, true value is about more than just price.

It’s about finding the right level of cover, from a trustworthy company, at a sensible price.

You have two main options. The first is going directly to a major insurer like Aviva or Legal & General. The second is using an independent broker (like us at Discount Life Cover). Going direct might seem simpler, but a broker has a significant advantage: they can compare policies from a whole panel of insurers. This often means they can find better-priced or more suitable options you might not find on your own. They do the research for you.

Navigating the Current Economic Climate

The wider UK economy always influences the insurance market. Heading into 2025, with inflation remaining stubbornly above the 2% target, the Bank of England has been making cautious moves. This has a knock-on effect on how insurers price their policies.

However, this has created a very competitive market. We have seen rates soften, with some providers reducing prices by as much as 10-20% in early 2025. For anyone seeking cover, this makes it a good time to shop around and lock in a favourable rate. You can read more about the UK insurance market outlook on aon.com.

True value isn't just the competitive monthly payment. It's about ensuring the policy has strong definitions, minimal exclusions, and is offered by a financially sound insurer who will be there to pay a claim years down the line.

What to Look for in the Fine Print

To properly gauge a policy's quality, you need to look beyond the headline price and examine the policy documents. This is where you find out what you are actually paying for.

Keep a sharp eye on these three areas:

- Key Exclusions: Every policy will have situations where it will not pay out. These are the exclusions. Common examples include death related to drug or alcohol abuse or from participating in a dangerous hobby you did not declare on your application. Read them carefully to ensure you are comfortable with them.

- Definitions: This is critical, especially if you are adding critical illness cover. What one insurer classifies as a "heart attack" can be completely different from another. A policy with broader, more generous definitions offers better protection when you might need it most.

- FCA Regulation: This is non-negotiable. Always check that the insurer is authorised and regulated by the Financial Conduct Authority (FCA). This is your guarantee that they meet strict financial and conduct standards, providing essential consumer protection.

Finalising Your Application and Using a Trust

Once you've compared quotes and selected the policy that feels right, the final step is the application form. This is where the insurer gathers all the final details needed to formally offer you cover at the quoted price.

For the most part, it’s a straightforward process. You'll complete a detailed form, double-checking all the health and lifestyle information you provided initially. Be prepared for the insurer to request more information.

This is not unusual and could involve:

- Asking your GP for a report to confirm your medical history.

- Arranging a nurse screening, which is a simple medical check-up, often conducted at your home.

- Requesting further financial details, but usually only if you are ing for a very large amount of cover.

This final check, known as underwriting, is a standard part of the process. It is the insurer's way of verifying all information before the policy goes live.

The Power of Putting Your Policy in a Trust

Before you file your policy documents away, there’s one more crucial step that many people overlook: putting your policy in a trust. It sounds complex, but it is a simple legal arrangement that keeps your life insurance payout separate from the rest of your estate.

Writing your policy in trust is usually free, and your insurer can help you set it up. This simple action means the payout goes directly to your beneficiaries, bypassing the lengthy probate process and potential inheritance tax complications.

In short, it helps the money get to your loved ones much faster—often in weeks, rather than being tied up in legal processes for months or even years.

For a more detailed explanation of how this works and why it's so important, have a look at our guide on putting life insurance in trust. It is one of the smartest things you can do to make your policy work as effectively as possible for your family.

Your Life Insurance Questions Answered

Understanding life insurance can raise many questions. Here are straightforward answers to some of the most common queries we hear from people in the UK.

Do I Need Life Insurance If I Am Single with No Dependants?

While life insurance is primarily about supporting dependants, it may still be relevant if you are single. For example, if you co-own a property, a policy could clear your share of the mortgage, protecting the other owner from a major financial burden. It could also cover funeral costs or allow you to leave a legacy to a loved one or charity. That said, for most single people without financial dependants, it is generally not a top priority.

Can You Have More Than One Life Insurance Policy?

Yes, and it is quite common. People often take out multiple policies to cover different needs. For instance, you might have a decreasing term policy to cover a repayment mortgage, which reduces as your loan does. At the same time, you could have a separate level term policy to provide your family with a fixed lump sum for their living costs. Holding multiple policies can offer greater flexibility as your life and finances change over time.

What Happens If I Stop Paying My Premiums?

This is a critical point. If you stop paying the premiums for a term life insurance policy, your cover will cease. The policy will lapse, which is the industry term for cancellation. If this happens, your insurer will not pay out a claim. Most insurers provide a 30-day grace period to catch up on a missed payment, but if you do not, the policy will be terminated. It is vital to ensure the monthly payments are affordable for the entire policy term.

Ready to take the next step and secure your family's financial future? At Discount Life Cover, we make it easy to compare quotes from the UK's top insurers, helping you find the right cover at the right price.

Get your free, no-obligation quote today and see how affordable peace of mind can be. Compare Quotes Now at Discount Life Cover.

This article is for information purposes only and does not constitute financial advice. Discount Life Cover is not providing personalised recommendations. Insurance policies vary depending on individual circumstances. For advice tailored to your situation, please speak with a qualified financial adviser or request a personalised quote.

Leave a Reply